ESSENTIAL EXIM DOCUMENTATION

Introduction :

Correct documentation is the backbone of smooth export–import (EXIM) operations. Missing, incorrect or inconsistent documents cause delays, higher costs, inspection holds, and even shipment rejection. This section explains each essential EXIM document in practical detail so manufacturers and exporters can prepare error-free paperwork from scratch to advanced levels.

Export Documentation Requirements

What:

Set of documents required to export goods from seller’s country. Typical set: Proforma Invoice, Commercial Invoice, Packing List, Bill of Lading/AWB, Export License (if required), Certificate of Origin, Insurance Certificate, Test/Quality Certificates, Customs Shipping Bill / Export Declaration.

Why:

- Legal clearance to leave the country.

- Customs valuation & duty purpose.

- Buyer’s import clearance.

- Bank payment under LCs.

- Proof for preferential tariff claims (FTAs).

Where/When:

Prepare before shipment and submit to customs/forwarder at time of filing shipping bill / export declaration. Banks require originals for LC payments after shipment.

How it works (practical):

- Seller issues Commercial Invoice & Packing List.

- Seller or forwarder files Export Declaration/Shipping Bill with customs.

- Customs clears if docs & inspections ok.

- Carrier issues B/L or AWB after receipt/boarding.

- Post-shipment docs sent to buyer/bank for payment & clearance.

Common mistakes & tips:

- Mismatched values/HS codes across documents — causes holds.

- Missing signatures or stamps on COO or export license.

- Always keep digital copies and a checklist to reconcile before submission.

EXPORT DOCUMENTATION – Complete List & Their Role

-

1.

Commercial Invoice

Acts as the main financial document showing product value, quantity, terms of sale, and buyer–seller details. Used by customs to assess duties and verify goods.

-

2.

Packing List

Shows how goods are packed—box numbers, weights, dimensions, and packaging type. Helps customs and freight handlers identify, inspect, and load cargo correctly.

-

3.

Shipping Bill / Export Declaration

Filed with customs to legally allow goods to exit the country. Contains HS codes, value, and shipment particulars.

-

4.

Bill of Lading (Sea) / Airway Bill (Air)

Issued by the shipping line or airline as proof of receipt, transport contract, and shipment details. Required for cargo release at destination.

-

5.

Certificate of Origin (COO)

Confirms the country where goods were manufactured. Used to determine duty rates and possibly qualify for preferential tariffs.

-

6.

Insurance Certificate

Shows the shipment is insured against transit risks like damage, loss, or theft.

-

7.

Proforma Invoice

The initial estimate shared with the buyer before order confirmation. Helps the buyer arrange payment or open an LC.

-

8.

Export Order / Purchase Order

Official confirmation from the buyer listing product details, price, and terms.

-

9.

Letter of Credit (if applicable)

A financial guarantee from the buyer’s bank ensuring payment after all conditions are met.

-

10.

Export License (for restricted goods)

Authorization from the exporting country when goods fall under regulated categories.

-

11.

Certificate of Inspection (SGS, TUV, Intertek,

etc.)

Verifies goods meet buyer specifications before shipping. -

12.

Fumigation Certificate

Shows wooden packaging materials were treated to prevent pests, usually required for USA, EU, Australia, etc.

-

13.

Phytosanitary Certificate (for plant/food

exports)

Ensures agricultural goods are free from harmful organisms.

-

14.

Material Test Certificate (MTC)

Common in engineering goods, confirming chemical and mechanical properties.

-

15.

Certificate of Analysis (COA)

Details product composition, often used for chemicals, pharmaceuticals, and food items.

-

16.

Export Packing Declaration

Confirms cargo packaging is free from prohibited materials.

-

17.

Dangerous Goods Declaration (if applicable)

Mandatory for chemical and hazardous cargo, detailing UN codes and safety parameters.

Case Study: How XYZ Company Mastered Export Documentation for Engineering Goods

When XYZ Company prepared its first major export shipment of precision-engineered shaft assemblies to a European buyer, the team expected the technical complexity to lie mostly in manufacturing. Instead, the real challenge emerged in the documentation phase — the part many exporters underestimate until they face it.

This case follows that journey, not as a theoretical explanation, but as a real process unfolding inside the company, revealing the decisions, bottlenecks, and turning points that shaped the final outcome.

1. The Moment the Purchase Order Arrived

The confirmed order from Germany came with strict standards and detailed product specifications.

What made

this shipment different was the buyer’s expectation for flawless documentation, matching

European customs and

engineering compliance requirements.

The export team realized that this shipment would test their internal systems. Nothing could be

handwritten,

loosely defined, or rushed. Every document had to match line-by-line.

2. Setting the Documentation Chain in Motion

Instead of creating documents in isolation, XYZ Company decided to treat documentation like an assembly line.

The internal process began with a simple rule:

“No document will be created until the product description is standardized.”

The engineering team finalized the technical description of the shaft assemblies.

The commercial team converted the technical language into a buyer-friendly commercial

description.

Together, they produced a “Master Description Sheet,” which became the reference for:

- Commercial Invoice

- Packing List

- Bill of Lading

- Certificate of Origin

- Insurance Certificate

- Quality Compliance Records

This prevented the most common EXIM mistake: mismatched terminology across documents.

3. The Turning Point: When Documentation Hit Its First Roadblock

While preparing the Certificate of Origin, the chamber rejected the first submission because the description included both the internal product code and the technical name. The chamber required a single clear product identity.

This setback forced XYZ Company to refine its entire documentation method:

- They removed internal codes from customer-facing documents.

- They aligned all descriptions with HS code interpretations.

- They prepared a permanent template for future shipments.

This was the moment they understood that documentation is not a checklist — it’s a system.

4. When Compliance Became the Hero of the Shipment

Engineering products entering Europe require quality assurance proof. The buyer insisted on a technical conformity pack containing:

- A dimensional accuracy certificate

- Material composition list

- Third-party inspection report

- ISO documentation

- Safety compliance declaration

XYZ Company treated these not as “extra papers” but as a trust-building tool.

Their compliance pack was so detailed that the buyer used it internally for their own audit

system.

This immediately strengthened the business relationship.

5. The Logistics Moment That Could Have Ruined Everything

The freight forwarder prepared the Bill of Lading draft, but the draft listed the cargo as “Engineering metal parts,” which was too generic and did not match the invoice description.

German customs earlier had flagged such mismatches in similar shipments from other exporters.

XYZ Company intervened quickly and requested a revised draft before final issuance.

This prevented:

- inspection delays in Germany

- container hold charges

- customs questioning

- buyer dissatisfaction

The accuracy of documentation became the backbone of smooth logistics.

6. The Final Documentation Set That Cleared Without a Single Query

At the end of the process, XYZ Company produced a clean, structured documentation set:

- Commercial Invoice aligned with HS codes

- Precise Packing List reflecting real packaging

- Bill of Lading with harmonized descriptions

- Chamber-certified Certificate of Origin

- Cargo Insurance Certificate

- Full compliance pack

- Digital customs filing ready for Let Export Order

The buyer received the document set even before the vessel departed.

This allowed the buyer’s customs broker to pre-clear the cargo upon arrival — a rare achievement

for small and

medium engineering exporters.

7. The Outcome: A Shipment That Became a Benchmark Inside the Company

When the shipment finally arrived in Germany, it passed customs verification instantly. The buyer expressed confidence and placed a repeat order within 30 days.

But the real win was internal:

- A “Master Description Sheet” for product identity

- A pre-export compliance checklist

- A documentation approval workflow involving engineering + logistics

- A standardized format for all export documents

The documentation process became predictable, structured, and error-free.

8. Learning That Emerged From This Case

The case taught XYZ Company that export documentation is not paperwork—it is a controlled operational flow that must match:

- regulatory rules

- buyer expectations

- logistics requirements

- product specifications

- compliance standards

The biggest realization was that documentation is not created at the end of the export cycle;

it evolves with the product and the order itself.

This approach transformed documentation from a pressure point into a competitive advantage.

Export Documentation Requirements – FAQs

Q1. What are the mandatory documents required for exporting goods? ▶

The essential export documents include the Commercial Invoice, Packing List, Shipping Bill, Bill of Lading/Airway Bill, Certificate of Origin, Insurance Certificate, and product-specific compliance certificates. Depending on the product and country, additional documents may be required.

Q2. Why is export documentation important? ▶

Export documentation ensures legal compliance, smooth customs clearance, buyer acceptance, proper valuation, tax benefits, and accurate shipment tracking.

Q3. Who prepares export documents? ▶

The exporter prepares core documents, while the Customs Broker (CHA) prepares the Shipping Bill. The freight forwarder issues the BL/AWB.

Q4. How do export documents help in customs clearance? ▶

They provide proof of product origin, value, HS code, shipment weight, and compliance, allowing customs to approve the shipment legally.

Q5. What happens if export documents have mistakes? ▶

Mistakes can lead to customs penalties, shipment delays, higher charges, and refusal by the buyer’s bank in LC transactions.

Import Documentation Requirements

What:

Documents needed by importer for customs entry: Commercial Invoice, Packing List, Bill of Lading/AWB, Certificate of Origin (if claiming preferential duty), Insurance Certificate, Import License (if applicable), Test/Compliance Certificates, Bank documents (LC, payment receipts).

Why:

Customs uses these to assess duties, enforce health/safety rules, and permit release. Buyers need them to take delivery and claim tax credits (e.g., GST/VAT).

Where/When:

Importer must file customs entry with the destination country’s customs authority using these docs — usually prior to arrival or immediately on arrival.

How it works (practical):

- Importer receives AWB/B/L and invoice via courier/electronic transmission.

- Importer/CHA files import declaration and arranges payment of duties.

- Customs inspects if needed; releases goods on clearance.

- Importer arranges inland delivery and receives goods.

Common mistakes & tips:

- Delayed receipt of original B/L can block release (use eB/L or express release when possible).

- Incorrect Incoterm interpretation leads to misallocated costs/responsibilities.

- Keep backup digital proofs and contact CHA in advance.

IMPORT DOCUMENTATION – Complete List & Their Role

-

1. Commercial Invoice

Used by customs to determine product value and calculate duties and taxes. -

2. Packing List

Helps customs, warehouse staff, and transporters identify the cargo and match it with the invoice. -

3. Bill of Lading / Airway Bill

Required for clearing goods from the shipping line or airline and verifying shipment details. -

4. Bill of Entry

Primary legal document filed by the importer or CHA to begin customs clearance and duty payment. -

5. Certificate of Origin (COO)

Used by customs to apply correct import duty based on trade agreements or tariff classification. -

6. Insurance Certificate

Assures that imported goods were insured during shipment. -

7. Import License (if required)

Allows import of restricted goods such as electronics, chemicals, or medical equipment. -

8. Purchase Order / Import Contract

Shows the terms, quantities, and pricing agreed with the supplier. -

9. Packing Declaration (for Australia/New

Zealand)

Ensures no prohibited materials were used in packaging. -

10. Certificate of Conformity (COC)

Required by several African and Middle Eastern countries to verify product quality and safety. -

11. Technical Standard Certificates (CE, UL,

RoHS,

etc.)

Required for electrical, engineering, and consumer products to meet international standards. -

12. Inspection Certificate

Shows goods were checked before shipment to avoid disputes during import clearance. -

13. Health Certificate / Sanitary Certificate

(food

items)

Required for edible goods to confirm hygiene and safety. -

14. Dangerous Goods Certificate

Needed when importing hazardous materials such as chemicals or batteries. -

15. Delivery Order (DO)

Issued by the shipping line to release the container once charges are paid. -

16. Freight Invoice

Shows the freight charges payable for sea or air transport.

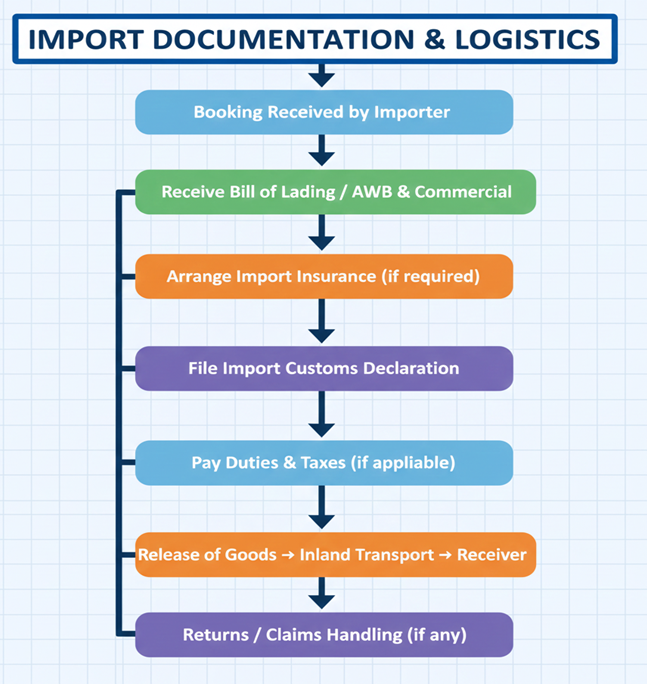

Quick Import Documentation Flowchart

Case Study: How ABC Industries Streamlined the Import Documentation Process for Engineering Components

1. The Background: When Imported Parts Decided Production Speed

ABC Industries, a mid-sized manufacturer of industrial pumps, depended on a critical component—precision bearing housings—that were not available locally with the required tolerance level. A shipment was arranged from a supplier in South Korea, and the company expected a routine clearance at the Indian port.

However, the import documentation was far more complex than they anticipated.

This case follows how the company navigated the entire process and transformed its internal

import workflow.

2. The Purchase Contract Becomes the First Documentation Trigger

When the order was finalized, the import team realized that everything in the documentation chain would ultimately refer back to the contract. The supplier contract contained technical drawings, tolerance criteria, and packaging specifications — all of which had to connect correctly with the commercial documents.

The company understood early that any contradiction between contract terms and import papers could invite customs questioning.

So, ABC Industries created an internal “contract summary dossier” and shared it with:

- the customs broker,

- the internal technical team,

- and the finance department handling duty assessment.

This alignment prevented future confusion.

3. When the First Set of Documents Arrived — and the First Red Flag Appeared

The supplier emailed the Commercial Invoice and Packing List before dispatch. At first glance, the documents appeared complete.

On deeper inspection, ABC Industries noticed that the invoice mentioned the goods simply as “Bearing Parts,” while the technical drawings described the product as “Precision-Machined Stainless Steel Bearing Housings.”

This mismatch was not a minor description issue.

Indian customs classify engineering components based on clarity of material, machining level, and end-use. Ambiguity could trigger manual examination, valuation queries, or duty reassessment.

ABC Industries requested the supplier to update the invoice with:

- the material grade

- the machining specification

- unified product name

- HS code reference

This early correction saved the shipment from potential clearance delays.

4. The Vessel Departs — and Documentation Becomes a Countdown

Once the cargo was loaded and the Bill of Lading was issued, ABC Industries entered the critical phase of the import process.

The Bill of Lading became the backbone of port clearance, but the company knew that relying only on the B/L was not enough.

They checked every document against the “contract summary dossier”:

- Invoice amount matching LC/payment terms

- Quantity matching purchase order

- Weight matching packing list

- HS code matching customs classification

- Origin declared correctly for preferential duty eligibility

This internal review acted like a filter, catching discrepancies before customs caught them.

5. The Unexpected Challenge: The Certificate of Origin Issue

The supplier issued a Certificate of Origin to claim a lower duty rate under a trade agreement.

But when ABC Industries examined it, they noticed a critical error — the supplier’s manufacturing address was incomplete.

This small omission could lead customs authorities to reject the certificate, resulting in higher duties.

ABC Industries immediately requested a corrected COO, ensuring that:

- the factory address matched the contract,

- the description was consistent,

- the chamber stamp was visible and valid.

The corrected document arrived just in time, protecting ABC Industries from unnecessary duty costs.

6. Customs Filing Begins — and the Real Test of Documentation Accuracy Arrives

The customs broker filed the detailed Bill of Entry.

At this stage, the customs system cross-checked all declarations with the provided documents.

ABC Industries’ earlier effort in standardizing descriptions paid off; the shipment was assessed without objections.

However, customs flagged the consignment for a physical examination because engineering components often require verification of material grade and intended use.

During inspection, the officer compared the documentation set — invoice, packing list, COO, and technical catalog — with the actual cargo.

The documentation clarity ensured that every detail corresponded exactly to the physical goods. The inspection concluded without queries, allowing the company to proceed to duty payment and cargo release.

7. The Cargo is Released — and the Documentation System Gets Redesigned

After the shipment was delivered to the factory, ABC Industries conducted an internal review to evaluate what worked and what needed improvement.

They recognized that import documentation had three recurring pressure points:

- Product description ambiguity

- Supplier-side documentation errors

- Last-minute discrepancies delaying clearance

To avoid repeated risks, they built a new internal structure:

- A mandatory “description harmonization sheet” for every imported component

- A supplier guideline document explaining how invoices, packing lists, and COO should be issued

- A verification checklist for documents received before the vessel arrives

- A direct communication loop between the customs broker and the procurement team

This transformed their import process from reactive to predictable.

8. The Result: A Shipment That Became the Template for All Future Imports

Because ABC Industries approached documentation as a controlled workflow instead of a formality, the shipment cleared faster than similar imports handled in the past.

The company realized that import documentation shapes:

- clearance speed

- duty accuracy

- logistics cost

- supplier reliability

- internal production planning

The shipment became a benchmark, allowing the company to establish a repeatable import documentation model that could scale as the business grew.

9. Key Insights That Emerged From the Case

The case highlighted that import success depends largely on documentation discipline.

ABC Industries learned that the importer must take responsibility for validating every document, even if the supplier prepares them.

The clarity and consistency of:

- the invoice

- the packing list

- the Bill of Lading

- the Certificate of Origin

- the specification sheet

determined whether customs clearance would be smooth or problematic.

The largest insight was simple yet powerful:

“Import documentation is not paperwork. It is the backbone of customs trust.”

Import Documentation Requirements – FAQs

Q1. What documents are required for import clearance? ▶

Common import documents include Commercial Invoice, Packing List, Bill of Lading/Airway Bill, Bill of Entry, COO, Insurance Certificate, Import License, and certificates required by the importing country.

Q2. Why does the importer need the Bill of Entry? ▶

The Bill of Entry is the primary document required for customs clearance, duty payment, and legal entry of goods into the country.

Q3. Who is responsible for preparing import documents? ▶

The exporter provides documentation, while the importer and customs broker prepare the Bill of Entry and clearance paperwork.

Q4. How do incorrect import documents affect clearance? ▶

Incorrect documents cause delays, demurrage charges, customs queries, and possible re-examination of cargo.

Commercial Invoice — Complete Guide

What:

The primary sales document showing the transaction between seller and buyer. It lists seller & buyer details, product description, quantity, unit & total price, Incoterm, payment terms, HS codes, currency, invoice date & number.

Why:

Used by customs to assess value for duties, by banks for LC/payment, and by buyers for accounting.

Key fields :

- Seller & Buyer full legal names & addresses

- Invoice number & date

- Purchase Order / Contract Ref

- Full product description (HS code, unit, quantity, net/gross weight)

- Unit price, total price, currency & INCOTERM (with named place)

- Payment terms (LC/T/T) & banking details

- Country of origin & COO reference

- Signature & authorized stamp (if required)

How to prepare:

Use standard format, ensure consistency across all docs, include HS code and unit of measure. For LCs, match the LC precisely.

Common mistakes & tips:

- Do not round numbers across documents.

- Ensure currency and amount match what bank requires.

- Include HS code — many customs require it.

Case Study: How XYZ Engineering Transformed Its Export Success Through a Perfect Commercial Invoice

1. When a Single Document Decided Whether the Shipment Would Move

XYZ Engineering, a manufacturer of precision-machined industrial shafts, secured a major export order from a distributor in Europe.

The order was straightforward on the surface—50 units of custom shafts with defined tolerances and packaging requirements. The factory prepared the goods on time, the buyer approved the inspection report, and the logistics team booked the container.

Everyone assumed the shipment would move smoothly.

But the real challenge began the moment the Commercial Invoice was created.

XYZ Engineering discovered that this single document had the power to influence customs

clearance, duty

calculation, buyer payment release, and even post-shipment claims.

The company learned quickly that the Commercial Invoice is not merely a bill—it is the legal

backbone of the

export process.

2. The First Draft of the Invoice Becomes an Early Warning

The exporter’s documentation officer prepared the first draft of the Commercial Invoice.

At a glance, it looked complete, but when the export compliance manager reviewed it, inconsistencies became clear.

The product description mentioned only “Industrial Steel Shafts,” even though the contract specified “High-Precision Machined Stainless Steel Industrial Shafts – Grade SS304 – Tolerance 0.02mm.”

The invoice value was correct, but the Incoterm was missing.

The buyer’s address was spelled differently from the LC document.

The HS code was incomplete.

Each of these details could have led to buyer dissatisfaction, customs questions, or even

rejection of payment

under the Letter of Credit.

This moment made XYZ Engineering recognize that the Commercial Invoice had to reflect the

contract with

absolute accuracy.

3. Rebuilding the Commercial Invoice From the Ground Up

The export team reconstructed the invoice, ensuring that every element matched the export order, the packing list, and the purchase contract.

The product description was expanded to capture:

- the machining grade,

- the exact material specification,

- the tolerance level,

- and the intended industrial application.

The Incoterm was clearly written with location: “FOB Mumbai Port.”

The HS code was fully stated to avoid misclassification at the destination customs.

The total value, currency, and payment terms were aligned with the buyer’s LC conditions.

Instead of treating the invoice as a document, XYZ Engineering approached it as the primary

proof of the

export transaction.

4. The Shipping Line Requests the Invoice — and a New Layer of Responsibility Emerges

Once the invoice was finalized, the shipping line required it to prepare the Bill of Lading.

At this stage, the invoice served as the foundation for drafting the B/L.

Any mismatch here would create a chain reaction of corrections, delays, and unnecessary costs.

The export team compared the invoice line-by-line with the packing list and found that the number of packages had a slight discrepancy.

The packing list mentioned 13 packages, while the invoice mentioned 12.

Had this passed through as-is, the B/L would have carried an incorrect package count, triggering

inspections

at the port.

A revised version was issued immediately, and the documentation stayed aligned.

5. Customs Examination Reveals the True Power of the Invoice

When the goods reached the port, customs officers evaluated the shipment.

The Commercial Invoice became the first document they scrutinized to verify value, classification, and compliance.

The detailed product description, accurate HS code, and complete Incoterms helped customs

understand the

nature of the cargo without raising queries.

The officer compared the invoice to the physical shipment and found everything consistent.

The cargo was cleared smoothly, proving that the quality of the Commercial Invoice directly

impacted

operational efficiency.

6. Buyer-Side Verification Highlights the Importance of Precision

After shipment, the European buyer used the Commercial Invoice for import clearance on their side.

Their customs authority cross-checked every detail:

- the declared value,

- the product classification,

- the country of origin,

- and the Incoterm.

The buyer later informed XYZ Engineering that the clear and detailed Commercial Invoice

significantly reduced

their clearance time.

They expressed appreciation for the professionalism, strengthening the business relationship

further.

The invoice also became the key reference for processing the payment under LC terms.

7. Post-Shipment Audit Turns the Invoice Into a Learning Tool

Once the shipment was delivered, XYZ Engineering conducted a quality review of the documentation process.

The Commercial Invoice became the centerpiece of the evaluation.

The team noted how clarity in description, accurate weight and quantity, and correct HS code prevented:

- destination customs delays,

- B/L amendments,

- bank rejections during payment,

- and communication misunderstandings with the buyer.

The invoice served as a blueprint for standardizing documentation across all future export shipments.

8. How the Perfect Commercial Invoice Became a Competitive Advantage

- enhance trust with global buyers,

- reduce customs clearance time,

- minimize operational disputes,

- prevent hidden penalties or misclassification,

- speed up payment settlement,

- and strengthen supply chain efficiency.

The company understood that the Commercial Invoice is not a clerical task—it is a strategic

instrument that

directly influences global trade performance.

The final version of the invoice was used as a template for all upcoming exports, ensuring

consistency,

compliance, and brand credibility.

9. Key Insight Gained From the Case

XYZ Engineering realized that the Commercial Invoice represents the exporter’s professionalism more clearly than any brochure, website, or marketing document.

It is the first point of trust between the exporter, the buyer, the shipping line, and the customs authorities of both countries.

The shipment taught them a long-lasting lesson:

“A precise Commercial Invoice is not paperwork — it is the international identity of the

exporter.”

Commercial Invoice – Complete Guide – FAQs

Q1. What is a Commercial Invoice in export–import? ▶

A Commercial Invoice is the legal contract between exporter and buyer showing product details, quantity, value, HS code, Incoterms, and shipment terms.

Q2. Why is the Commercial Invoice important in EXIM trade? ▶

It is required for customs clearance, foreign exchange, taxation, valuation, and payment under LC or bank transfer.

Q3. What must be included in a perfect Commercial Invoice? ▶

Exporter details, buyer details, product description, HS Code, quantity, unit price, total value, Incoterms, payment terms, origin, and signature.

Q4. Does the Commercial Invoice need to match the Packing List? ▶

Yes. All information must match exactly. Even small mistakes can create customs delays.

Packing List — Complete Guide

What:

Detailed list of the way goods are packed — shows package type (crate/pallet), marks & numbers, number of packages, net & gross weight, dimensions, content per package, and consignee details.

Why:

Used by carriers and customs to identify cargo, calculate volume/weight for freight, and to inspect physical goods against invoice.

Key fields:

- Invoice reference & P.O. number

- Package description (box/crate/pallet) & unique marks

- Number of packages, total gross & net weight

- Dimensions (L×W×H) per package

- Item-wise breakdown and quantity per package

- Special handling instructions (Fragile, This Side Up)

How to prepare:

Produce a master packing list and individual package lists. Use barcodes or QR codes for traceability.

Common mistakes & tips:

- Not providing accurate dimensions increases freight cost or causes stuffing issues.

- Mismatched item counts vs invoice cause customs queries.

Packing List Requirements for Export

-

1. Shipper & Consignee Details

A packing list must identify who is sending the goods and who is receiving them. This ensures that customs, the freight forwarder, and the carrier can match the shipment to its rightful sender and consignee. -

2. Buyer / Notify Party Information

Sometimes the buyer is different from the consignee. This detail helps carriers and customs authorities know whom to contact when cargo arrives. -

3. Invoice Number & Date Reference

The packing list must cross-reference the commercial invoice so authorities can verify the quantity and physical cargo against financial documentation. -

4. Purchase Order or Contract

Reference

This allows the buyer to check whether goods match the agreed terms of the purchase order or contract. -

5. Detailed Product Description

A clear description of each product being shipped — engineering goods must identify their type, material, and nature so customs can classify them correctly. -

6. HS Code for Each Item

Though optional, many exporters include HS codes on packing lists to speed up customs clearance and avoid misclassification. -

7. Quantity of Each Item

Both unit quantity and total quantity must appear so that customs can verify that what is declared is actually packed. -

8. Weight (Net Weight & Gross

Weight)

Net weight is the weight of goods alone; gross weight includes packaging. Both are needed for freight costing, customs declaration, and container loading. -

9. Number of Packages / Cartons /

Crates

This allows carriers and customs officials to verify that physical packages match the documents. -

10. Type of Packaging

Whether the cargo is packed in cartons, wooden boxes, pallets, metal drums, or crates. Ensures safe stowage and proper handling. -

11. Dimensions of Each Package

Length, width, and height of each box or crate support freight calculations and container planning. -

12. Marks & Numbers on Each Package

Symbols, handling marks, or package codes help warehouse teams identify packages during loading and unloading. -

13. Total Volume (CBM)

The cubic meter measurement is crucial for planning space inside a container or LCL consolidation. -

14. Country of Origin

Even if it appears in the commercial invoice, many countries require the origin also on the packing list to verify the authenticity of goods. -

15. Mode of Shipment & Container

Details

For engineering goods, the packing list may include container numbers, seal numbers, or transport mode to link cargo to a specific shipment.

Packing List Requirements for Import

-

1. Exporter & Importer

Identification

The authorities in the importing country check this detail to confirm the legitimacy of both the exporter and the importer. -

2. Invoice Reference for

Verification

Customs compares the packing list with the invoice to ensure that the quantity and type of goods match declared values. -

3. Bill of Lading or Airway Bill

Reference

Used to match the physical cargo with transport documents. -

4. Product Description for Customs

Classification

Import customs requires precise descriptions to classify goods correctly and assess applicable duties. -

5. HS Code (If Provided)

Many importers require HS codes in the packing list to ensure correct duty and tax calculation. -

6. Quantity Verification

The declared quantities must match what is inside the container, crate, or pallet during customs inspection. -

7. Packaging Details

Import customs and warehouse teams verify the condition and type of packaging—cartons, pallets, wooden crates (ISPM-15 compliant), etc. -

8. Weight Details (Net & Gross)

Import authorities use this to determine risk level, inspection needs, and freight-related charges. -

9. Dimensions & Volume

Necessary for warehouse space allocation and container de-stuffing planning. -

10. Marks & Numbers for

Identification

These help the importer’s warehouse staff identify the correct cargo, especially during large shipments. -

11. Container Number & Seal Number

Vital for matching containerized cargo during de-stuffing, preventing tampering issues, and ensuring the chain of custody. -

12. Country of Origin for Duty

Assessment

Import duty rates often depend on origin due to trade agreements or restrictions. -

13. Batch Number / Serial Number (If

Applicable)

Engineering products sometimes require batch traceability, especially if they are mechanical components, precision parts, or electrical goods.

Packing List – Complete Guide – FAQs

Q1. What is a Packing List? ▶

A Packing List details how goods are packed, including dimensions, weight, packaging type, number of boxes, and marks & numbers.

Q2. Why is the Packing List important for shipping? ▶

It helps customs officers verify cargo, supports safe loading, and is required by shipping lines to calculate container planning.

Q3. What is the difference between a Packing List and a Commercial Invoice? ▶

The Packing List shows physical details, while the Invoice shows financial details.

Q4. Who checks the Packing List? ▶

Customs, freight forwarders, cargo loaders, and the buyer’s warehouse team.

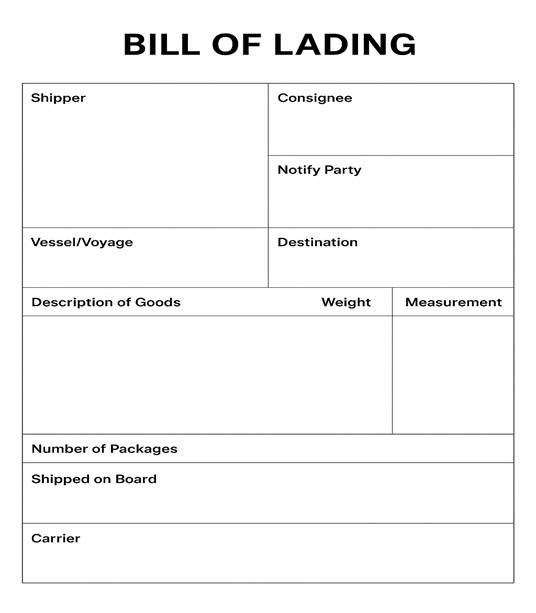

Bill of Lading (B/L) & Airway Bill (AWB) — Explained

What:

Bill of Lading (Sea) — Carrier-issued document acknowledging receipt of goods, evidence of contract of carriage and (for negotiable B/L) title to goods.

AWB (Air) — Non-negotiable transport document for air cargo; proof of carriage & contract.

Why:

Required by buyer for taking delivery, by banks (for LCs) as shipping evidence, and by customs.

Types of B/L:

- Ocean Bill of Lading (Negotiable / To Order)

- Seawaybill (non-negotiable)

- Clean B/L vs Claused B/L

- Multimodal B/L

Key fields:

Consignee, notify party, shipper, vessel/voyage, port of loading & discharge, description of goods, gross weight, number of packages, B/L number.

How it works practically:

- Seller hands cargo to carrier or forwarder.

- Carrier issues B/L or forwarder issues house B/L.

- If negotiable B/L used, original B/Ls are couriered to buyer/bank for document against payment.

- AWB normally transmitted electronically and original not required for import release (airlines accept e-AWB).

Common mistakes & tips:

- Delay in sending original B/L delays release at destination. Use telex release or electronic B/L where possible.

- Ensure B/L consignee matches LC terms.

Types of Bill of Lading (B/L) — Detailed Explanation

A Bill of Lading is one of the most powerful documents in global trade because it acts simultaneously as a contract of carriage, a receipt of goods, and a document of title. Its type determines who can claim the cargo, how fast goods are released, how bankers deal with it under LC, and what level of security an exporter or importer gets.

Below is each type, explained in depth.

1. Straight Bill of Lading

A Straight B/L is issued when the shipment is meant for a specific, named consignee, and the carrier is obligated to deliver the goods only to that party. It functions like a locked and directed instruction: the carrier cannot release the goods to anyone except the named consignee. It is most commonly used when the importer has already paid in full or when the two trading partners have high trust. The release of goods in this case is non-transferable; no third party can endorse the document to gain ownership. This type works well in commercial arrangements where the exporter wants to ship goods without safeguarding control through negotiable title documents. At the destination port, the importer simply proves identity, presents required identification or authorization, and receives the cargo. No endorsement or negotiation is required. Because of its simplicity, banking institutions rarely prefer it for Letters of Credit.

2. Order Bill of Lading

An Order B/L is the most powerful and flexible form because it is a negotiable instrument. It allows ownership of the cargo to be transferred from one party to another through endorsement, similar to signing over a cheque. It is commonly used when payments involve Letters of Credit or when intermediary traders buy and sell goods while the shipment is still in transit. The wording “To Order” or “To Order of XYZ Bank” is what makes it negotiable. Its working mechanism is rooted in endorsement. If the B/L is “To Order of Shipper,” the shipper can endorse it to the buyer once payment terms are satisfied. If it is “To Order of Bank,” then the bank controls the release until the importer meets financial conditions. At the destination port, whoever holds the properly endorsed original B/L legally holds the right to claim the cargo. This element of title makes the Order B/L indispensable in complex international trade transactions.

3. Bearer Bill of Lading

A Bearer B/L transfers ownership purely by physical possession. Whoever holds the document is considered the rightful claimant to the cargo. This format is extremely rare today because it poses high risks of theft or fraud. It is sometimes used for bulk shipments or in situations where goods are sold multiple times while in transit. The carrier releases the cargo to whoever physically presents the original document without requiring endorsement or identification. Because of the high security risks, most shipping lines avoid issuing Bearer B/Ls unless explicitly requested and justified by the shipper. Regulatory authorities also monitor such documents closely due to their potential misuse.

4. Clean Bill of Lading

A Clean B/L is issued when the carrier receives the cargo in good condition, with no visible damage or shortage. This document is vital in LC transactions because banks only accept a Clean B/L as proof that the goods were shipped properly. If the carrier finds defective packaging, missing items, or broken units, they will refuse to issue a Clean B/L. The working principle is simple: it becomes the carrier’s declaration that the goods were handed to them exactly as contracted. Importers and banks rely on this as a guarantee that the shipment quality at loading was as promised. A Clean B/L therefore protects buyers against unscrupulous exporters.

5. Claused / Foul Bill of Lading

A Claused or Foul B/L is issued when the carrier notices damage, poor packaging, or discrepancy in the shipment during loading. Instead of refusing, the carrier adds remarks such as “Cartons torn,” “Packaging wet,” or “Goods partially broken.” These remarks serve as warnings to buyers and banks that the cargo was not in perfect condition when handed over. Such a document can disrupt Letters of Credit because banks usually reject a Claused B/L. Importers also use this document as evidence if they decide to file claims against exporters. Essentially, a Claused B/L weakens the exporter’s position and signals risk of damaged goods.

6. Shipped Bill of Lading

A Shipped (or On-Board) B/L is issued only after the cargo is physically loaded onto the vessel. This is extremely important for banks under Letters of Credit, as they require proof that goods were not only received by the carrier but actually placed on the ship for departure. The exporter receives the Shipped B/L after loading confirmation, and this document assures the importer that delivery has already begun. For carriers, issuing this form means they accept responsibility for the cargo from the moment it is on board.

7. Received for Shipment Bill of Lading

This type is issued when the carrier receives the cargo at the port or container yard but has not yet loaded it onto the vessel. It acts as a temporary acknowledgment of receipt. However, it does not guarantee that the cargo has been loaded. For this reason, banks prefer not to accept it in LC transactions unless specifically allowed. In practice, freight forwarders or shipping lines often issue this when the goods arrive early at the port and wait for the assigned ship. Once loaded, it is usually converted into a Shipped B/L.

8. Through Bill of Lading

A Through B/L is issued when the cargo must travel through multiple modes of transport or via multiple carriers—from truck to ship, or from ship to rail, before reaching the final destination. This allows the exporter to issue a single document that covers the entire multi-leg journey. It is commonly used in inland or landlocked trade corridors, where goods travel long distances from the exporter’s factory to the final delivery point. The major advantage is convenience. The importer does not need to handle multiple transport documents. The carrier issuing the Through B/L takes responsibility for the cargo across all segments, even when subcontracted to other carriers.

9. House Bill of Lading (HBL)

An HBL is issued by a freight forwarder or NVOCC (Non-Vessel Operating Common Carrier). It reflects the agreement between the exporter and the forwarder. In this arrangement, the forwarder acts as a logistics intermediary. The HBL names the exporter as the shipper and the foreign buyer as the consignee, but the forwarder is the one managing the movement. The forwarder then receives a Master Bill of Lading from the shipping line for the consolidated cargo. The HBL is typically used in LCL (Less-than-Container Load) shipments or when the exporter deals directly with the forwarder rather than the carrier.

10. Master Bill of Lading (MBL)

A Master B/L is issued by the shipping line or vessel operator to the freight forwarder or NVOCC. It captures the relationship between the forwarder and the carrier. The forwarder consolidates multiple small shipments into a single container and receives one MBL for that entire load. For the shipping line, the forwarder is the customer, and the MBL reflects that. At the destination, the forwarder deconsolidates the shipments and releases them to individual importers as per their HBLs. The MBL ensures that the carrier deals only with the forwarder or NVOCC, not the actual cargo owners.

11. Sea Waybill

A Sea Waybill resembles a Bill of Lading but does not function as a document of title. It is simply a receipt and transport contract. It enables quick release because no original document is needed for cargo collection. Importers only need identification and the carrier’s arrival notice. The exporter cannot hold the cargo until payment like they can with a negotiable B/L. This is widely used in highly trusted trading relationships or where the importer has already paid (e.g., open account terms). For express customs clearance, it is one of the most efficient instruments.

12. Switch Bill of Lading

A Switch B/L is a second version issued to replace the original B/L, typically during a triangular or intermediary trade. This is commonly used when a middleman or trader wants to hide the identity of the original supplier or original buyer. The shipping line issues the second set of B/Ls based on instructions of the cargo-controlling party, while retaining legal accuracy of quantities and descriptions. Switch B/Ls allow traders to protect their business relationships but are carefully monitored by shipping lines to prevent misuse or discrepancies.

13. Charter Party Bill of Lading

Used when an entire vessel is chartered by a company under a charter party agreement, this type references the charter contract rather than standard carrier terms. It is common for large-volume shipments such as steel coils, machinery, bulk engineering equipment, or raw materials. Banks often hesitate to accept this type in LC transactions unless specifically stated, because the terms are governed by the private charter contract rather than standard shipping laws.

Bill of Lading / Airway Bill – FAQs

Q1. What is a Bill of Lading (BL)? ▶

A BL is a legal shipping document issued by the carrier showing cargo receipt, transport contract, and ownership of goods.

Q2. What is an Airway Bill (AWB)? ▶

AWB is the air cargo equivalent of a BL, used for air shipments but non-negotiable.

Q3. Why is the BL important? ▶

It acts as:

- Proof of shipment

- Title (ownership) of goods

- Receipt issued by carrier

- Required for cargo release at destination

Q4. What types of BL exist? ▶

- Original BL

- Seaway Bill / Express BL

- House BL

- Master BL

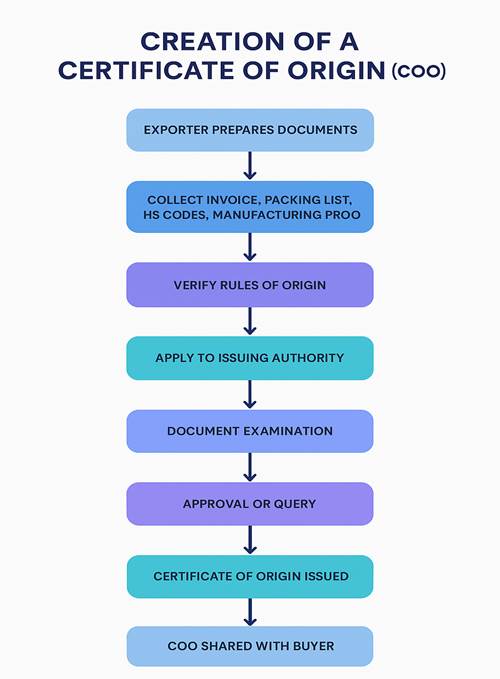

Certificate of Origin (COO)

What:

Official document certifying the product’s country of origin. Issued by chamber of commerce or designated authority.

Why:

To claim preferential duties under Free Trade Agreements, to meet importing country’s rules of origin, and for statistical purposes.

Where / When:

Applied/issued before shipment based on supplier declarations & supporting documents; presented to importer for customs.

How it works:

- Seller applies to local Chamber with invoice, packing list & manufacturer’s declaration.

- Chamber verifies and issues COO (digital/electronic COO increasingly used).

- Importer submits COO to customs to claim preferential tariff.

Common mistakes & tips:

- Wrong origin claims lead to penalties or denial of preferential rates.

- Keep supplier/manufacturer evidence for audits.

Types of Certificate of Origin (COO)

A Certificate of Origin (COO) confirms where a product is manufactured, and it is a mandatory international trade document for customs clearance, duty benefits, and compliance verification.

COOs are classified into two major categories, and each category has multiple sub-types.

1. Non-Preferential Certificate of Origin (General COO)

What it is

A document that certifies that goods originate from a particular country but do not qualify for any duty concession or tariff preference.

Why it is used

It is required when importing countries want to verify product origin for regulatory, statistical, or compliance purposes.

Where it is used

Middle East, Africa, Europe, and countries where there is no Free Trade Agreement (FTA) with the exporting nation.

How it works

The exporter submits shipment details to an authorized issuing body (Chamber of Commerce or Export Promotion Council), and the body certifies origin after document verification.

2. Preferential Certificate of Origin (Under Trade Agreements)

What it is

A COO issued under a Free Trade Agreement (FTA) or Preferential Trade Agreement (PTA) where the buyer receives reduced or zero import duty.

Why it is used

To enable importers to claim preferential duty benefits under specific trade agreements.

Where it is used

Countries with FTAs/PTAs such as ASEAN, SAARC, EU-GSP, etc.

How it works

Exporter proves that goods meet the Rules of Origin (ROO) of the agreement. Authorities issue a preferential COO only if requirements such as value addition, change in tariff code, or regional content are satisfied.

Detailed Types of Preferential COOs

-

A. Form A – GSP Certificate of

Origin

Used for exports to countries that offer Generalized System of Preferences (GSP) benefits.

Examples: EU, UK (GSP), Canada (GSP), Japan (GSP). -

B. EUR.1 Certificate

Used for shipments going to the European Union under certain trade agreements. -

C. Form AI – ASEAN-India FTA (AIFTA)

Used when exporting to ASEAN member countries under the ASEAN-India Free Trade Agreement. -

D. SAFTA Certificate of Origin (South Asian Free

Trade

Area)

Used for duty benefits when exporting among SAARC countries. -

E. APTA Certificate (Asia Pacific Trade

Agreement)

Used for duty concessions between APTA member countries (India, China, Korea, Sri Lanka, etc.). -

F. India–UAE CEPA Certificate

Issued for exports to the UAE under the Comprehensive Economic Partnership Agreement (CEPA) for zero or reduced duties. -

G. India–Australia ECTA COO

Used when exporting to Australia under the Economic Cooperation & Trade Agreement (ECTA). -

H. India–Japan CEPA COO

Issued for exports under the Comprehensive Economic Partnership Agreement with Japan. -

I. RCEP COO (Where Applicable)

Used for countries participating in the Regional Comprehensive Economic Partnership. -

J. Country-Specific Preferential

COOs

Examples:- Indo-Chile PTA

- Indo-Mercosur PTA

- Indo-Korea CEPA

- Indo-Singapore CECA

3. Self-Certified Certificate of Origin (For Certain Agreements Only)

Some trade agreements allow approved exporters to issue COOs themselves.

Examples:

- EU’s Registered Exporter System (REX)

- ASEAN Self-Certification

- UK self-declaration system

Why it exists: To speed up shipments and reduce dependency on issuing authorities.

4. Digital Certificate of Origin (e-COO)

National or Chamber-based digital COO platform.

Where it is used:

India, Singapore, UAE, and multiple Asian economies.

How it works:

Documents are uploaded digitally → verified online → issued as an electronic COO with QR Code.

BONUS: Industry-Specific COOs

Some countries issue special COOs for:

- Textiles

- Agricultural goods

- Steel & metal products

- Electronics with restricted origin rules

Flowchart of Certificate of Origin (COO)

Certificate of Origin (COO) – FAQs

Q1. What is a Certificate of Origin? ▶

A COO certifies the country where the goods are manufactured.

Q2. Why is a COO required? ▶

It helps in:

- Determining import duty

- Enjoying FTA / Preferential tariff benefits

- Confirming authenticity of goods

Q3. Who issues the COO? ▶

Chambers of Commerce or authorized trade bodies.

Q4. What is the difference between a Normal COO and Preferential COO? ▶

- Normal COO → No duty benefit

- Preferential COO → Reduced duty under Free Trade Agreements

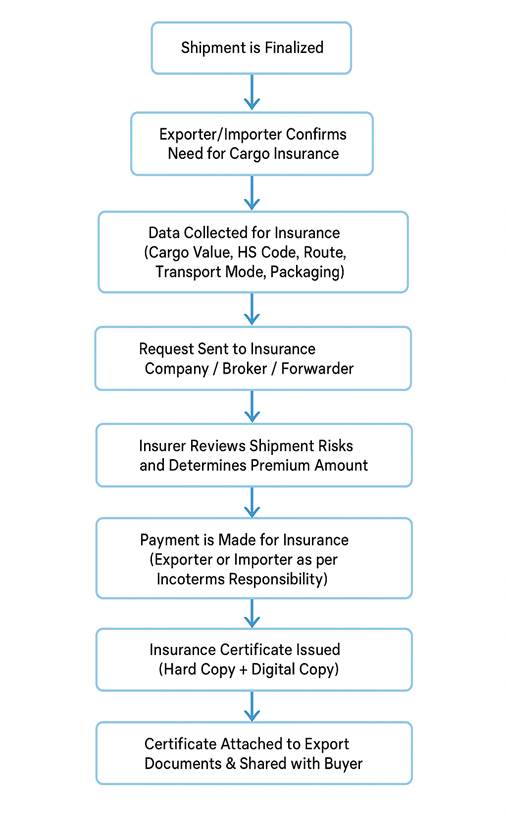

Insurance Certificate

What:

Evidence that cargo is insured for loss or damage during transit. Issued by an insurer or insurance broker.

Why:

Protects the seller or buyer (depending on Incoterm) from the risk of loss or damage during transit.

Types:

Marine Cargo Insurance (All Risk / Named Perils), A to A, Institute Cargo Clauses.

Key fields:

Policy number, insured party, description of goods, sum insured (usually CIF or CIF + 10%), voyage details, risk covered.

How it works:

Buyer or seller obtains the policy before shipment, depending on who is responsible under the Incoterm. In case of loss or damage, a claim is filed with the insurer by submitting the Bill of Lading, Commercial Invoice, Packing List, and survey report.

Common mistakes & tips:

- Underinsurance — insure at appropriate value (invoice + freight + margin).

- Wrong consignee or insured party details invalidate claims.

Insurance Certificate in EXIM: Types, Roles, Benefits & Process Flow

An Insurance Certificate is an official document issued by an insurance provider confirming that a shipment is insured against specific risks during transit. In global trade, it acts as a financial safeguard for exporters, importers, and logistics stakeholders who rely on secure cargo movement across borders.

1. Types of Insurance Certificates in EXIM

a. Marine Cargo Insurance Certificate

This is the most widely used certificate in global trade. It covers loss or damage to goods during sea, air, or land transportation. It can include risks such as theft, rough handling, natural disasters, fire, and accidents.

b. All-Risk Insurance Certificate

This certificate offers the broadest form of coverage. It generally includes most unforeseen events except those clearly excluded by the insurer. Highly preferred for high-value, fragile, or sensitive shipments.

c. Institute Cargo Clause (ICC-A / ICC-B / ICC-C) Certificate

These are standardized coverage levels used internationally:

- ICC-A → Maximum protection (all-risk)

- ICC-B → Medium protection, covering significant but not all risks

- ICC-C → Minimum protection, mostly basic hazards

Each clause’s certificate outlines terms, conditions, and exclusions.

d. Warehouse-to-Warehouse Insurance Certificate

This covers the cargo from the exporter’s warehouse to the importer’s warehouse, including all transit stages. Useful when multi-modal transport is involved.

e. Contingency Insurance Certificate

Issued by exporters to protect themselves if the buyer fails to insure the goods or their insurance becomes invalid. Ensures non-payment disputes are avoided.

f. Open Policy Insurance Certificate

For companies handling regular shipments, one policy covers multiple consignments. Each shipment receives its own certificate under the master policy. This reduces repetitive documentation and speeds up export processing.

2. Who Issues the Insurance Certificate?

- Licensed Insurance Companies: Insurance providers authorized to offer marine or cargo insurance.

- Insurance Brokers / Agents: They act on behalf of exporters or importers to arrange insurance with licensed insurers.

- Freight Forwarders (In Some Cases):Some globally recognized logistics companies offer cargo insurance through partnerships with insurance firms and issue certificates accordingly.

3. Who Is Responsible for Obtaining the Insurance Certificate?

- Exporter’s Responsibility: Under terms like CIF, CIP, the exporter must insure the goods and issue/provide the certificate.

- Importer’s Responsibility: Under terms like FOB, EXW, FCA, the importer arranges insurance in their own country.

- Logistics Partners: Freight forwarders or customs brokers assist by preparing drafts and coordinating with insurers.

4. Key Benefits of an Insurance Certificate

- Protection against financial loss due to cargo damage or loss.

- Ensures compliance in international trade and banking requirements.

- Enhances trust between buyer and seller.

- Smooth and faster insurance claim process.

- Supports multi-modal transport across sea, road, rail, and air.

Insurance Certificate Creation Process

Insurance Certificate – FAQs

Q1. What is an Insurance Certificate in export–import? ▶

It is a document proving that the shipment is insured against loss, damage, or theft during transit.

Q2. Why is cargo insurance necessary? ▶

It protects the exporter or importer from financial loss, especially during long international transit.

Q3. Who arranges insurance in EXIM? ▶

It depends on the Incoterms:

- CIF / CIP → Exporter arranges

- FOB / FCA / EXW → Buyer arranges

Q4. What details must be included? ▶

Cargo value, insured amount, risk coverage, shipment route, transport mode, and policy number.

Quality & Compliance Certificates (CE, ISO, SGS, BIS etc.)

What:

Certificates proving product quality, safety, or compliance with standards (CE for EU, UL for US, BIS for India, ISO for quality management, SGS / Intertek test reports).

Why:

Many countries require compliance certificates to clear customs or meet buyer acceptance. They also build buyer trust.

Where / When:

Obtain from recognized testing bodies or accredited labs prior to shipment or during product development. Some are manufacturer-issued (ISO), others are third-party test reports.

How it works:

- Manufacturer gets product tested or implements a certified management system.

- Certification body issues certificate valid for a defined period.

- Certificates accompany shipment and are retained for audits.

Common certificates for engineering goods:

- ISO 9001 (Quality Management)

- CE marking (if product falls under EU directives)

- BIS (India Standards)

- Material Test Certificates (MTC) / Mill Test Certificates for metals

- Third-party inspection certificates (SGS, Bureau Veritas)

Common mistakes & tips:

- Using expired certificates.

- Not matching certificate scope with the actual product.

Types of Quality & Compliance Certificates in Export–Import

Quality and compliance certificates demonstrate that exported or imported goods meet international standards, safety requirements, and buyer expectations. These certificates vary depending on the product category, destination country, and regulatory body.

Below are the most commonly required certificates in global trade, especially for engineering goods.

1. ISO Certificates (International Organization for Standardization)

What it is:

A global standard confirming that the company follows consistent quality management,

safety protocols, and operational processes.

Common ISO Standards in Engineering Exports:

- ISO 9001 – Quality Management System

- ISO 14001 – Environmental Management

- ISO 45001 – Occupational Health & Safety

- ISO 50001 – Energy Management

- ISO/IEC 17025 – Testing & Calibration Labs

Who creates it: Accredited ISO Certification Bodies.

Who is responsible: Manufacturer or exporter.

2. CE Certificate (European Conformity)

What it is:

Mandatory certificate for exporting machinery, electronics,

and industrial products to Europe.

Confirms product safety, health, and environmental compliance.

Who creates it: Notified Bodies in Europe or approved global agencies.

Who is responsible: Manufacturer (self-declaration allowed for some products).

3. SGS / TÜV / BV Inspection Certificates

What it is:

Third-party inspection confirming product quality,

safety, and compliance with buyer specifications.

Who creates it:

- SGS

- TÜV Rheinland / TÜV SÜD

- Bureau Veritas

- Intertek

Who is responsible: Buyer often requests it; exporter arranges it.

4. BIS Certificate (Bureau of Indian Standards)

What it is:

Required for products imported into India that fall under the BIS mandatory list

(electronics, steel items, chemicals, etc.).

Who creates it: BIS-certified testing labs.

Who is responsible: Importer.

5. ROHS Certificate (Restriction of Hazardous Substances)

What it is:

Confirms that the product does not contain harmful substances

such as lead, mercury, or cadmium.

Who creates it: Accredited compliance labs.

Who is responsible: Manufacturer and exporter.

6. REACH Certificate (EU Chemical Safety Regulation)

What it is:

Required for products or materials containing chemicals exported to the EU.

Who creates it: EU-authorized testing labs.

Who is responsible: Manufacturer and exporter.

7. FDA / ASTM Certificates

What it is:

Required for products that must meet U.S. Food & Drug Administration standards,

including food-contact materials and medical equipment.

Who creates it: FDA-approved testing facilities.

Who is responsible: Manufacturer or exporter.

8. Phytosanitary Certificate

What it is:

Ensures wooden packaging, pallets, or agricultural goods are free from pests.

Who creates it: Government agricultural or plant quarantine departments.

Who is responsible: Exporter.

9. Material Test Certificate (MTC) / Mill Test Certificate

What it is:

Confirms chemical composition and mechanical properties

of steel, metals, and engineering components.

Who creates it: Manufacturer’s quality department.

Who is responsible: Manufacturer or exporter.

10. Certificate of Compliance (COC)

What it is:

Confirms that the product meets buyer specifications or industry standards.

Who creates it: Manufacturer, testing lab, or inspection agency.

Who is responsible: Exporter or manufacturer.

Who Creates Quality & Compliance Certificates?

Quality and compliance certificates may be created by:

1. Manufacturer

- MTC (Mill Test Certificate)

- Self-declared CE

- Certificate of Compliance

- Internal quality assurance certificates

2. Third-Party Inspection Agencies

- SGS, TUV, Bureau Veritas, Intertek

- Pre-shipment inspection (PSI)

- Physical testing and compliance verification

3. Government Authorities

- Phytosanitary Certificate

- BIS

- FDA

- Country-specific regulatory bodies

4. Accredited Testing Laboratories

- ISO

- ROHS

- REACH

- Electrical and mechanical safety tests

- Chemical analysis

Who Is Responsible?

Responsibility depends on the agreement between buyer and seller, often influenced by Incoterms.

Exporter is responsible when:

- Buyer requests certifications

- Destination country requires safety standards

- The product is regulated (electronics, machinery, steel, chemicals)

Importer is responsible when:

- Importing country requires compulsory registration (BIS, FDA, GCC Conformity)

- They need to comply with internal market regulations

Shared responsibility occurs when:

- Buyer provides technical specifications

- Exporter handles testing

- Third-party inspector verifies quality

Benefits of Quality & Compliance Certificates

- Improved buyer confidence

- Reduced shipment rejections

- Faster customs clearance

- Assurance of safety and reliability

- Eligibility to enter regulated markets (EU, USA, GCC)

- Reduced financial risk

- Higher product acceptance rate

- Professional credibility and brand value

- Prevention of compliance-related penalties

Quality & Compliance Certificate Creation Process

Quality & Compliance Certificates (CE, ISO, SGS, BIS) – FAQs

Q1. What are quality certificates in international trade? ▶

They verify that products meet international standards, safety norms, and buyer requirements.

Q2. Why are certifications like CE, ISO, SGS, BIS required? ▶

They increase buyer trust, ensure market access, and prevent customs rejections.

Q3. Who issues these certificates? ▶

Independent certification bodies such as ISO agencies, SGS, TÜV, BIS, Intertek, and similar organizations.

Q4. Do all countries require the same compliance? ▶

No. Every country has different regulatory standards depending on product type and safety requirements.

Country-Specific Documentation Requirements — Overview & How to Handle

What:

Additional documents unique to destination or origin countries: phytosanitary certificates, fumigation certificates, import licenses, halal certificates, hazardous goods declarations, local distributor agreements, consular legalization, VAT / EORI registrations.

Why:

Regulatory compliance and avoiding shipment detention, penalties, or rejection.

How to manage:

- Maintain a country-docs matrix per target market listing required documents by HS code and product category.

- Use export promotion councils and local embassies for up-to-date regulatory documentation lists.

- Implement a pre-shipment compliance checklist for every destination.

Example common country requirements:

- EU: CE marking, REACH (chemicals), EU declarations, EORI for importers.

- USA: FDA (food / medical), EPA (chemicals), UL for electrical products.

- Australia / New Zealand: Strict biosecurity requirements — packaging and wood treatment documentation (ISPM-15).

- Middle East: Chamber attestation and consular legalization (varies by country).

- Brazil: Local registration and ANVISA / INMETRO approvals depending on product category.

Tips:

Maintain a per-market Standard Operating Procedure (SOP) and update it annually or whenever the product specification changes.

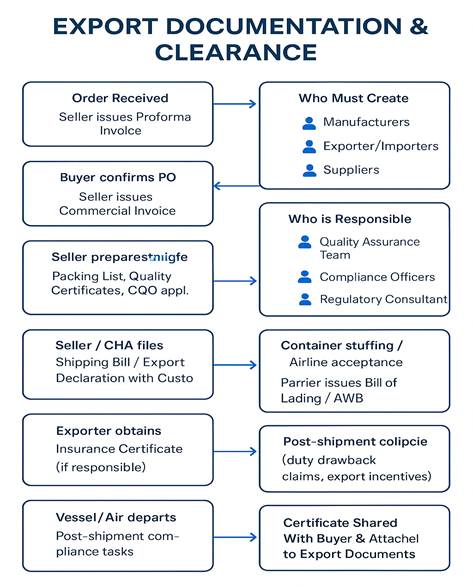

Detailed Flowchart: Export Documentation & Clearance

- Order received → Seller issues Proforma Invoice.

- Buyer confirms PO → Seller issues Commercial Invoice.

- Seller prepares Packing List, Quality Certificates, and applies for Certificate of Origin (if required).

- Seller books freight with forwarder (sea / air) and receives booking confirmation.

- Seller or CHA files Shipping Bill / Export Declaration with customs (attach Invoice, Packing List, COO, licenses).

- Customs may inspect the cargo → If compliant, clearance is granted.

- Container stuffing or airline acceptance → Carrier issues Bill of Lading or Airway Bill.

- Exporter obtains Insurance Certificate (if responsible under Incoterms).

- Export documents (Original B/L, Invoice, Packing List, COO, Insurance, test certificates) are sent to buyer or bank.

- Vessel or aircraft departs → Post-shipment compliance tasks (duty drawback claims, export incentives).

Export Documentation and Clearance

Country-Specific Documentation Requirements

Exporters and importers must follow additional documentation rules based on the destination or origin country. These requirements ensure compliance with local customs laws, product regulations, and safety standards.

1. United States (USA)

Documents Required

- Commercial Invoice (must follow US CBP format)

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin (Generalized or US-specific)

- AES Filing (Automated Export System)

- FDA Approval (food, pharma, medical devices, cosmetics)

- FCC Certificate (electronics & communication devices)

- EPA Certificate (chemicals, environmentally sensitive goods)

Special Requirements

- Wood packaging must follow ISPM-15 compliance

- Strict trademark and anti-counterfeit compliance

2. European Union (EU)

Documents Required

- Commercial Invoice (EU customs format)

- Packing List

- Bill of Lading / Airway Bill

- EUR.1 Certificate (for preferential duty)

- CE Certification (machinery, electronics, PPE, medical, pressure equipment)

- RoHS Certificate (electronics)

- REACH Compliance (chemicals, coatings, metals)

Special Requirements

- Energy label requirements for electronics

- Eco-compliance documentation for environmental products

3. United Kingdom (UK)

Documents Required

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- UK Certificate of Origin

- UKCA Certificate (post-Brexit certification)

- SPS Documentation (food, agriculture, animals, plant products)

Special Requirements

- Additional inspection rules for metal products and machinery

4. United Arab Emirates (UAE) / GCC Countries

Documents Required

- Commercial Invoice (attested by Chamber of Commerce)

- Packing List

- Bill of Lading / Airway Bill

- Arab Certificate of Origin

- SASO / G-Mark (electronics, appliances)

- Halal Certificate (food & consumables)

Special Requirements

- Invoice notarization required for certain products

- Country of origin stamp mandatory

5. Saudi Arabia

More specific due to strict customs rules

Documents Required

- Commercial Invoice (SABER platform mandatory)

- Packing List

- Bill of Lading / Airway Bill

- SASO Certificate

- Shipment Tracking Number (SFDA traceability for food/pharma)

Special Requirements

- SASO conformity before shipment

- Regulated categories: electronics, machinery, steel, chemicals

6. China

Documents Required

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- CCC Certificate (China Compulsory Certification)

- CIQ Certificate (China Inspection & Quarantine)

- Fumigation Certificate (wood/packaging)

Special Requirements

- HS code must match China customs exact classification

- Strict chemical and metal composition testing

7. Japan

Documents Required

- Commercial Invoice (Japan format)

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin

- PSE Certificate (electronics)

- FTA Certificate for preferential duty

Special Requirements

- Very strict quality and safety compliance for engineering goods

8. South Korea

Documents Required

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- K-Mark Certification (electronics & machinery)

- Origin Certificate under Korea-FTA (if applicable)

Special Requirements

- Additional testing reports for high-risk engineering goods

9. Australia

Documents Required

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin (Australia FTA)

- Biosecurity Certificate (food, wooden goods, plants)

Special Requirements

- Very strict biosecurity inspection for natural materials

10. Canada

Documents Required

- Commercial Invoice (Canada Customs Invoice – CCI)

- Packing List

- Bill of Lading / Airway Bill

- COO under Canada Tariff Preference

- CFIA Certificate (food, agriculture, lumber)

Special Requirements

- Separate invoice format required for Canadian imports

11. African Countries (Nigeria, Kenya, South Africa, Egypt)

Common Required Documents

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin (general or country-specific)

- SONCAP (Nigeria)

- KEBS Certificate (Kenya)

- COO with additional inspection (Egypt)

Special Requirements

- Pre-shipment inspection mandatory in many African countries

12. Latin America (Brazil, Mexico, Chile, Colombia)

Required Documents

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin

- Spanish or Portuguese translated documents

- ANVISA Certificate (Brazil – food, pharma, cosmetics)

Special Requirements

- HS codes must match country-specific tariffs

13. Russia & CIS Countries

Required Documents

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- EAC Certificate (equipment, electronics, machinery)

- Certificate of Origin

Special Requirements

- Mandatory equipment and engineering safety certification

Country-Specific Documentation Requirements – FAQs

Q1. Why do different countries require different export documents? ▶

Each country has unique import laws, safety regulations, and compliance requirements based on product category.

Q2. What are examples of country-specific documentation? ▶

- USA: FDA, EPA, FTA Certificates

- EU: CE Marking, REACH, EUR.1

- Middle East: SASO, SABER, Halal Certificate

- Africa: Pre-Shipment Inspection (PSI)

Q3. How can exporters know the exact requirements? ▶

By checking:

- Buyer’s instructions

- Destination customs website

- Freight forwarder or CHA

- Country trade portals

Q4. What happens if a required country-specific document is missing? ▶

Cargo may face rejection, detention, penalties, or may need to be returned to the origin country.