How to Register as an Exporter (IEC Code etc.)

WHAT is IEC?

The Importer Exporter Code (IEC) is a mandatory 10-digit registration number issued by DGFT (India) required for any business involved in importing or exporting goods.

WHY is IEC Required?

- Mandatory for customs clearance

- Required for receiving export incentives

- Needed for opening a foreign currency bank account

- Allows participation in global trade legally

WHERE to Register?

(Users will apply online through the DGFT website.)

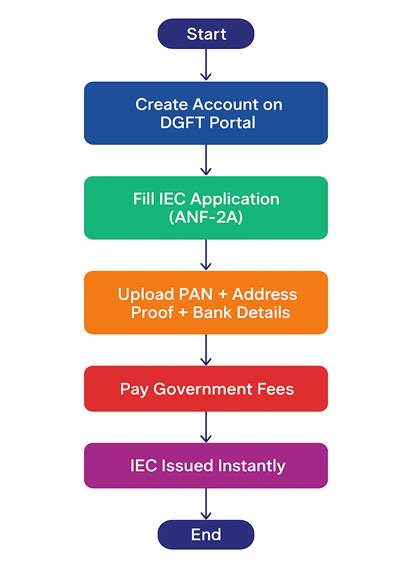

HOW to Register for IEC (Step-by-Step)

- Visit DGFT portal → Create account

- Fill IEC application (ANF-2A Form)

- Upload PAN, Address Proof, Bank Certificate

- Pay Govt fee

- Receive IEC instantly via email

How to Register as an Exporter (IEC Code etc.) – FAQ

Q1. What is an IEC Code in export? ▶

IEC (Importer Exporter Code) is a 10-digit mandatory registration issued by DGFT for exporting or importing goods from India.

Q2. Why is IEC required for exporters? ▶

IEC is required for customs clearance, bank payments in foreign currency, and claiming export benefits.

Q3. How can I apply for IEC online? ▶

You can apply for IEC through the DGFT website by submitting PAN, address proof, bank details, and paying the government fee.

Q4. What documents are needed for IEC registration? ▶

PAN card, business address proof, bank certificate/cancelled cheque, and a valid mobile & email.

Q5. How long does it take to get an IEC? ▶

IEC is issued instantly upon successful online submission.

How to Find International Buyers (B2B Platforms, AI Tools, Trade Shows)

What is Buyer Sourcing? (Definition)

Buyer Sourcing is the process of identifying, attracting, and converting potential international buyers who are interested in your export products. It is the foundation of successful global trade and helps exporters connect with genuine, high-value global customers.

Why is Buyer Sourcing Important for Exporters?

- Ensures consistent export orders

- Expands your reach into multiple international markets

- Reduces dependency on a single buyer or region

- Builds long-term stability and predictable revenue

- Strengthens brand presence in global trade

In the coming future, Navanta Exim will make this entire buyer-sourcing process easier for exporters by integrating advanced AI-driven global visibility tools.

Where to Find International Buyers? (Top Sources)

1. B2B Marketplace Platforms (Category)

These platforms help exporters list their products and attract inquiries from global importers. Common types of B2B platforms include:

- Global trade directories

- International wholesale marketplace platforms

- Engineering and industrial product marketplaces

- Import–export buyer inquiry portals

2. AI Tools for Buyer Research (Category)

Modern exporters use AI tools for:

- Generating potential buyer lists

- Understanding buyer behaviour

- Writing professional email outreach

- Finding import data & trade insights

- Analysing competitors’ global shipments

AI will soon play a major role — and Navanta Exim aims to bring AI-powered buyer discovery to one platform.

3. International Trade Shows (Category)

Trade exhibitions are the strongest offline method for meeting genuine buyers. Examples of major categories:

- Industrial machinery & engineering product fairs

- Construction & building material expos

- Global sourcing and trade development events

- Technology, manufacturing and B2B industry shows

- Country-specific trade promotion fairs

Attending these events helps exporters showcase products, understand market trends, and build long-term buyer relationships.

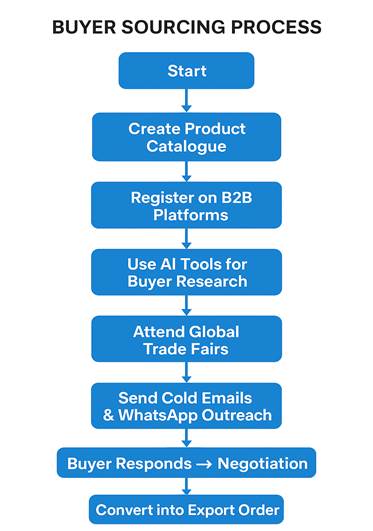

How to Find Buyers – Step-By-Step Guide

- Professional product photos

- Technical specifications

- Export-grade packaging details

- Compliance certifications

- Clear pricing terms

Upload your:

- Company profile

- Product catalogue

- HS Codes

- Export-ready documents

A well-optimized profile increases global visibility.

AI can assist in:

- Identifying active importers

- Personalizing outreach emails

- Analysing competitor shipments

- Prioritizing high-potential markets

Navanta Exim will soon integrate advanced AI-powered buyer sourcing tools to simplify this entire process for exporters.

- Network with buyers

- Display your samples and catalogues

- Understand live market demand

- Build trust and long-term relationships

A good cold email should include:

- Brief introduction

- Product value proposition

- Technical details

- Certifications

- Call to action (CTA)

- Send reminders every 3–5 days

- Share relevant technical data

- Offer pricing transparency

- Build buyer trust and credibility

Future Vision – Navanta Exim Buyer Sourcing Platform

In the future, Navanta Exim aims to build an AI-integrated global sourcing platform where:

- Finding buyers becomes instant

- Market insights are AI-driven

- Export documentation becomes automated

- Every manufacturer gets global visibility

- Buyer–seller trust is strengthened through technology

This will create a revolution in the export industry by making global trade simple, transparent, and technology-driven.

How to Find Buyers (B2B Platforms, AI Tools, Trade Shows) – FAQ

Q1. What is the best way to find international buyers? ▶

The best way to find international buyers is by using global B2B marketplaces, AI-powered buyer research tools, and strategic online outreach methods. In the future, Navanta Exim will offer a powerful AI-integrated global buyer sourcing platform that will make this process even simpler, faster, and more efficient for exporters.

Q2. How can AI help in finding export buyers? ▶

AI helps exporters by identifying active importers using global data, analysing competitor shipments, creating personalized outreach messages, and automating follow-ups to increase conversions. Navanta Exim aims to integrate these AI systems for exporters, giving them one platform for buyer discovery and communication.

Q3. Are trade fairs useful for exporters? ▶

Yes, international trade fairs are extremely useful because they allow exporters to meet verified buyers face-to-face, showcase physical samples, build trust and long-term partnerships, and understand global market trends. Navanta Exim will soon guide exporters on which trade fairs are best for their product category.

Q4. How do I attract buyers online? ▶

You can attract global buyers online by creating a highly professional product catalogue, optimizing your online business profile, using SEO for your export website, posting case studies, certifications & product demos, responding quickly to inquiries, and maintaining credibility and transparent communication. Navanta Exim aims to help exporters build a globally trusted digital presence.

Q5. Which B2B platforms are best for small exporters? ▶

Instead of relying on multiple external portals, exporters can soon benefit from Navanta Exim’s upcoming all-in-one AI-powered global sourcing platform, specially designed to support small, medium, and large exporters with verified buyer access, AI-driven lead generation, industry-specific buyer matches, and transparent communication tools. This ensures small exporters can build global visibility without depending on multiple scattered B2B platforms.

Proforma Invoice & Quotation

What is Proforma Invoice?

A Proforma Invoice is a preliminary commercial document issued by the exporter to the overseas buyer before shipment of goods. It provides complete details about the product, price, delivery terms, payment terms and other commercial conditions.

Why is Proforma Invoice Important?

- Acts as a formal quotation for the buyer

- Helps the buyer apply for import license (if required)

- Used by banks for opening Letter of Credit

- Helps buyer arrange foreign exchange

- Forms the base document for the final Commercial Invoice

What Does a Proforma Invoice Contain?

- Exporter name & address

- Buyer name & address

- Product description

- HS Code

- Quantity & unit of measurement

- Unit price & total value

- Incoterms (FOB / CIF / CFR etc.)

- Mode of shipment

- Port of loading & destination

- Payment terms

- Delivery period

- Validity of Proforma Invoice

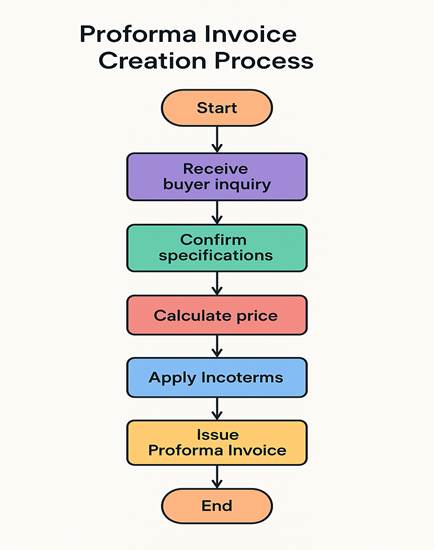

How to Prepare Proforma Invoice – Step by Step

- Receive buyer enquiry with product specifications

- Calculate export price based on cost & Incoterms

- Finalize payment terms & delivery schedule

- Prepare Proforma Invoice with all commercial details

- Send Proforma Invoice to buyer for confirmation

Proforma Invoice & Quotation – FAQ

Q1. Is Proforma Invoice legally binding? ▶

No, a Proforma Invoice is not legally binding. It is only a preliminary document used for mutual understanding between exporter and importer.

Q2. When should a Proforma Invoice be issued? ▶

A Proforma Invoice should be issued after buyer confirmation and before receiving advance payment or opening a Letter of Credit.

Q3. What is the difference between quotation and Proforma Invoice? ▶

A quotation gives price indication, whereas a Proforma Invoice includes complete commercial terms such as payment, delivery and shipment details.

Q4. Can Proforma Invoice be revised? ▶

Yes, a Proforma Invoice can be revised if there are changes in price, quantity, delivery terms or buyer requirements.

Export Price Calculation

WHAT is Export Pricing?

Export Pricing is the process of calculating the total landed cost and determining the final selling price for international buyers based on Incoterms.

It includes every expense from manufacturing to delivery, ensuring the exporter sets a profitable and competitive price for global markets.

A well-structured export pricing model helps you estimate costs accurately, avoid losses, and confidently quote to buyers.

WHY is Export Pricing Important?

✔ Profitability

Ensures the exporter earns a sustainable margin even after international logistics,

customs, and compliance costs.

✔ Global Competitiveness

Helps you compare prices with competitors while maintaining quality and service

levels.

✔ Avoiding Under-Quoting

Incorrect pricing can lead to loss-making orders, especially under CIF, FOB, or DDP

terms.

✔ Negotiation Strength

A structured price breakdown gives confidence during buyer negotiations.

✔ Long-Term Buyer Trust

Transparent and consistent pricing helps you build credibility in international

markets.

WHERE Do Export Pricing Components Come From?

Export pricing is influenced by all cost elements involved from production to final delivery. These include:

- Raw Material Cost

Based on current market rates, supplier pricing, and order quantity. - Manufacturing & Labor Cost

Includes machinery usage, workforce, utilities, and production overheads. - Packaging Cost

Export-quality packing such as wooden boxes, pallets, bubble wrap, cartons, fumigation, etc. - Inland Transportation

Cost of moving goods from:

Factory → ICD / Port → Warehouse → Forwarder - International Freight

Air / Sea freight charges based on Incoterms (FOB, CIF, CFR, DAP, DDP). - Marine Insurance

Required under CIF, CIP, and sometimes requested by buyers for risk coverage. - CHA (Custom House Agent) Charges

Includes export documentation, customs filing, shipping bill, port handling, etc. - Bank Charges

LC handling, bank commission, TT charges, currency conversion fees. - Export Incentives / Duties (If Applicable)

RoDTEP, Duty Drawback, MEIS (if available), GST refunds. - Profit Margin

Your final markup based on:- market competition

- manufacturing efficiency

- buyer relationship

- order size

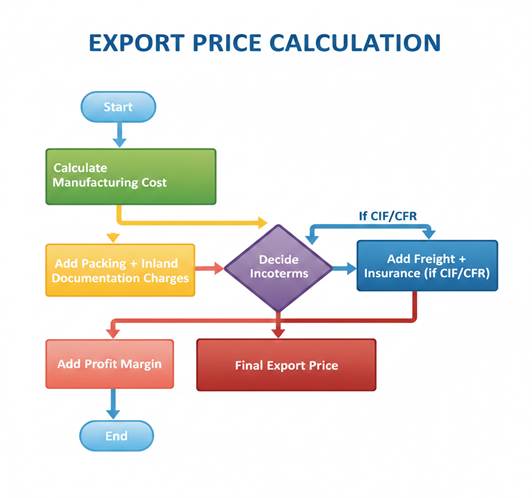

HOW to Calculate Export Price (Incoterm-Wise)

Seller Responsibility: Up to loading goods on vessel at Port of Export.

FOB Price Formula

FOB Price =

(Manufacturing Cost + Packing Cost + Inland Transportation to Port + Export Documentation Charges + CHA Charges + Port Handling Charges + Export Inspection (If Required)) + Exporter Margin

Seller Responsibility: Deliver goods to carrier/forwarder at port/warehouse.

FCA Price Formula

FCA Price =

(Manufacturing Cost + Export Packing + Transport to Carrier Location (ICD/Airport/Forwarder Warehouse) + Documentation Charges + CHA Filing Charges (If Applied)) + Exporter Margin

Seller Responsibility: Deliver goods alongside vessel at port.

FAS Price Formula

FAS Price =

(Manufacturing Cost + Export Packing + Inland Transport to Port + Port Entry Fees + Cargo Storage / Wharfage + Documentation Charges

+ CHA Charges (Up to Wharf))

+ Exporter Margin

Seller Responsibility: Goods loaded + freight to destination port.

CFR Price Formula

CFR Price = FOB Price + Ocean Freight Charges

Seller Responsibility: Goods loaded + freight + marine insurance.

CIF Price Formula

CIF Price = CFR Price + Marine Insurance Premium

Marine Insurance = (FOB Price + 10% Mark-up) × Insurance Rate%

Used for air cargo / courier / LCL where seller pays freight.

CPT Price Formula

CPT Price = FCA Price + International Freight (Air / LCL)

Seller Responsibility: Freight + insurance UNTIL destination terminal.

CIP Price Formula

CIP Price = CPT Price + Cargo Insurance Premium

Insurance = (FCA Price + Freight + 10% Buffer) × Insurance Rate%

Seller Responsibility: Deliver up to buyer’s country location (warehouse/port), but DOES NOT pay import customs.

DAP Price Formula

DAP Price = CIP Price + Destination Local Delivery Charges + Destination Handling (If Paid by Seller)

Note: Buyer pays import duty + customs clearance.

Seller delivers AND unloads at buyer’s location.

DPU Price Formula

DPU Price = DAP Price + Unloading Charges at Buyer’s Location

Seller Responsibility: EVERYTHING, including import clearance and taxes.

Full DDP Price Formula (Most Detailed)

DDP Price = DAP Price + Destination Customs Clearance Fee + Import Duty % + VAT / GST % + Port Storage (If Any) + Documentation at Destination

+ Last Mile Delivery

+ Exporter Risk Buffer

Export Price Calculation Flowchart

Export Pricing – FAQs

Q1. What is export pricing and why is it important? ▶

Export pricing determines the total cost and selling price for overseas buyers. It ensures profitability, prevents under-quoting, and supports competitive positioning.

Q2. Which costs must be included when calculating an FOB export price? ▶

FOB pricing includes manufacturing, packing, inland transport to port, documentation, port handling, CHA services, and profit margin.

Q3. How do Incoterms influence the final export price? ▶

Incoterms define which party pays for insurance, freight, customs, and delivery. As responsibilities increase from FOB to CIF to DDP, the export price increases accordingly.

Q4. What is the difference between CIF and CFR in export pricing? ▶

CFR covers cost and freight to the destination port, while CIF adds marine insurance, making CIF slightly higher due to risk coverage.

Q5. Why is marine insurance included in export price calculations? ▶

Insurance protects goods during transit and is mandatory under certain terms like CIF and CIP. It helps reduce financial risk for both exporter and buyer.

Q6. Can government incentives reduce export costs? ▶

Yes. Incentives such as RoDTEP or duty drawback can offset some expenses, improving price competitiveness without compromising profit margins.

Q7. How can exporters avoid quoting loss-making prices? ▶

By accurately calculating all costs, understanding Incoterm responsibilities, and applying suitable margins based on product, market, and logistics factors.

Understanding Incoterms for Exporters

WHAT are Incoterms?

International Commercial Terms regulated by ICC defining buyer-seller responsibilities in international trade.

WHY Incoterms Matter?

- Prevents disputes

- Clarifies cost responsibility

- Defines risk transfer

WHERE Incoterms Apply?

In quotation, PI, CI, contract & shipping documents.

HOW Exporters Use Incoterms?

Choose based on:

- Buyer requirement

- Risk level

- Shipping mode

- Profitability

Popular Export Incoterms: EXW, FOB, CIF, CFR, DDP, DAP.

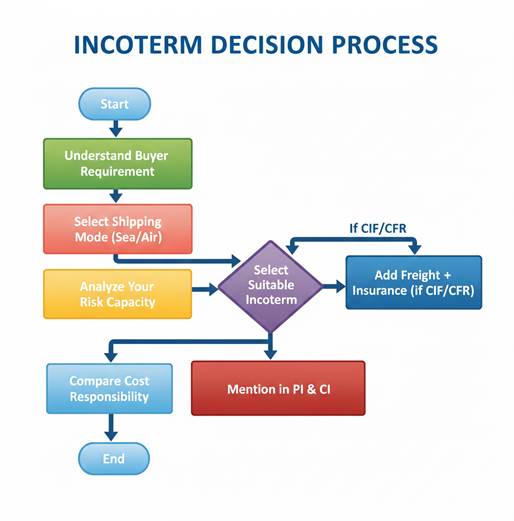

Incoterms Decision Process

🌐 Case Study: Strategic Export Pricing & Incoterms Selection for Global Competitiveness

1. Executive Summary: Optimizing the Export Value Chain

This case study examines the critical decision-making processes an exporter, "Global Goods Co.", undertakes when preparing a quotation for a new international market. The core challenge is balancing competitive pricing (to win the order) with effective risk management (to ensure profitability). The solution lies in a structured approach to Export Price Calculation and the strategic selection of the most suitable Incoterm for each transaction.

2. The Case: Global Goods Co.'s New Export Market Challenge

The Scenario

Global Goods Co. (GGC), a mid-sized manufacturer of specialized industrial components, has received a substantial inquiry from a new buyer in a distant, high-growth market. GGC’s domestic prices are known, but translating them into a final export price requires careful consideration of various international costs and logistics. The buyer is open to different trade terms but prefers a quotation that includes shipping to their country.

The Primary Objectives

- Establish a profitable and competitive Final Export Price.

- Select the optimal Incoterm that aligns with GGC’s logistical capacity and risk tolerance.

3. Phase I: Structured Export Price Calculation

The process begins with a meticulous cost accumulation to establish the true export floor price. This is vital for competitive and sustainable pricing.

Key Cost Factors Defined

- Manufacturing Cost: The baseline cost of producing the goods (Fixed and Variable costs). This forms the foundation of all subsequent calculations.

- Domestic & Inland Costs: Includes Packing (export-grade materials), Labeling, and Inland Transport from the factory to the port/airport of loading.

- Export Formalities & Documentation: Charges levied by the Customs House Agent (CHA) for Export Clearance, along with fees for necessary documents like the Bill of Lading or Air Waybill, and inspection certificates.

The Pricing Process

- Cost Base Determination: Summing up the Manufacturing, Domestic, and Export Formalities costs provides the Ex Works (EXW) equivalent cost base.

- Trade Term Specific Additions: Additional costs like Freight (main carriage) and Marine/Air Insurance are added only if required by the chosen Incoterm (e.g., CFR, CIF, CIP, DAP).

- Strategic Profit Margin: A Profit Margin is applied to the total calculated cost. This margin is flexible, adjusted based on market conditions, competitor pricing, and strategic goals (e.g., market entry vs. market dominance).

4. Phase II: Strategic Incoterms Decision Process

The Incoterm selection dictates Cost, Risk, and Responsibility transfer between GGC (Seller) and the Buyer. This decision is as critical as the price itself.

Driving Factors for Incoterm Selection

| Factor | Definition | GGC's Strategic Consideration |

|---|---|---|

| Risk Capacity | GGC’s willingness to manage the risk of loss/damage during main carriage. | Higher risk tolerance favors 'F' terms (FOB, FCA); Lower risk tolerance favors 'C' or 'D' terms (CIF, DAP). |

| Logistics Expertise | GGC’s capability in managing international freight and carriers. | High expertise allows GGC to manage shipping for 'C' or 'D' terms, potentially adding a margin on freight costs. |

| Buyer's Requirement | The buyer’s preference and logistical strength in their own country. | A strong buyer often prefers simpler terms like FOB/FCA; a weaker buyer may demand DAP/DDP. |

| Mode of Transport | Whether the shipment is by Sea or Any Mode. | GGC must choose a rule appropriate for the chosen carrier method. |

The Decision Process

- Understand Buyer Requirement: The buyer requested a price inclusive of main carriage.

- Analyze Risk and Logistics: GGC has reliable forwarders and wishes to control the supply chain.

- Cost Comparison: GGC calculates the final price for both FOB and CIF.

- Final Selection: GGC opts for CIF (Cost, Insurance, and Freight) to the destination port.

5. Conclusion: A Strategic Advantage

By following a defined, two-phase process—meticulous Cost Calculation followed by Strategic Incoterm Selection—Global Goods Co. successfully generated a competitive, profitable, and risk-managed CIF quotation. This structural approach is a non-negotiable best practice for all companies seeking sustainable success in international trade.

Incoterms FAQs

Q1. Do Incoterms determine who arranges and pays for international freight? ▶

Yes. Each Incoterm clearly specifies whether the seller or the buyer is responsible for selecting the carrier, arranging transportation, and bearing international freight costs.

Q2. Are Incoterms legally binding on their own? ▶

No. Incoterms become legally binding only when they are explicitly incorporated into a sales contract or referenced in shipping and commercial documents.

Q3. Can exporters use any Incoterm for both sea and air shipments? ▶

No. Certain Incoterms such as FOB, CFR, and CIF are strictly meant for sea transport, while terms like FCA, CPT, and CIP can be used for any mode of transport.

Q4. Do Incoterms decide when ownership of goods transfers to the buyer? ▶

No. Incoterms define the point of risk transfer, not ownership. Transfer of title must be defined separately in the sales contract.

Q5. Can choosing the wrong Incoterm lead to unexpected costs? ▶

Yes. An incorrect Incoterm selection can result in unplanned expenses related to freight, insurance, customs clearance, or handling, potentially reducing profit or causing disputes.

Q6. Is it possible for buyers to request modifications to standard Incoterms? ▶

Yes. Buyers and sellers may negotiate adjustments, but any modifications must be documented clearly in writing to avoid ambiguity in responsibilities.

Q7. Do Incoterms cover customs clearance requirements at the destination country? ▶

Only partially. While terms such as DDP include import customs duties, most Incoterms place destination clearance responsibility on the buyer. Exporters must still verify destination-specific regulations.

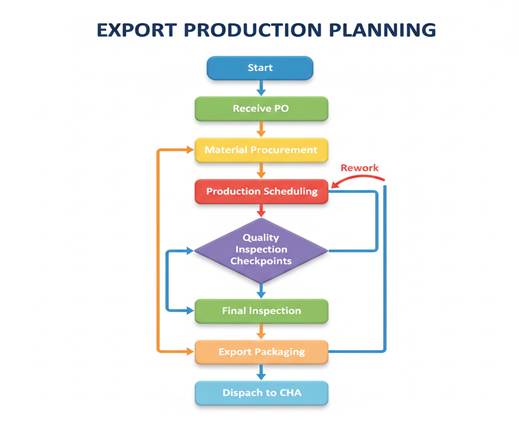

Production Planning for Export Orders

WHAT is Export Production Planning?

Coordinating manufacturing timelines for export-specific requirements.

WHY Needed?

- Ensures timely shipment

- Maintains quality standards

- Helps manage inventory & labour

WHERE It Applies?

Factory workflow, vendor management, packaging, QC.

HOW to Plan Production

- Review PI & PO

- Allocate raw materials

- Fix production stages

- Schedule QC checkpoints

- Conduct final inspection

- Pack & handover to logistics

Essential Skills & Knowledge for Successful Export Production Planning

1. Core Knowledge Required for Export Planning (The "What")

An effective Export Planner must possess deep subject matter expertise to navigate the regulatory and commercial environment of global trade.

A. International Trade & Compliance

- Incoterms Mastery: A thorough understanding of the current Incoterms (e.g., 2020) is essential to accurately define the transfer points of Cost, Risk, and Responsibility (e.g., knowing the difference between FCA and FOB).

- Trade Compliance & Documentation: Expert knowledge of the required Export Documentation (Commercial Invoice, Packing List, Certificate of Origin, Shipping Bill, etc.) and the country-specific regulations (e.g., testing or labeling standards).

- Customs & Port Procedures: Familiarity with the Customs Clearance Process in both the exporting country (filing the Shipping Bill) and the importing country (basic knowledge of destination duties and taxes).

B. Financial & Commercial Acumen

- Payment Terms (e.g., L/C): Knowledge of various international payment methods, particularly the strict requirements of a Letter of Credit (L/C), which dictates all production and documentation deadlines.

- Export Costing: Ability to reverse-engineer the Final Export Price to determine the maximum tolerable production and logistics costs.

- Currency Risk Awareness: Basic understanding of foreign exchange fluctuations and how they impact the local cost of raw Material Procurement.

2. Project Management Skills for Export Planning (The "How")

Export planning is fundamentally a complex, cross-functional project with a non-negotiable end date (Vessel/Flight Sailing Date). Strong PM skills are critical for coordinating the internal team and external partners.

A. Hard PM Skills

| Skill | Application in Export Planning |

|---|---|

| Schedule/Time Management | Creating and managing the Time and Action (T&A) Plan from PO receipt to Dispatch to CHA. |

| Risk Management | Identifying potential failure points and developing mitigation strategies. |

| Scope & Quality Management | Ensuring production specifications strictly match the buyer’s Purchase Order (PO). |

| Resource Allocation | Coordinating Production Scheduling by ensuring machine capacity, labour, and materials. |

B. Soft PM Skills

- Communication & Negotiation: Coordinating between Sales, Production, Finance, CHA, and Freight Forwarders.

- Leadership & Team Motivation: Driving internal teams to meet the export deadline.

- Problem-Solving: Rapidly addressing unexpected issues during production or inspection.

3. Critical Care Points (Things to Take Care Of)

A. Material & Production Alignment

- Proactive Procurement: Delays in Material Procurement are the number one cause of late shipment.

- Capacity Buffer: Always factor in buffer time for machine maintenance or unexpected stoppages.

- Integrated QC: Ensure Quality Inspection Checkpoints are mandatory during production.

B. Documentation & Logistics Handover

- Accurate Packaging Details: Verify labels, markings, weights, and dimensions match the Packing List.

- CHA Coordination: Confirm cut-off date and time for handing over cargo and documentation.

- Final Review Checklist: Use a Pre-Shipment Checklist with cross-team sign-offs before Dispatch to CHA.

Export Planning FAQs

Q1. What does export production planning involve beyond basic manufacturing scheduling? ▶

Export production planning goes beyond factory scheduling. It includes coordination of raw material procurement, quality control timelines, packaging standards, documentation readiness, and logistics handover to meet international shipment deadlines.

Q2. How do purchase orders and proforma invoices influence production planning? ▶

Purchase orders and proforma invoices define product specifications, quantities, delivery terms, and documentation requirements. These inputs help planners structure production stages, allocate resources, and set inspection checkpoints.

Q3. Why is quality control integrated throughout the export production process? ▶

Continuous quality control helps identify defects early, reduces rework, and minimizes the risk of batch rejection during final inspection or at the destination port.

Q4. How does export planning reduce the risk of delayed shipments? ▶

By creating realistic schedules, incorporating buffer time, coordinating with suppliers, and aligning customs and CHA deadlines, export planning mitigates delays caused by material shortages or operational disruptions.

Q5. What skills are essential for managing export production effectively? ▶

Effective export production planning requires skills in supply chain management, production scheduling, quality control, logistics coordination, and risk assessment.

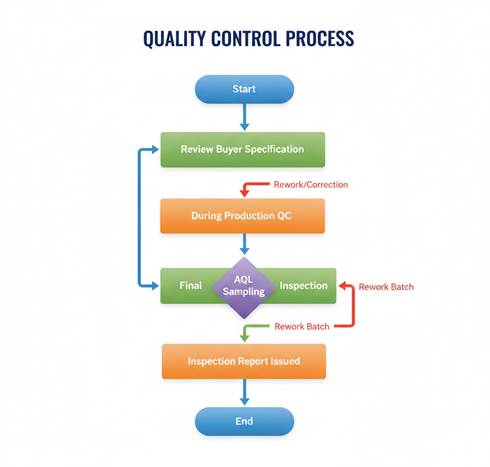

Quality Inspection Process

WHAT is Export QC?

A structured process to ensure goods meet buyer standards.

WHY QC Matters?

- Avoids shipment rejection

- Reduces claims & disputes

- Builds long-term trust

WHERE QC Happens?

- Factory level

- Third-party inspection agencies (SGS, Intertek, Bureau Veritas)

HOW QC Works

- Pre-production QC

- During-production QC

- Final QC

- Random sampling (AQL method)

- Issue inspection report

Complete Quality Inspection Process in Export Manufacturing (Full Workflow Explained)

1. Introduction to Quality Inspection in Export Manufacturing

The Quality Inspection Process is a systematic, multi-stage approach that ensures products meet international standards, buyer specifications, and legal compliance before being exported. It covers Pre-Production QC, In-Process QC, Final QC, Pre-Shipment Inspection, and Buyer QC inspections.

High-quality control builds trust, reduces returns, minimizes disputes, and strengthens long-term global relationships.

2. Pre-Production Quality Control (PPQC)

Pre-Production QC ensures that raw materials, components, machines, and processes are ready for production. This stage prevents defects before production starts.

A. Raw Material Verification

- Check material grade, hardness, composition

- Verify supplier certification (Mill Test Certificate, Material Test Report)

- Confirm compliance with international standards (ASTM, DIN, ISO, JIS, etc.)

B. Component Inspection

- Dimensional accuracy

- Surface finish

- Tolerance levels

- Compatibility with engineering drawings

C. Tooling & Machine Calibration

- CNC calibration

- Tool alignment

- Temperature & pressure checks (if applicable)

- Verification of cutting tools, moulds, dies

D. Production Planning Verification

- Review technical drawings

- Confirm sample approval

- Cross-check Bill of Materials (BOM)

- Review SOPs and quality guidelines

E. Pre-Production Sample (PPS) Approval

- Sample manufactured before mass production

- Sample cross-verified with buyer specifications

- Adjustments made before final production starts

3. In-Process Quality Control (IPQC)

A. First Article Inspection (FAI)

- Inspect first produced item

- Check dimensions against drawing

- Compare product with Tolerance Standard

B. Stage-wise Inspection

- Inspection after every major manufacturing stage

- Recording data in QC check sheets

- Monitoring machine output consistency

C. Process Monitoring & Control

- Temperature control

- Pressure control

- Tool wear monitoring

- Operator performance tracking

D. Random Sampling

- Select samples from running production

- Visual inspection

- Dimensional measurement

- Surface quality analysis

E. Defect Identification & Correction

- Immediate feedback to production team

- Root cause analysis

- Preventive & corrective actions (CAPA)

4. Final Quality Control (FQC)

A. Final Dimensional Inspection

- Micrometer, Vernier, CMM tests

- Tolerance check

- Flatness, roundness, hardness testing

B. Visual & Surface Inspection

- Rust, scratches, dents, deformities

- Coating thickness (if applicable)

- Surface finishing quality

C. Functionality & Performance Testing

- Load test

- Leakage test

- Pressure test

- Electrical test (if applicable)

D. Compliance Verification

- Confirm adherence to ISO, CE, ASTM, BIS, or other standards

- Ensure certification requirements are complete

5. Pre-Shipment Inspection (PSI)

A. Packing & Labeling Inspection

- Export-grade packing

- Moisture/impact protection

- Palletization

- Barcode & labeling accuracy

B. Quantity Verification

- Check total quantity

- Carton count

- Weight validation

- SKU confirmation

C. Product Verification

- Random sampling from finished lot

- Functional and dimensional checks

- AQL (Acceptable Quality Level) based inspection

D. Documentation Verification

- Export Invoice

- Packing List

- Certificate of Origin

- Test certificates

- Buyer-specific documents

E. Final Approval for Dispatch

- QC team approval

- Photographic record

- Sealing & marking of shipment

Export QC FAQs

Q1. What is the main purpose of quality inspection in export manufacturing? ▶

The primary purpose of quality inspection is to verify that goods meet the buyer’s specifications, international standards, and packaging requirements before shipment, reducing the risk of rejection or post-shipment claims.

Q2. When should quality checks be conducted during the production cycle? ▶

Quality checks should be carried out before production begins, throughout the manufacturing process, and after completion. This ensures early defect detection and consistent product quality.

Q3. What is the role of pre-production inspection in export quality control? ▶

Pre-production inspection verifies raw materials, machine calibration, and approved samples to prevent defects before mass production starts, saving both cost and time.

Q4. How does in-process quality control improve product reliability? ▶

In-process quality control monitors production at each stage, performs first-article inspections and random sampling, and enables corrective action before issues affect the entire batch.

Q5. Why is pre-shipment inspection critical for exporters? ▶

Pre-shipment inspection confirms final quantity, labeling, packaging condition, and compliance with specifications, ensuring that delivered goods match the contract and standards.

Q6. Do third-party inspection agencies play a role in export quality control? ▶

Yes. Independent agencies such as SGS or Intertek provide unbiased inspection reports that validate product quality and build buyer confidence.

Q7. What is the AQL method and why is it used in export QC? ▶

AQL (Acceptable Quality Level) defines the maximum number of defects allowed in a sample. It enables inspectors to statistically assess quality without checking every unit, balancing efficiency and reliability.

Buyer QC Inspection (Optional but Common in Global Trade)

In international trade, many buyers send their own inspectors or third-party agencies (like SGS, TUV, BV) to verify shipment quality before goods are dispatched.

A. Buyer QC Activities

- Independent sampling

- Inspection based on purchase order specifications

- Verification of dimensions, surface, coating, and weight

- Re-check packaging and labeling

B. Compliance Check

- Ensure product matches approved sample

- Verify test certificates and reports

- Check safety, regulatory, and industry compliance

C. Report Issuance

- Buyer QC submits a detailed inspection report

- Includes photos, measurements, findings, and pass/fail conclusion

D. Approval or Rejection

- Shipment is approved if standards are met

- Non-conformities require reworking or replacement

Why the Full Quality Inspection Process Is Essential

✔ Reduces product defects

Ensures consistency and reliability in every export batch.

✔ Builds global buyer trust

Buyers prefer suppliers with strong Quality Control Systems.

✔ Minimizes returns & disputes

Proper QC prevents expensive replacements and delays.

✔ Ensures compliance with international standards

Maintains certifications and regulatory requirements.

✔ Strengthens export reputation

High-quality exporters are preferred in global markets.

Flowchart: Quality Control Process

QC Process FAQs

Q1. Why do some international buyers request their own QC inspection even after factory QC is completed? ▶

Buyers rely on independent inspections to confirm that goods match the purchase order and approved samples, ensuring transparency and reducing risk before shipment.

Q2. What activities are typically performed during a buyer QC inspection? ▶

Inspectors conduct sampling, measure dimensions, verify surface finish and coating quality, and review packaging and labeling to confirm compliance with buyer requirements.

Q3. Can a buyer reject goods after their QC inspection? ▶

Yes. If non-conformities are identified, the shipment may require rework, replacement, or corrective action before approval is granted.

Q4. Is buyer QC inspection legally mandatory? ▶

No. Buyer QC inspections are contract-dependent and optional, but they are widely practiced in global sourcing, especially for high-value, customized, or regulated products.

Q5. How does buyer QC help prevent shipment disputes? ▶

Buyer QC provides documented inspection reports with measurements, observations, and photographs, creating clear evidence that reduces post-shipment claims and disagreements.

Q6. Does buyer QC replace factory or third-party inspection? ▶

No. Buyer QC complements internal factory inspections and third-party audits, adding an extra validation layer rather than replacing existing quality control processes.

Q7. What are the benefits for exporters when buyers conduct QC inspections? ▶

Buyer QC inspections strengthen trust, enhance exporter credibility, and successful approvals reinforce a reputation for quality, reliability, and consistency in international markets.

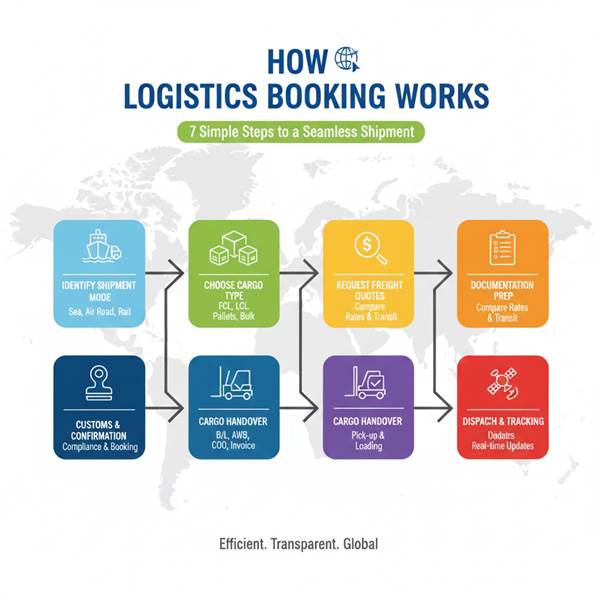

Logistics Booking (Sea, Air, Road)

WHAT is Logistics Booking?

Confirming cargo movement through sea, air, or road.

WHY Needed?

- Ensures space availability

- Provides shipping schedule

- Helps plan production timeline

WHERE to Book Logistics?

- Freight Forwarders

- Shipping lines

- Airlines

- Transporters

HOW to Book Logistics

- Identify mode of transport

- Share cargo details (volume, weight, HS code)

- Receive freight quotation

- Confirm booking

- Receive BL/AWB draft

Logistics Booking (Sea, Air, Road) – Complete Export Guide

1. What is Logistics Booking in Export?

Logistics booking refers to the process of arranging the transportation of goods from the exporter’s warehouse to the buyer’s destination using Sea Freight, Air Freight, Road Transport, or Multimodal Logistics.

It includes:

- Freight booking

- Container selection

- Scheduling shipments

- Handling documentation

- Customs coordination

- Shipment tracking

2. Why is Logistics Booking Important in Global Trade?

Efficient logistics ensures:

✔ On-time delivery

Avoids delays and penalties.

✔ Cost efficiency

Selecting the right mode reduces freight expenses.

✔ Smooth customs clearance

Correct documentation prevents detention and demurrage.

✔ Better buyer satisfaction

Timely shipments improve trust and long-term relationships.

✔ Supply chain reliability

Reduces disruptions and ensures consistent order flow.

Keywords: Timely delivery, export supply chain, freight optimization, customs-ready logistics.

3. Types of Logistics Used in Export (Sea, Air, Road, Rail, Multimodal)

A. Sea Freight Logistics (Ocean Shipping)

Best for: Heavy goods, bulk items, engineering products, machinery, non-urgent cargo.

Types of Sea Shipments

- FCL (Full Container Load)

One exporter uses one complete container. - LCL (Less than Container Load)

Consolidated cargo with multiple exporters. - Breakbulk Cargo

Oversized machinery, heavy equipment. - RORO (Roll-on Roll-off)

Vehicles, trucks, project cargo. - Reefer Containers

Temperature-controlled shipments.

Functions of Sea Freight

- Cost-effective transport

- Global shipping connectivity

- Container-based safety

- Suitable for long-distance movement

B. Air Freight Logistics (Air Cargo)

Best for: Urgent shipments, high-value items, lightweight goods.

Types of Air Cargo Options

- Express Air Cargo (FedEx, DHL-like service but don’t name brands on your portal)

- General Air Cargo through airlines

- Charter Aircraft Cargo for large urgent shipments

Functions of Air Freight

- Fastest international delivery

- Lower damage risk

- Ideal for perishable or time-sensitive goods

C. Road Transport Logistics

Used for inland movement, cross-border trade (Nepal, Bangladesh, Bhutan), and domestic transit to ports.

Types of Road Transport

- FTL (Full Truck Load)

- LTL (Less Truck Load)

- Containerized Trucks

- Trailers, low-bed trucks for heavy cargo

Functions of Road Logistics

- Moves goods from warehouse → port → airport

- Essential for first-mile and last-mile delivery

- Flexible and faster for short distances

D. Rail Freight Logistics

Used for:

- Long-distance inland movement

- ICD (Inland Container Depot) shipments

- Cost-efficient bulk movement

E. Multimodal & Intermodal Logistics

Combination of Sea + Road + Rail + Air under one logistics contract.

Example:

Factory → Truck → ICD → Rail → Port → Sea → Buyer Location

How Logistics Booking Works (Step-by-Step Process)

Step 1: Identify Shipment Mode

Based on:

- Cargo type

- Weight

- Delivery timeline

- Cost preference

- Buyer’s requirement (Incoterms)

Step 2: Choose Container / Cargo Type

FCL, LCL, Air Cargo, Reefer, Breakbulk, etc.

Step 3: Request Freight Quotes

Exporter contacts:

- Freight forwarders

- Shipping lines

- Air cargo agents

- Transport companies

Step 4: Documentation Preparation

- Commercial Invoice

- Packing List

- HS Code confirmation

- Export Declaration

- Certificates (if required)

Step 5: Customs Compliance & Booking Confirmation

CHA / forwarder files shipping bill and confirms vessel/flight schedule.

Step 6: Cargo Handover

- For Sea: CY (Container Yard) or CFS (Container Freight Station)

- For Air: airline warehouse

- For Road: transporter warehouse

Step 7: Shipment Dispatch & Tracking

Tracking using:

- AWB (Air Waybill)

- BL (Bill of Lading)

- CMR (Road Document)

5. Seller & Buyer Logistics Responsibilities (Based on Incoterms)

Seller Logistics Responsibilities

Under common Incoterms:

EXW

Seller only makes goods available; buyer arranges logistics.

FOB

Seller manages:

- Inland transport

- Export customs

- Loading at port

Buyer manages:

- Sea freight

- Destination customs

CIF / CFR

Seller manages:

- Inland transport

- Export customs

- Sea freight

- Insurance (only CIF)

Buyer handles:

- Destination port charges

- Final delivery

DAP / DDP

Seller manages:

- Full logistics until buyer’s door

- For DDP, seller pays import duty as well

Buyer Logistics Responsibilities

Depending on terms, buyer usually handles:

- Freight (under FOB, EXW)

- Import customs clearance

- Local delivery

- Duty & taxes

6. How to Connect with Logistics Providers (Practical Guide)

✔ Freight Forwarders

They handle end-to-end shipping and documentation.

✔ Shipping Lines

Direct booking for FCL.

✔ CHA (Custom House Agents)

Handle customs filing and port coordination.

✔ Air Cargo Agents

Arrange air freight and AWB.

✔ Transport Companies

For local movement and container pickup.

7. Making Logistics Cost-Effective & Efficient

A. Consolidation (LCL for small shipments)

Reduces sea freight cost.

B. Proper Packaging

Prevents damage and reduces insurance claims.

C. Booking in Advance

Reduces freight fluctuation risk.

D. Choosing the Correct Incoterm

Avoids unnecessary seller or buyer cost burden.

E. Container Optimization

Maximize space usage to reduce per-unit cost.

F. Using Multimodal Logistics

Combines affordable rail + efficient sea freight.

G. Building Long-Term Forwarder Partnerships

Better rates + priority space allocation.

8. Complete Logistics Workflow (Seller to Buyer)

Seller Side:

- Confirm Incoterm

- Arrange packing

- Inland transport

- Customs clearance

- Freight booking

- Handover cargo to forwarder

Transit Stage:

- Goods move via sea/air/road/rail

- Tracking provided by logistics provider

Buyer Side:

- Receive BL/AWB

- Arrange customs clearance

- Pay duties

- Local delivery to warehouse

Types of Logistics in Export & Import — Full Explanation

1. Sea Freight (Ocean Shipping)

What it is: International transport of goods by sea using containers (FCL/LCL) or non-containerized methods (breakbulk, bulk carriers, tankers).

How it functions: Exporter books space on a vessel or via a freight forwarder; goods are packed into containers (FCL) or consolidated (LCL) at a Container Freight Station (CFS); shipping lines issue Bill of Lading (B/L); cargo sails to destination port where it undergoes import customs and onward delivery.

Key documentation & parties: Bill of Lading (B/L), booking confirmation, packing list, commercial invoice, shipping line, freight forwarder, CHA (Custom House Agent), port terminal.

When to use: Bulk, heavy, or large-volume shipments; non-urgent deliveries.

Advantages: Cost-effective per unit for large volume; global network; container security.

Limitations: Longer transit time; port congestion; potential demurrage/detention charges.

Cost drivers: Container type (20’/40’/reefer), FCL vs LCL, bunker/fuel surcharges, port handling, THC, container detention.

Best practices / KPIs: Container utilization, on-time sailing ratio, freight per TEU, demurrage days.

2. Air Freight (Air Cargo)

What it is: Transportation of goods via commercial airlines or air cargo carriers; uses Air Waybill (AWB).

How it functions: Exporter or forwarder books space; cargo sent to airline cargo terminal; AWB issued; fast transport to destination airport; customs clearance followed by delivery.

Key documentation & parties: Air Waybill (AWB), commercial invoice, packing list, airwaybill manifest, airline, air cargo agent, ground handling agent.

When to use: Time-sensitive shipments, high-value goods, perishable items with short shelf life.

Advantages: Fast transit, low inventory holding, lower damage risk, reliable schedules.

Limitations: High cost per kg, weight/volume constraints, restrictions on hazardous goods.

Cost drivers: Chargeable weight (volumetric vs actual), fuel surcharge, security fees, airport handling charges.

Best practices / KPIs: Transit time, freight per kg, percent of on-time departures, AWB accuracy.

3. Road Transport (Trucking / LTL / FTL)

What it is: Movement of cargo by truck for first-mile, last-mile, cross-border, or full overland routes.

How it functions: Cargo is moved from factory to port/ICD/warehouse or from port to buyer warehouse. Modes include FTL (Full Truck Load), LTL (Less Than Truckload), container haulage.

Key documentation & parties: Consignment note / CMR (in some regions), proof of delivery (POD), transporter, trucking company, driver, local customs for cross-border.

When to use: Short to medium distances, final delivery, cross-border land routes, inland transport to ports/airports.

Advantages: Flexible routing, door-to-door service, lower fixed costs for short hauls.

Limitations: Road conditions, border delays, weight/height restrictions, higher risk of theft.

Cost drivers: Distance, fuel, tolls, driver costs, payload optimization.

Best practices / KPIs: On-time pickup/delivery, truck utilization, cost per km/ton, damage rate.

4. Rail Freight (Rail Cargo / Intermodal)

What it is: Long-distance overland transport by rail — often used for heavy or bulk cargo and intermodal container movement between inland terminals and ports.

How it functions: Containers or wagons loaded at origin ICD/terminal, moved by rail to destination terminal, then transshipped to road for final delivery.

Key documentation & parties: Rail Bill, intermodal booking, rail operator, terminal operator, rail freight forwarder.

When to use: Large volumes over long land distances, inland connectivity to ports, cross-country corridors.

Advantages: Cost-effective for heavy/bulk; energy efficient; predictable transit times on major corridors.

Limitations: Lower flexibility, schedule constraints, transshipment handling.

Cost drivers: Rail tariff, terminal handling, drayage for first/last mile.

Best practices / KPIs: Dwell time, rail load factor, intermodal transfer time, schedule reliability.

5. Inland Waterways (Barges / River Transport)

What it is: Movement of goods on rivers, canals, and inland waterways to/from ports or terminals.

How it functions: Goods loaded onto barges/containers and transported along navigable rivers to connecting ports or terminals.

Key documentation & parties: Barge waybills, port authority permissions, barge operator.

When to use: Regions with navigable rivers (e.g., Rhine, Mekong); heavy or bulk cargo; intermodal solutions.

Advantages: Low cost per ton, eco-friendly, bulk handling.

Limitations: Seasonal water levels, limited network coverage, slower transit.

Cost drivers: Barge capacity, river tolls, transshipment costs.

Best practices / KPIs: Transit time, cargo throughput, barge utilization.

6. Multimodal / Intermodal Logistics

What it is: A single contract covers movement of goods using two or more modes (e.g., truck + rail + sea) with one carrier responsible.

How it functions: Freight forwarder or multimodal operator coordinates pickup, modal transfers, documentation, and delivery.

Key documentation & parties: Multimodal Bill of Lading (combined B/L), forwarder, modal carriers, terminals.

When to use: Complex routes, cost optimization, improved transit time via modal combination.

Advantages: Single point of contact, optimized cost/time, easier documentation.

Limitations: Complexity in fault/liability allocation; potential modal schedule mismatch.

Cost drivers: Mode switching, terminal handling, drayage.

Best practices / KPIs: Multimodal transit time, handover times, single-contract coverage, claims ratio.

7. Cold Chain Logistics (Temperature-Controlled)

What it is: End-to-end temperature-controlled logistics for perishables, pharmaceuticals, and temperature-sensitive components.

How it functions: Uses refrigerated containers (reefers), cold rooms, temperature-controlled trucks, and monitored warehousing; includes temperature logging & chain-of-custody documentation.

Key documentation & parties: Temperature logs, Certificates of Analysis (COA), cold chain operator, reefer monitoring provider.

When to use: Food & beverage, pharmaceuticals, chemicals, biotech products.

Advantages: Preserves product integrity; compliance with health regulations.

Limitations: High costs, strict handling protocols, energy dependency.

Cost drivers: Reefer hire, power during container dwell, monitoring services, expedited handling.

Best practices / KPIs: Temperature compliance, spoilage rate, cold chain integrity, time outside controlled environment.

8. Project Cargo / Heavy Lift / Breakbulk

What it is: Movement of oversized, heavy, or non-containerizable items (e.g., turbines, machinery, construction modules).

How it functions: Requires specialized vessels, heavy-lift cranes, platform trailers, route surveys, and possibly permits for oversized road transport.

Key documentation & parties: Heavy-lift plan, lifting certificates, project cargo operator, naval architects, port engineers.

When to use: Industrial projects, energy sector, large infrastructure components.

Advantages: Enables transport of unique/large equipment; specialized handling reduces risk.

Limitations: Very high cost, complex planning, long lead time.

Cost drivers: Chartering special vessels, heavy-lift equipment, specialized insurance, route permits.

Best practices / KPIs: Lifting safety incidents, on-schedule project milestones, load planning accuracy.

9. Roll-on / Roll-off (RoRo)

What it is: Vehicles and wheeled equipment are driven onto vessels; used for cars, trucks, construction equipment.

How it functions: Cargo is driven on/off RoRo vessels at roll-on ramps; minimal lifting required.

Key documentation & parties: RoRo booking, vehicle manifest, port RoRo operator.

When to use: Vehicle exports, mobile construction machinery.

Advantages: Faster loading/unloading for wheeled cargo; lower handling damage.

Limitations: Limited to wheeled loads; dependent on RoRo vessel schedules.

Cost drivers: RoRo freight, port ramp fees, vehicle handling.

Best practices / KPIs: Vehicle throughput, damage incidence, turnaround time.

10. Express / Courier Logistics

What it is: Door-to-door, fast parcel delivery for documents, samples, and small high-value shipments.

How it functions: Courier picks up at origin, clears customs under courier provision, delivers to buyer quickly using air networks.

Key documentation & parties: Air Waybill / courier AWB, commercial invoice, courier company.

When to use: Samples, documents, urgent small shipments, e-commerce urgent orders.

Advantages: Speed, end-to-end visibility, simplified customs for small parcels.

Limitations: Costly per kg; weight/size restrictions.

Cost drivers: Speed (overnight vs economy), pickup density, customs brokerage fees.

Best practices / KPIs: Door-to-door transit time, first-attempt delivery success, tracking accuracy.

11. Bonded Warehousing & Distribution (Customs Warehousing)

What it is: Warehousing under customs control where goods can be stored duty-suspended until clearance or re-exported.

How it functions: Importer stores goods in bonded warehouse; duties deferred until goods leave warehouse for local consumption.

Key documentation & parties: Bonded warehouse license, warehouse receipts, customs authority.

When to use: Duty optimization, staging for re-export, inventory smoothing.

Advantages: Cash-flow benefits (deferred duties), flexible distribution, value-added services in bonded zone.

Limitations: Regulatory compliance, potential storage fees.

Cost drivers: Warehouse rent, handling fees, customs compliance.

Best practices / KPIs: Inventory turnover, duty deferral value, bonded cycle time.

12. Customs Brokerage & Clearance Services

What it is: Specialist services to prepare & submit customs documentation, pay duties, and ensure compliance.

How it functions: Customs Broker / CHA files shipping bill, custom entries, coordinates inspections and clearance.

Key documentation & parties: Customs declarations, shipping bill, duty payment, CHA, customs authority.

When to use: Mandatory for most exports/imports.

Advantages: Faster clearance, compliance expertise.

Limitations: Broker fees; reliance on accurate documentation.

Cost drivers: Broker fee, assessments, any post-clearance adjustments.

Best practices / KPIs: Clearance time, number of inspections, duty accuracy.

13. Reverse Logistics & Returns Management

What it is: Handling returned goods, repairs, refurbishing, recycling, and disposal.

How it functions: Reverse pick-up, inspection, repair/refurbish, re-stocking or disposal, customs procedures for returns.

Key documentation & parties: RMA (Return Merchandise Authorization), return shipping documents, repair centers.

When to use: Warranty returns, defective goods, product recalls.

Advantages: Customer satisfaction, recovery of value.

Limitations: Costly handling, complex reverse flow.

Cost drivers: Return transport, refurbishment, disposal fees.

Best practices / KPIs: Return rate, refurbishment yield, time to resolution.

14. E-commerce & Fulfilment Logistics (Cross-Border)

What it is: End-to-end fulfilment for online orders across borders including pick-pack, customs clearance, last-mile.

How it functions: Listings, order capture, warehouse picking, international shipping, local last-mile delivery, returns handling.

Key documentation & parties: Customs declarations, courier / express partners, fulfilment centers.

When to use: Online retailers exporting B2C orders globally.

Advantages: Scalability, market reach, integrated fulfillment.

Limitations: Complexity of many small parcels, returns high.

Cost drivers: Per-order handling cost, last-mile cost, customs thresholds.

Best practices / KPIs: Order fulfilment time, shipping cost per order, delivery success rate.

15. Value-Added Logistics (Packaging, Labeling, Kitting)

What it is: Services such as re-packing, labeling for market compliance, kitting, assembly before shipment.

How it functions: Performed at factory, 3PL/contract manufacturer, or bonded warehouse to meet buyer/country requirements.

When to use: Regulatory compliance, retail readiness, localization.

Advantages: Saves buyer time, reduces returns, aids compliance.

Cost drivers: Labor, materials, regulatory checks.

Best practices / KPIs: Accuracy rate, cost per unit for VAS, compliance rate.

How These Logistics Types Integrate in an Efficient Export/Import Supply Chain

- Planning & Mode Selection: Choose mode(s) based on cost, speed, product type, Incoterms and buyer requirements.

- Single Point Coordination: Use a freight forwarder/multimodal operator for single-contract visibility.

- Optimize Packaging & Unitization: Improve containerization and palletization to reduce damage and increase load efficiency.

- Consolidate Shipments: LCL or groupage for small shipments to reduce per-unit cost.

- Leverage Bonded Facilities: Defer duties, perform VAS, or stage inventory for re-export.

- Use Technology: TMS, Track & Trace, EDI, and temperature monitoring to increase visibility.

- KPIs & Continuous Improvement: Measure transit time, cost per unit, on-time delivery, claims ratio, and container utilization.

- Risk Mitigation: Insurance, contingency routing, supplier redundancy, and advance customs compliance.

Practical Tips for Sellers & Buyers (Logistics Roles)

- Sellers should confirm Incoterms early, choose efficient packaging, pre-book freight space, and work with experienced forwarders & CHA.

- Buyers should provide accurate delivery addresses, agree on shipment windows, arrange import customs broker, and prepare for last-mile delivery.

- Both should share real-time tracking, agree on insurance responsibilities, and document handover points clearly to avoid disputes.

How to Select Logistics for Export & Import Purpose (Complete Guide: Beginner to Advanced)

1. WHAT is Logistics Selection in Export–Import?

Logistics selection refers to choosing the best mode of transport, freight forwarder, shipping line, CHA, and routing depending on product type, buyer requirements, Incoterms, and delivery deadlines.

It determines how your cargo moves from:

2. WHY Selecting the Right Logistics is Important?

✔ Reduces total export & import cost

✔ Improves delivery speed

✔ Minimizes risks & damages

✔ Ensures customs compliance

✔ Builds long-term buyer confidence

✔ Strengthens global supply chain efficiency

3. FACTORS to Consider When Selecting Logistics (Beginner to Advanced)

A. Product Factors

- Product Type

Machinery, raw materials, perishables, chemicals, textiles, electronics, etc. - Product Sensitivity

Fragile, temperature-controlled, hazardous, oversized cargo. - Weight & Volume

Decides air freight vs sea freight vs road transport. - Packaging Requirements

Pallets, wooden boxes, fumigation, moisture control.

B. Shipping Requirement Factors

- Delivery Deadline

Urgent → Air freight

Flexible → Sea freight - Incoterms

EXW, FOB → Seller handles local logistics

CIF, DAP → Seller handles international logistics

DDP → Seller handles everything end to end - Route Feasibility

Direct sailing/flight vs transshipment

Risk of delays - Buyer Requirements

Some buyers prefer specific carriers or transshipment hubs.

C. Cost Factors

- Freight Rate Comparison

Evaluate 3–5 freight forwarders. - Port Charges, THC, Documentation Fees

- Customs Clearance Charges

- Insurance Cost

- Warehousing Fees (if applicable)

D. Risk Factors

- Political stability of transit countries

- Weather conditions

- Port congestion risk

- Fragile / dangerous goods handling requirements

E. Supply Chain Efficiency Factors

- Tracking & Digital Visibility

- Communication speed

- Experience of logistics partner

- Shipment consolidation options

- Availability of after-sales support

4. HOW to Select the Right Logistics for Export (Step-by-Step)

Step 1: Analyze Product & Market Requirements

- Identify cargo dimensions, volume, weight.

- Understand buyer’s delivery expectations.

- Check whether the cargo is general, temperature-controlled, hazardous, or oversized.

Step 2: Select Mode of Transport (Sea, Air, Road)

Sea Freight (FCL/LCL)

✔ Best for bulk cargo

✔ Low cost

✔ Slower transit

✔ Best for machinery, bulk materials, industrial goods

Air Freight

✔ Fastest

✔ Expensive

✔ Best for high value, urgent goods, small cargo

Road Transport (Cross-border/Local)

✔ Used for EXW, FCA, DAP deliveries

✔ Used before and after sea/air shipment

Step 3: Choose the Right Freight Forwarder

Evaluate forwarders based on:

- Experience in your product category

- Global network and carrier partnerships

- Documentation expertise

- Past performance & reliability

Step 4: Compare Freight Rates (3–5 Quotes)

Check:

- Freight charges

- Surcharges (BAF, CAF, PSS, GRI)

- Free days for container

- Transit time

- Route selection

Step 5: Confirm Export Documentation Support

A good logistics partner must handle:

- Bill of Lading

- Airway Bill

- Shipping Bill

- COO, Fumigation, Phytosanitary Certificates

- Packing List & Invoice checking

Step 6: Check Customs Clearance Expertise (CHA)

Customs clearance is a major factor. Choose a partner who:

- Understands HS Codes

- Has smooth customs processing

- Provides accurate documentation guidance

Step 7: Evaluate Insurance Options

Choose based on:

- Incoterms

- Cargo sensitivity

- Buyer’s risk tolerance

Step 8: Finalize Booking & Execution

- Confirm shipping schedule

- Submit documents

- Plan stuffing / loading

- Coordinate with buyer for arrival updates

Logistics FAQs

Q1. How does choosing the right mode of transport affect export logistics? ▶

The selected transport mode—sea, air, road, rail, or multimodal—directly affects delivery speed, freight cost, cargo safety, and suitability for the product type, influencing overall supply chain performance.

Q2. What information must exporters provide when booking logistics? ▶

Exporters must provide cargo dimensions, weight, HS code, destination, packing type, and preferred shipment dates so logistics partners can quote rates accurately and reserve capacity.

Q3. Why is early logistics booking important for export shipments? ▶

Early booking secures cargo space, reduces last-minute freight surcharges, supports smoother customs coordination, and helps align production schedules with vessel or flight departures.

Q4. Can multimodal logistics offer advantages over a single transport mode? ▶

Yes. Multimodal logistics can optimize cost and transit time by combining road, rail, sea, or air transport while simplifying coordination through a single logistics contract.

Q5. How do Incoterms affect logistics responsibilities between seller and buyer? ▶

Incoterms define who arranges and pays for freight, customs clearance, insurance, and final delivery. For example, under FOB the buyer manages international freight, while under CIF the seller covers it.

Q6. Why is comparing multiple freight quotes important? ▶

Comparing quotes helps evaluate differences in cost, transit time, routing options, free days, and surcharges, enabling exporters to choose the most reliable and economical service.

Q7. How do freight forwarders add value in export logistics planning? ▶

Freight forwarders coordinate transport, documentation, customs interaction, tracking, and multimodal routing, acting as a single point of contact for complex export movements.

Q8. What strategies help reduce logistics costs without compromising delivery? ▶

Effective strategies include cargo consolidation, container optimization, early booking, multimodal transport, and long-term partnerships with reliable logistics providers.

Q9. Why is shipment tracking essential after dispatch? ▶

Tracking provides real-time shipment visibility, supports destination warehouse planning, reduces uncertainty, and allows proactive handling of delays or route changes.

Q10. Does logistics planning impact overall export competitiveness? ▶

Yes. Efficient logistics planning reduces landed cost, improves delivery reliability, enhances buyer satisfaction, and strengthens an exporter’s competitive position in global markets.

How to Select Logistics for Import (Step-by-Step)

Step 1: Understand Supplier’s Incoterms

- FOB → You choose the freight forwarder

- CIF → Supplier selects forwarder (but you can negotiate)

- DAP/DDP → Supplier handles full logistics

Step 2: Evaluate Port Charges & Destination Costs

Importers often miss:

- D/O charges

- Port storage

- Demurrage

- Late filing fees

Step 3: Select Reliable Customs Broker

Your CHA must help with:

- HS code classification

- Duty calculation

- Exemptions & benefits

- Smooth customs clearance

Step 4: Evaluate Freight Options

Choose the most cost-effective based on:

- Transit time

- Freight rates

- Type of cargo

- Shipment frequency

Step 5: Warehouse & Distribution Planning

Plan for:

- Bonded warehouse

- Free trade zone

- Last-mile delivery scheduling

ADVANCED LEVEL: How Professionals Select Logistics Smartly

✔ Use Multi-Modal Logistics (Air + Road / Sea + Rail)

Reduces cost and optimizes transit.

✔ Evaluate Carrier Performance (KPIs)

- On-time delivery

- Damage rate

- Documentation accuracy

✔ Use Digital Freight Tools

(Shipment tracking, rate comparison portals)

✔ Create Vendor Performance Scorecard

Rate forwarders based on:

Cost | Speed | Reliability | Communication | Problem-solving

✔ Build Backup Routing

Always have an alternative port or forwarder in case of delay.

Logistic Imports FAQs

Q1. How do Incoterms influence logistics decisions in imports? ▶

Incoterms determine who controls freight, customs clearance, and delivery. Under FOB, the importer selects the forwarder and manages logistics, while under CIF or DDP, the supplier may handle transport, affecting both cost control and operational visibility.

Q2. Why is it important to evaluate local port and destination charges before selecting logistics? ▶

Overlooking charges such as demurrage, storage, port handling, or documentation fees can significantly increase the total landed cost, making an initially low freight quote more expensive overall.

Q3. What role does a customs broker play in import logistics? ▶

A customs broker assists with HS code classification, duty calculation, documentation preparation, and customs clearance, helping importers avoid delays, penalties, and compliance risks.

Q4. How should importers compare freight options effectively? ▶

Importers should evaluate transit time, cost structure, cargo type, carrier reliability, and sailing frequency to balance speed and budget, rather than choosing solely based on the lowest rate.

Q5. Why is warehouse planning crucial in import logistics? ▶

Proper warehouse and distribution planning ensures timely unloading, efficient storage, and smooth final delivery, while minimizing storage charges and improving overall supply chain flow.

Q6. What advanced strategies help importers optimize logistics? ▶

Advanced importers use multimodal transport solutions, digital tracking tools, and carrier performance KPIs to control costs, monitor shipment performance, and improve supply reliability.

Q7. Does having a backup logistics plan make a difference? ▶

Yes. Backup routes, carriers, and forwarders provide alternatives during port congestion, weather disruptions, or carrier failures, minimizing supply chain interruptions.

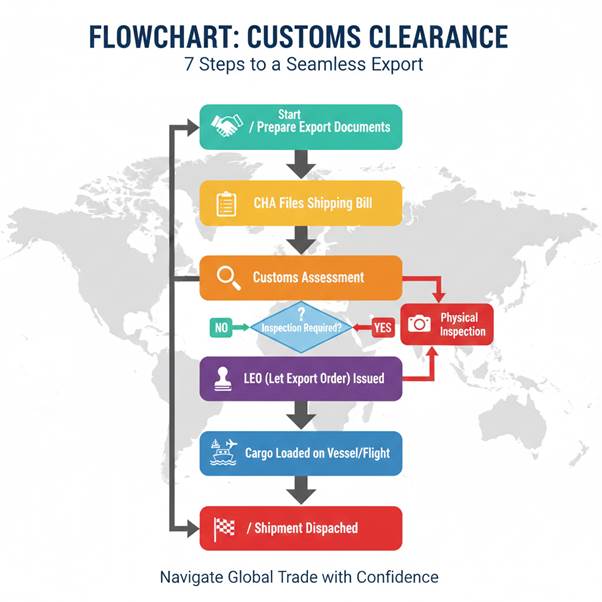

Export Customs Clearance Explained

WHAT is Customs Clearance?

A process of legally clearing goods for export by Indian Customs.

WHY Needed?

- Mandatory for shipment

- Ensures compliance

- Enables government records & incentives

WHERE Done?

Indian ports, ICDs, airports.

HOW Clearance Works

- CHA files Shipping Bill

- Customs assess documents

- Examination (if required)

- Let Export Order (LEO)

- Cargo allowed for loading

1. CHA Files Shipping Bill (The Initiation)

This step officially begins the export process with the Customs department.

- Action: The exporter’s authorized representative, typically a Customs House Agent (CHA) or the exporter themselves, electronically submits the Shipping Bill (or Bill of Export for land/air cargo) via the centralized customs system (ICEGATE in India).

- Content: The Shipping Bill acts as the primary document containing all details about the shipment, including the Exporter and Consignee details, Declared Value, HS Code (Harmonized System Code), Quantity, and the chosen Port of Destination.

2. Customs Assess Documents (The Review)

Once the Shipping Bill is filed, Customs authorities scrutinize the data to verify accuracy, legality, and duty eligibility.

- Action: Customs officers review the data submitted against supporting documents like the Commercial Invoice, Packing List, and Declarations. They also check for regulatory adherence, such as licenses required for restricted goods.

- Verification Focus:

- Valuation: Ensuring the declared value aligns with market norms to prevent fraud.

- Duty Drawback/Incentives: Assessing eligibility for government export schemes or refunds.

- Compliance Check: Verifying that the assigned HS Code matches the product and that all necessary clearances (e.g., Phytosanitary) are in place.

3. Examination (The Physical Verification)

Not all cargo requires physical examination, but shipments flagged by the risk management system (RMS) are subject to inspection.

- Action: If the Customs system flags the shipment (based on shipper history, product category, or random selection), a Customs officer will physically inspect the goods at the port or inland container depot (ICD).

- Purpose: To confirm that the physical cargo inside the container exactly matches the description, quantity, and classification declared in the Shipping Bill and supporting documents.

- Output: The officer affixes an examination report to the file. If discrepancies are found, they may lead to penalties or delays.

4. Let Export Order (LEO) (The Approval)

The Let Export Order (LEO) is the final, non-negotiable authorization from Customs that permits the cargo to be loaded onto the designated carrier (ship, plane, or train).

- Action: After the documentation is assessed, duties/fees are paid, and any required examination is completed satisfactorily, the Customs officer grants the LEO in the system.

- Significance: This is the official green light. Without the LEO, the cargo cannot proceed to the vessel and will be held at the port terminal.

5. Cargo Allowed for Loading (The Execution)

- Action: The shipping line or airline receives the electronic LEO confirmation. The container or package is then moved from the stacking yard to the ship/aircraft side and loaded onto the booked vessel according to the manifest.

- Final Documentation: The carrier issues the final transport document, such as the Bill of Lading (B/L) or Airway Bill (AWB), confirming receipt and intent to carry the goods.

Shipment Dispatch & Tracking

Shipment Dispatch & Tracking: Ensuring Supply Chain Visibility

The final stage of the logistics booking process—Shipment Dispatch and Tracking—marks

the

physical handoff

of the cargo to the carrier and initiates the critical phase of monitoring its journey.

This process is essential for maintaining supply chain transparency and effective

inventory

management.

1. What is Shipment Dispatch?

Shipment Dispatch is the pivotal moment when the cargo officially leaves the origin facility or port, commencing its transit to the final destination.

- Action: It occurs immediately after the Customs Clearance process culminates in the Let Export Order (LEO).

- Definition: Dispatch refers to the Cargo Loaded onto the Vessel/Flight, and the physical movement of the shipment starts, transitioning the goods from static inventory to dynamic transit.

- Key Event: Upon dispatch, the carrier (shipping line or airline) acknowledges receipt and issues the legally binding transportation document (Bill of Lading or Airway Bill), confirming the start of their responsibility.

2. Why is Tracking Important?

Shipment Tracking offers end-to-end visibility across the complex global supply chain, transforming logistics from a black box into a transparent operation.

- Provides Visibility: Real-time location updates enable businesses to monitor cargo status (e.g., "Departed," "In Transit," "Arrived") preventing uncertainty and allowing for immediate intervention if issues arise. This is critical for Supply Chain Management (SCM).

- Helps Buyer Plan Warehouse: Accurate Estimated Time of Arrival (ETA) allows the buyer to perfectly synchronize Inventory Management and Warehouse Resource Planning (e.g., scheduling labor, forklifts, and staging space for unloading), minimizing idle time and demurrage charges.

- Reduces Disputes: Transparent tracking creates an undeniable record of movement, arrival, and delivery times. This shared data helps resolve disagreements regarding delays, custody transfers, and delivery performance between the buyer, seller, and carrier.

3. Where to Track?

Tracking information is typically managed by the entity physically moving the cargo or by the authorized booking agent.

- Shipping Line Website: For ocean freight, the container's status is tracked directly on the website of the carrier (e.g., Maersk, CMA CGM) using the B/L or container number.

- Airline Tracking Portal: For air freight, the status is monitored via the airline's cargo tracking portal using the AWB number.

- Forwarder Dashboard: Many modern Freight Forwarders offer an integrated digital dashboard that consolidates tracking data from multiple carriers into a single, user-friendly interface. This is the preferred method for managing Multimodal Shipments.

4. How to Track Shipment

Tracking requires the use of specific, unique identifiers assigned to the shipment at the time of booking.

| Mode | Tracking Identifier | Description |

|---|---|---|

| Sea Freight | Bill of Lading (B/L) Number | The unique contract number identifying the entire shipment on the vessel. Container Number is also commonly used. |

| Air Freight | Air Waybill (AWB) Number | The unique 11-digit identifier that serves as the receipt for the goods and the contract of carriage for air cargo. |

Process: The user inputs the appropriate tracking number into the carrier's or forwarder's tracking tool to instantly retrieve the shipment's last known location and status updates.

Post-Shipment Documentation

Post-Shipment Documentation refers to the comprehensive set of final papers prepared and dispatched by the exporter or their agent after the cargo has been successfully loaded and cleared for transit. This phase is non-negotiable, as these documents are the legal instruments that allow the buyer to receive the goods, fulfill banking requirements, and complete import formalities.

1. What are Post-Shipment Documents?

These documents are the legally required papers that travel ahead of the goods or electronically follow the consignment.

- Definition: They are the Mandatory Documents Required for Buyer Payment & Customs at Destination, confirming the details of the transaction, the goods, and the carriage contract.