Foundations of Export–Import Introduction

Understanding the fundamentals of export–import (EXIM) is essential for every manufacturer, exporter, and trader entering global markets. These fundamentals define who pays for what, who arranges transport, and when risk transfers between buyer and seller.

Basic EXIM Terms — What they mean, why they matter, and how they work

Understanding core EXIM terms (Incoterms, HS codes, FOB, CIF, B/L, AWB, invoice types) is essential for every exporter and importer. These terms define who pays, who arranges transport, and when risk transfers from seller to buyer.

Incoterms (Complete list — Incoterms® 2020 standard)

What are Incoterms?

Incoterms are internationally recognised trade terms published by the ICC that define responsibilities (delivery, cost, risk) between buyer and seller.

Why they matter:

They avoid misunderstandings about who pays for transport, insurance, customs, and who bears loss/damage risk at each stage.

How they work (practical examples):

Each Incoterm below shows: who arranges transport, who pays for freight, who buys insurance (if applicable), and when risk transfers.

Note: EXW/FCA = seller minimal responsibility; DDP = seller maximum responsibility.

EXW — Ex Works (Seller minimum obligation)

- Seller responsibility: Make goods available at seller’s premises.

- Buyer responsibility: All export formalities, transport, insurance, import customs, duties.

- Risk transfer: When goods made available at seller’s place.

- Example: Small machine parts packed at factory gate in Mumbai. Buyer arranges pickup, export clearance, sea freight to Rotterdam, and import clearance.

FCA — Free Carrier (Named place)

- Seller: Delivers goods to carrier at named place and clears export (if agreed).

- Buyer: Arranges main carriage, insurance, and import.

- Risk transfer: When goods handed to the carrier.

- Example: Seller delivers palletized goods to shipping terminal in Nhava Sheva; buyer’s forwarder collects them.

FAS — Free Alongside Ship (Named port of shipment)

- Seller: Places goods alongside vessel at port of shipment.

- Buyer: Loads on ship, pays sea freight, insurance, import.

- Risk transfer: When goods placed alongside ship.

- Example: Steel coils delivered to the quay at Mumbai port; buyer arranges loading and sea freight.

FOB — Free On Board (Named port of shipment)

- Seller: Loads goods on board vessel at named port, clears export.

- Buyer: Pays sea freight, insurance, import.

- Risk transfer: When goods pass ship’s rail.

- Example: Pump sets loaded onto vessel in Chennai; buyer arranges sea freight to Hamburg.

- Common use: Conventional for sea freight (FCA preferred for containers).

Incoterms Responsibility Matrix (All 11 Incoterms)

| Responsibility | EXW | FCA | FAS | FOB | CFR | CIF | CPT | CIP | DAP | DPU | DDP |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Export Packaging | S | S | S | S | S | S | S | S | S | S | S |

| Loading at Seller’s Premises | B | S | S | S | S | S | S | S | S | S | S |

| Inland Transport (Seller Country) | B | S | S | S | S | S | S | S | S | S | S |

| Export Customs Clearance | B | S | S | S | S | S | S | S | S | S | S |

| Port Charges | B | B/S | S | S | S | S | S | S | S | S | S |

| Main International Freight | B | B | B | B | S | S | S | S | S | S | S |

| Insurance | B | B | B | B | B | S | B | S | B | B | B |

| Risk Transfer Point |

Seller Premises |

Carrier Pickup |

Alongside Ship |

Onboard Ship |

Onboard Ship |

Onboard Ship |

Carrier Pickup |

Carrier Pickup |

Destination |

Destination (Unloaded) |

Final Delivery |

| Destination Port Charges | B | B | B | B | B | B | B | B | S | S | S |

| Import Customs Clearance | B | B | B | B | B | B | B | B | B | B | S |

| Final Inland Transport(Buyer's Country) | B | B | B | B | B | B | B | B | S | S | S |

| Delivery to Buyer’s Door | B | B | B | B | B | B | B | B | S | S | S |

CIP — Carriage & Insurance Paid To (Named place)

- Seller: Pays carriage and insurance to named destination. Insurance must be minimum coverage.

- Buyer: Bears risk after handing goods to the first carrier and completes import clearance.

- Example: Small precision instruments shipped CIP to Berlin, with seller covering multimodal freight and insurance.

DAP — Delivered At Place (Named place of destination)

- Seller: Delivers goods ready for unloading at named place and pays main carriage (excluding import duties).

- Buyer: Unloads goods, clears import customs, and pays duties.

- Risk transfer: When goods are available for unloading at destination.

- Example: Generator delivered DAP to buyer’s warehouse in Lagos; buyer handles customs clearance.

DPU — Delivered at Place Unloaded (formerly DAT)

- Seller: Delivers and unloads goods at named destination, covering carriage and unloading costs.

- Buyer: Handles import customs clearance and duties.

- Risk transfer: Once goods are unloaded at destination.

- Example: Heavy machinery delivered DPU at factory gate in Accra, with seller arranging unloading equipment.

DDP — Delivered Duty Paid (Named place)

- Seller: Bears maximum responsibility — delivers goods cleared for import, paying all duties, taxes, and formalities.

- Buyer: Has minimal responsibility and only receives the goods.

- Risk transfer: When goods are delivered at the named place.

- Example: Exporter delivers spare parts DDP to a UK warehouse, handling customs, VAT, and final delivery.

Real-life tips :

- Use EXW/FCA when buyers prefer to control shipping.

- Use FOB/CIF historically for sea shipments — for containerized cargo, FCA with onboard bill is increasingly used.

- Use DDP only if seller can handle import compliance in buyer’s country.

- Always state the named place and version (Incoterms 2020) on contract.

1.2 HS Code (Harmonized System)

What: Global product classification code (6–10 digits) used for customs, duties, and trade statistics.

Why: Determines tariff, compliance, export controls, and allowed documentation.

How: Example: A ball bearing might be under HS 8482.10 — you must declare correct HS code on commercial invoice and customs forms. Use local tariff schedules to get duty rates.

1.3 FOB vs CIF (Simple comparison)

| Parameter | FOB (Free On Board) | CIF (Cost, Insurance & Freight) |

|---|---|---|

| Freight Cost | Paid by Buyer | Paid by Seller |

| Insurance | Arranged by Buyer | Arranged by Seller |

| Risk Transfer Point | When goods are on board vessel | When goods are on board vessel |

| Control over Shipping | Buyer has more control | Seller has more control |

| Common Usage | Preferred by experienced importers | Preferred by buyers wanting simplicity |

Explanation of Each Incoterm (Buyer & Seller Responsibility Summary)

| Incoterm | Seller Responsibilities | Buyer Responsibilities | Best For / Common Use |

|---|---|---|---|

| EXW (Ex Works) | Makes goods available at seller’s premises. No loading, no export clearance. | Handles loading, export clearance, freight, insurance, import clearance, and delivery. | Experienced buyers with strong logistics capability. |

| FCA (Free Carrier) | Delivers goods to carrier at named place and completes export customs clearance. | Arranges main transport, insurance, and import customs clearance. | Containerized and multimodal shipments. |

| FAS (Free Alongside Ship) | Places goods alongside the vessel at port of shipment and clears export customs. | Handles loading, freight, insurance, and import clearance. | Bulk and break-bulk sea shipments. |

| FOB (Free On Board) | Loads goods on board the vessel and completes export customs clearance. | Arranges freight, insurance, and import customs clearance. | Traditional sea freight exports. |

| CFR (Cost and Freight) | Pays cost and freight to destination port. Risk transfers once goods are on board. | Arranges insurance and import customs clearance. | Sea shipments where buyer manages insurance. |

| CIF (Cost, Insurance and Freight) | Pays freight and minimum insurance to destination port. Risk transfers at shipment port. | Handles import customs clearance and duties. | Sea shipments where seller provides insurance. |

| CPT (Carriage Paid To) | Pays carriage to named destination. Risk transfers to buyer at first carrier. | Handles insurance and import customs clearance. | Multimodal transport without seller insurance. |

| CIP (Carriage and Insurance Paid To) | Pays carriage and insurance to named destination. Risk transfers at first carrier. | Handles import customs clearance and duties. | High-value multimodal shipments. |

| DAP (Delivered At Place) | Delivers goods ready for unloading at destination. Handles all transport up to destination. | Handles import customs clearance and duties. | Door delivery without import duties. |

| DPU (Delivered at Place Unloaded) | Delivers and unloads goods at named place. Handles all transport and unloading. | Handles import customs clearance and duties. | Projects requiring unloading at destination. |

| DDP (Delivered Duty Paid) | Handles all costs, risks, transport, and import duties up to buyer’s door. | No logistics or customs responsibility. | Buyers wanting complete seller responsibility. |

1.4 Bill of Lading (B/L) & Airway Bill (AWB)

Bill of Lading (B/L): Legal document issued by carrier/shipper for sea freight. Acts as: receipt of goods, evidence of contract, and negotiable title (when “to order”). Types: Ocean B/L, Sea-Waybill, Multimodal B/L.

Airway Bill (AWB): For air freight — not negotiable, receipt + contract of carriage.

How used in practice: Exporter receives B/L from forwarder and uses it to evidence shipment to buyer/ bank (in LC transactions).

1.5 Commercial Invoice, Packing List, Certificate of Origin (COO), Insurance Certificate

- Commercial Invoice: Primary trading document showing price, description, terms.

- Packing List: Details packaging, weights, dimensions—used for customs and logistics.

- Certificate of Origin: Proves origin—required for preferential tariffs under FTAs.

- Insurance Certificate: Evidence of marine or cargo insurance.

1.6 Other essential terms (brief)

- LC (Letter of Credit): Bank guarantee of payment.

- TT (Telegraphic Transfer): Wire transfer payment.

- RCMC: Registration with export promotion councils (country-specific).

- CHA / Freight Forwarder: Customs house agent / logistics partner.

Basic EXIM Terms (Incoterms, HS Codes, FOB, CIF, B/L etc.) – FAQ

Q1. What are Incoterms in export–import? ▶

Incoterms (International Commercial Terms) are standardized trade rules defined by the ICC that explain the responsibilities of buyers and sellers in international trade—especially related to shipping, insurance, costs, and risks.

Q2. Why are Incoterms important for exporters and importers? ▶

Incoterms remove confusion, prevent disputes, and clearly define who pays for what, who handles logistics, and where the risk transfers during shipment.

Q3. What is the difference between FOB and CIF? ▶

• FOB (Free on Board): Seller delivers goods at the port; the buyer pays freight

&

insurance.

• CIF (Cost, Insurance & Freight): Seller covers freight + insurance up to

buyer’s

port.

Q4. What is an HS Code in international trade? ▶

An HS Code (Harmonized System Code) is a 6-digit global classification number used to identify products for customs, taxation, and export documentation.

Q5. How do HS Codes affect export duties and compliance? ▶

HS Codes determine:

- Export duty rates

- Import customs duties

- Banned & restricted items

- Required certificates (COO, fumigation, etc.)

Q6. What is a Bill of Lading (B/L)? ▶

A Bill of Lading is a legal document issued by a carrier that acts as:

- Proof of shipment

- Contract of carriage

- Title of goods (ownership)

Q7. What is the difference between a Bill of Lading and an Airway Bill? ▶

• B/L: Used for sea shipments; transferable

• AWB: Used for air shipments; non-transferable

Q8. Which Incoterms are best for new exporters? ▶

Common beginner-friendly terms:

- FOB – Most preferred for exporters

- EXW – Buyer handles everything

- CIF – Seller controls freight

Q9. How do Incoterms work in real life? ▶

Real-life example:

FOB Mumbai → Buyer in USA

- Seller delivers container to Mumbai port

- Buyer arranges ocean freight & insurance

- Risk transfers once cargo is loaded on vessel

Simplified Buyer vs Seller Matrix

| Responsibility Category | Seller Covers (Incoterms) | Buyer Covers (Incoterms) |

|---|---|---|

| Minimum Seller Responsibility | EXW | DDP |

| Shared Responsibility | FCA, FOB, CFR, CPT, CIF, CIP | FCA, FOB, CFR, CPT, CIF, CIP |

| Maximum Seller Responsibility | DDP | EXW |

| Sea-Only Terms | FAS, FOB, CFR, CIF | FAS, FOB, CFR, CIF |

| Multimodal Terms | EXW, FCA, CPT, CIP, DAP, DPU, DDP | Same |

Understanding International Markets — Factors, Examples, and How to Research

Understanding international markets is key to successful exports. Market selection should be based on demand, tariff barriers, logistics feasibility, local standards, and buyer behaviour. Below we list the factors and a practical research approach.

2.1 Key Market Factors to Evaluate

- Demand & Market Size: Does the target country import your engineering product? Check import volumes and trends.

- Tariff & Non-Tariff Barriers: Customs duties, quotas, product standards, certifications (CE, UL).

- Regulatory & Compliance Requirements: Product safety, packaging, labelling, environmental rules.

- Logistics & Transit Time: Sea/air routes, lead times, costs, inland transport.

- Competitive Landscape: Local producers, price levels, brand expectations.

- Payment & Banking Risks: Currency stability, payment norms (LC vs open account).

- Trade Agreements & Preferential Tariffs: FTAs, bilateral agreements reduce duties.

- Cultural & Commercial Practices: Negotiation norms, contract preferences, language.

- After-Sales Support & Service Network: Spare parts, warranty support expectations.

- Market Entry Costs: Marketing, certification, local partner costs.

2.2 Practical Market Research Steps

Example Target Market: Brazil

Product: Metal fittings for engineering applications

Step 1: Desk Research

Use trade statistics to check import volumes for metal fittings into Brazil.

Step 2: Identify Buyers and Segments

Distributors, EPC contractors, OEMs.

Step 3: Check Tariffs & Standards

Look up the HS Code for metal fittings to determine:

- Applicable import duty rates

- Local standards and certifications (e.g., ABNT)

Step 4: Evaluate Logistics

Sea freight time to Santos, inland delivery costs.

Step 5: Assess Payment Terms

Preference for LC or open account; buyer credit risk.

Step 6: Decide Market Entry Route

- Direct exports to buyers

- Local distributor or agent

- B2B marketplace or platform

Step 7: Pilot Order

Small consignment via express freight to test demand & clearance.

2.3 Tools & Sources for Market Research

- UN Comtrade — global trade statistics

- Country customs tariff portals

- Trade associations and trade shows

- Export promotion councils

- Local embassy and trade offices

Understanding International Markets — FAQ

Q1. What is meant by International Market Analysis? ▶

It is the process of studying global demand, competition, pricing, regulations, and buyer preferences to identify suitable export markets.

Q2. What factors affect international market selection? ▶

- Demand size and import dependency

- Competitor pricing

- Trade barriers and duties

- Logistics cost and transit time

- Cultural buying behaviour

- Currency stability

Q3. Why should exporters study competitor countries? ▶

It helps exporters understand pricing benchmarks, market gaps, quality expectations, and differentiation opportunities.

Q4. How do trade agreements affect market selection? ▶

Free Trade Agreements (FTAs) can reduce or eliminate customs duties, making products more competitive in certain markets.

Q5. What tools help analyze international markets? ▶

- Google Market Finder

- Government export portals

- Trade Map

How to Identify the Right Buyer Overseas — Detailed Steps & Flowchart

Finding the right overseas buyer is both an art and a science. Successful exporters follow a structured funnel that moves from lead generation to verification, negotiation, and onboarding. This reduces payment risk, improves conversion, and builds long-term partnerships.

3.1 Buyer Identification Workflow (Step-by-Step)

-

Define Ideal Buyer Profile

industry, company size, annual purchase volume, distribution channels. -

Generate Leads

B2B marketplaces, trade shows, referral, LinkedIn, AI buyer-finder tools. -

Initial Screening

website, product catalogue, corporate registration, financial snapshot. -

Qualification Call / Email

confirm product fit, volumes, lead times, payment terms. -

Request Documents

company registration, VAT number, trade references. -

Sample Order / Pilot Shipment

pilot shipment to check quality acceptance. -

Negotiate Contract Terms

Incoterms, price, QC, delivery schedule. -

Finalize Buyer Onboarding

registration on your platform, payment method, performance KPIs. -

Ongoing Relationship Management

Use CRM, after-sales support, and periodic performance reviews.

3.2 Buyer Verification Checklist (Due Diligence)

- Active business registration & physical address proof

- Functional website & product traceability

- Bank reference or trade references

- Import history (customs data, if available)

- Credit check (where applicable)

- References from trade associations or B2B platforms

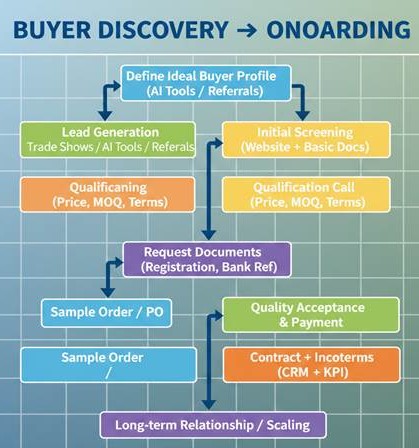

3.3 Buyer Discovery → Onboarding Flowchart

The following flowchart illustrates the structured buyer onboarding journey from lead generation to long-term engagement.

Figure: Buyer discovery to onboarding workflow

Case Study: How a Pune-Based Hydraulic Valve Manufacturer Identified the Right Overseas Buyer

1. Company Background

A mid-sized Pune-based engineering manufacturer specializing in hydraulic valves wanted to expand its export footprint to the Middle East, where demand for industrial hydraulic components is growing due to construction, oil & gas, and heavy machinery sectors.

2. Objective of Expansion

The company set a clear buyer profile:

- Target Buyers: Industrial distributors and machinery OEM suppliers

- Region: UAE, Saudi Arabia, Oman, Qatar

- Minimum Order Quantity: USD 5,000 per shipment

- Goal: Build long-term distribution partnerships, not one-time orders

3. Market Research & Segmentation

To identify suitable B2B partners, the company performed:

- Industry segmentation (construction equipment dealers, OEMs)

- Competitive supplier mapping

- Price benchmarking (EXW Pune vs CIF Jebel Ali)

- Demand analysis using HS Code 848120

This helped the company narrow down demand clusters to: Dubai, Abu Dhabi, Riyadh, Dammam, Muscat.

4. Lead Generation Strategy

The company used a multi-layer approach:

a. Global Trade Shows

- Participated in ADIPEC, Big 5 Dubai and Middle East Manufacturing Expo

- Collected over 120+ distributor contacts.

b. AI Buyer-Finder Tool

Used an AI-powered system to:

- Scrape import data (HS Code 848120)

- Identified high-volume importers

- Scored leads using demand, pricing history & credibility

This produced 30 high-quality potential buyers.

5. Lead Screening & Qualification

The company refined the list through:

- KYC & business verification

- Creditworthiness checks

- Website and product catalogue analysis

- Phone interviews to understand technical requirements

From 30 leads, 8 serious buyers were shortlisted.

6. Sampling & Technical Validation

The manufacturer sent engineering samples:

- 3 buyers requested compatibility testing

- Samples included drawings, pressure test certificates, and material specs

- Testing duration: 2–3 weeks per buyer

After validation, 3 buyers approved samples.

7. Negotiation & Pilot Order Execution

- Pilot Order: USD 5,000

- Incoterm: CIF Jebel Ali

- Payment: 30% advance, 70% against BL copy

- Packaging: Heat-treated wooden boxes with rust prevention

8. Distribution Agreement Finalization

After the successful pilot:

- 12-month demand projection shared

- Regional distribution agreement signed

- Minimum sales targets & exclusive pricing defined

Outcome: The manufacturer secured a stable long-term export partner.

How to Identify the Right Buyer Overseas — FAQ

Q1. What is the best way to find genuine international buyers? ▶

B2B platforms, trade exhibitions, LinkedIn outreach, embassy trade directories, and verified import data platforms.

Q2. How do you verify if an overseas buyer is genuine? ▶

Check company registration, website authenticity, trade history, bank references, and Chamber of Commerce validation.

Q3. What questions should you ask a potential buyer? ▶

- What products do you currently import?

- What quantities do you require?

- What is your target price?

- What are your preferred shipping terms?

Q4. What documents should buyers provide for verification? ▶

- Purchase order

- Import license (if applicable)

- Company incorporation documents

- Tax registration details

Q5. How do flowcharts help in buyer selection? ▶

A flowchart simplifies decision-making by mapping the steps: Lead → Verification → Compliance Check → Negotiation → Contract → Shipment

How to Identify the Right Supplier Overseas — Detailed Steps & Flowchart

Supplier selection is critical for quality, cost, lead times, and reliability. Use verification, factory audits, sample testing, and contractual SLAs.

4.1 Supplier Selection Process (Step-by-Step)

-

Define Supplier Requirements

product specs, minimum order quantity, lead time, certifications. -

Source Potential Suppliers

Alibaba, global sourcing platforms, trade directories, trade shows, local agents. -

Initial Screening

company registration, factory photos, product catalogue, compliance certificates. -

Request Samples & Technical Documentation

-

Quality & Compliance Checks

test reports, ISO, material certificates. -

Factory Audit / Video Inspection

on-site audit or virtual inspection. -

Price Negotiation & Lead Time Confirmation

-

Agreement on packing, Incoterms, payment terms & penalties for defects.

-

Small trial order → scale on satisfactory performance.

-

Supplier Performance Management

KPIs: on-time delivery, defect rate, responsiveness.

4.2 Supplier Due Diligence Checklist

- Business license & registered address.

- Production capacity and lead time evidence.

- Quality certifications (ISO, CE, etc.)

- References & export history.

- Sample testing and material traceability

- Social compliance if required (ethical sourcing).

4.3 Supplier Sourcing → Approval Flowchart

The following flowchart represents the structured journey from supplier sourcing to final approval.

Figure: Supplier sourcing to approval workflow

Case Study: How an Engineering Company Used AI-Driven Supplier Verification & Automated Factory Scoring to Select a Reliable Overseas Supplier

1. Company Background

A mid-sized Indian engineering products exporter (manufacturing precision-machined components) wanted to source special-grade alloy castings from overseas suppliers to reduce cost while maintaining strict quality standards. The challenge: Finding a trustworthy global supplier who could deliver consistent quality, meet compliance standards, and handle long-term orders.

2. Problem Statement

The company faced three major issues:

- Unverified suppliers online — risk of fraud and fake credentials.

- Lack of transparency — unclear certifications, outdated compliance records.

- High-quality requirements — castings must pass tensile, hardness, and material composition tests.

To eliminate risks, they implemented an AI-based Supplier Verification & Factory Scoring System.

3. Objective

- To verify overseas suppliers using AI-powered background checks.

- To automate factory capability scoring.

- To mandate quality acceptance tests before finalizing bulk orders.

- To reduce sourcing risk and secure long-term supply reliability.

4. AI-Driven Supplier Verification System Implemented

The company used a custom AI tool to cross-check all supplier information in real time. AI Verification Included:

a. Legal & Company Registration Cross-Check

AI automatically checked:

- Government Trade licenses

- Company registration numbers

- Tax IDs and export/import certificates

- Blacklisted or suspicious record databases

Output: Supplier legitimacy score (0–100)

b. Financial & Compliance Audit

AI extracted data from:

- Credit rating agencies

- Global compliance databases

- Trade finance histories

- Export performance records

Output: Financial stability score (A / B / C)

c. Operational & Production Capability Analysis

AI reviewed:

- Factory equipment list

- Production capacity

- Machine age & technology level

- Process automation capability

- Labour skill mapping

- Safety certifications

Output: Factory capability score (1–5 stars)

d. Online Reputation & Behaviour Analysis

- Supplier website activity

- Social presence

- Customer feedback

- Marketplace seller history

- Review authenticity using NLP detection

Output: Trustworthiness score

5. Shortlisting Suppliers

AI evaluated 18 initial suppliers → shortlisted 4 reliable suppliers based on:

- Legitimacy

- Certification validation

- Financial stability

- Quality capability

- Reputation indicators

6. Factory Scoring & On-Ground Validation

Before issuing any trial order, the company requested:

- Factory audit videos

- Machinery run-time demos

- Quality system documentation

- ISO certificates

- Material test reports

7. Mandatory Quality Acceptance Test (Before Bulk Order)

The Indian engineering company implemented a strict Quality Acceptance Protocol for sample validation.

- Material Chemical Composition Test: Using spectrometer analysis → Must match alloy standards (±2% tolerance)

- Hardness Test: Required: 28–35 HRC → Passed: 31 HRC

- Tensile Strength: Required: 520–560 MPa → Achieved: 545 MPa

- Dimensional Accuracy: Tolerance: ±0.02 mm → All samples passed

- Surface Roughness: Required Ra: 0.8–1.2 → Achieved Ra: 1.0

8. Decision & Trial Order

After successful testing:

- Supplier approved for trial order of USD 8,000

- Contract signed with clear QC requirements

-

Payment terms:

- 30% advance

- 70% after Quality Acceptance Certificate

9. Results Achieved

-

Zero quality complaints

The first shipment met all specifications.

-

17% cost reduction

Compared to the previous Indian tier-2 supplier.

-

40% faster supplier onboarding

AI reduced manual verification time from 18 days → 4 days.

-

Long-Term Supply Contract

1-year supply contract worth USD 120,000

How to Identify the Right Supplier Overseas — FAQ

Q1. How do you find reliable suppliers for import? ▶

Manufacturer directories, verified B2B platforms, trade councils, and sourcing partners such as Navanta Exim.

Q2. How do I verify a supplier’s authenticity? ▶

Factory audits, certification checks, video inspections, and third-party inspection reports.

Q3. What are red flags when selecting a supplier? ▶

- No physical address

- Extremely low pricing

- Refusal to provide certifications

- Negative reviews or inconsistencies

Q4. Why is sample testing important? ▶

Samples validate product quality and compliance before placing bulk orders.

Q5. What is a supplier qualification process? ▶

A structured evaluation of supplier capability, reliability, pricing, and compliance.

What is a Supply Chain? — Meaning, Components, and EXIM Perspective

A supply chain is the end-to-end network of suppliers, manufacturers, warehouses, transporters, and customers that create and move a product from raw materials to the final buyer.

5.1 Core components

- Sourcing & Procurement: buying raw materials and components.

- Manufacturing / Production: conversion, assembly, quality control.

- Packaging & Palletization: preparing goods for transport (VCI, crates, pallets).

- Warehousing & Inventory Management: storage, picking, FIFO/LIFO.

- Transportation & Freight: sea, air, road, rail logistics.

- Distributors & After-Sales: delivering to buyer, returns, spare parts.

- Finance & Payments: LC, TT, factoring, trade finance.

- Information Flow & IT Systems: ERP, TMS, WMS, EDI, and AI analytics.

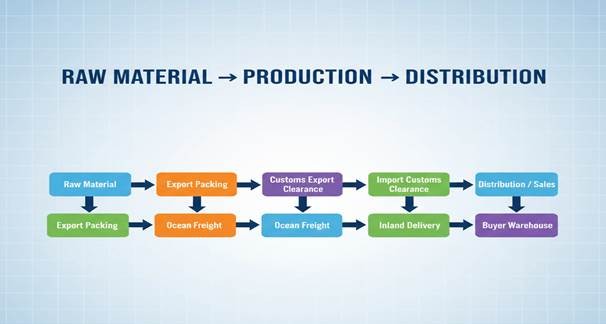

5.2 Export–Import Supply Chain Flow

In international trade, the supply chain spans multiple countries and involves additional stakeholders such as freight forwarders, customs brokers, inspection agencies, and banks.

Figure: Typical export–import supply chain flow

5.3 KPIs to monitor

- On-time delivery rate

- Order lead time

- Inventory turnover

- Freight cost per unit

- Fill rate

- Defect rate / ppm

- Days Sales Outstanding (DSO)

Case Study: Export–Import Supply Chain Optimization for Engineering Goods

1. Company Background

An Indian CNC-engineering components manufacturer faced delays, documentation errors, and poor shipment visibility, leading to slow exports and high logistics costs.

2. Key Problems

- Incorrect HS codes & documentation errors

- Slow production planning

- Last-minute container booking

- Zero visibility after shipment

- Packaging inconsistencies causing minor damages

3. Solution Implemented

The company adopted a structured, AI-enabled supply chain covering procurement → production → packaging → logistics → customs → delivery.

4. Optimized Supply Chain Workflow

-

AI-Based Material & Production Planning

Forecasted materials, supplier lead times & machine loads

Reduced production delays significantly -

Smart Export Documentation

Auto-generated invoices, packing lists, COO, HS codes

99% documentation accuracy -

Optimized Packaging & Container Selection

VCI packaging, ISPM-15 wooden crates, proper palletization

Zero transit damage -

Digital Freight Booking

Compared freight rates & schedules

Saved 15% on logistics -

Predictive Customs Clearance

AI pre-checks documentation

Clearance time reduced from 3 days → 1 day -

Real-time Shipment Tracking

Live vessel updates

Transparent ETA forecasting

5. Results Achieved

- Export lead time: 27 days → 14 days

- Freight cost reduction: 12–15%

- Accuracy: 99% correct documentation

- Buyer satisfaction: 40% repeat order increase

- Full supply chain visibility: Factory → Port → Vessel → Buyer

What is a Supply Chain? — FAQ

Q1. What is the difference between logistics and supply chain? ▶

Logistics focuses on transportation and storage, while supply chain covers the entire flow from sourcing to final delivery.

Q2. Why is supply chain management important in exports? ▶

It reduces cost, ensures compliance, improves delivery reliability, and increases customer trust.

Q3. What risks affect international supply chains? ▶

- Port congestion

- Customs delays

- Supplier failures

- Currency fluctuations

- Geopolitical disruptions

Q4. How can technology improve supply chains? ▶

Through tracking systems, automation, AI forecasting, and digital documentation.

Q5. Who manages the supply chain in EXIM? ▶

Exporters, importers, freight forwarders, customs brokers, and logistics partners collectively manage the supply chain.

What is a Logistics Channel? — and how it works in EXIM

A logistics channel is the physical and contractual route goods follow from seller to buyer: carriers, intermediaries (freight forwarder, NVOCC), modes (sea/air/road/rail), and the nodes (ports, warehouses).

6.1 Components of a logistics channel

- Origin Pickup — factory/warehouse to origin transport.

- Port / Terminal Handling — stuffing, customs, terminal operations.

- Main Carriage — ocean vessel, airfreight, rail, or multimodal.

- Transshipment & Hubs — intermediate transfer points.

- Destination Port / Terminal — unloading, container handling.

- Import Customs Clearance — duties, inspections, paperwork.

- Inland Delivery / Last Mile — trucking to buyer or warehouse.

- Reverse Logistics — returns, repairs, recycling.

6.2 How it works in EXIM — stepwise example (sea freight, container export)

- Order confirmation → seller books container with freight forwarder.

- Pickup & consolidation → goods palletized, loaded into container at seller’s warehouse.

- Export customs → export declarations, export license (if needed).

- Port arrival & stuffing → container arrives at port and is stuffed or moved to terminal.

- Loading & carriage → container loaded on vessel → ocean voyage to destination port.

- Arrival & discharge → container discharged at destination port.

- Import customs clearance → importer or their CHA submits docs, pays duties.

- Inland transport → container picked up and delivered to buyer’s facility.

- Unloading & returns → empty container returned to container depot.

6.3 Logistics channel roles (who does what)

- Manufacturer / Seller: Produces and packs goods, usually arranges export docs (depending on Incoterm).

- Freight Forwarder / NVOCC: Books space, issues house B/L, consolidates cargo.

- Shipping Line / Airline: Provides carriage and ocean/air waybill.

- Customs House Agent (CHA): Handles customs paperwork and clearance.

- Terminal Operator: Stuffing/unstuffing and container handling.

- Trucking / Rail Operator: Last-mile delivery.

- Insurance Provider: Covers cargo risk (as per contract).

6.4 Common logistics channel types

- Direct export logistics — factory → port → destination.

- Consolidated (groupage) shipments — multiple sellers share container (LCL).

- Multimodal / Intermodal — combined sea, rail, truck with single contract.

- Door-to-Door — freight forwarder arranges all legs.

- Port-to-Port — only maritime leg; buyer/seller manage inland movement.

6.5 Practical logistics tips

- Choose FCL for high volume/high value; LCL for small shipments.

- For urgent small parts use air freight despite higher cost.

- Use DDP only if you can legally & financially manage import compliance.

- Map the entire logistics channel early to estimate landed cost (product + freight + duties + local transport).

6.6 Case Study: Streamlining EXIM Logistics for an Engineering Goods Exporter

1. Company Overview

A mid-scale engineering goods manufacturer in India exports precision components to Europe and the Middle East. Although demand was strong, the company struggled with export logistics delays, unclear documentation flow, and inconsistent coordination between freight forwarders, transporters, and customs brokers.

2. Challenges Faced

- Delayed container bookings during peak season

- Incorrect or incomplete export documents (Invoice, Packing List, COO)

- Inefficiencies in cargo packaging & palletization

- Lack of coordination between CHA, freight forwarder & transporter

- Frequent rollovers due to missed cut-off dates

- No proper shipment tracking until the vessel sailed

These issues increased logistics cost and extended total export lead time.

3. Project Objective

To create a smooth, timely, and compliant EXIM logistics workflow covering:

- Cargo readiness

- Packaging

- Container booking

- Customs clearance

- Export documentation

- Shipment dispatch

- Delivery to buyer’s port

4. Logistics Process Implemented (Step-by-Step)

-

Step 1: Cargo & Packaging Preparation

- Engineering components packed in ISPM-15 wooden crates

- VCI wraps used to prevent corrosion

- Proper labeling: HS Code, Gross/Net Weight, Handling Symbols

- Palletized for faster loading

-

Step 2: Freight Planning & Container Booking

- Booking secured 10–12 days before cargo readiness

- Compared vessel schedules to select shortest transit time

- Coordinated with forwarder for SI submission

-

Step 3: Documentation Coordination

- Commercial Invoice

- Packing List

- COO (if required)

- Insurance Certificate

- Material Test Certificates

- Export Declaration paperwork

-

Step 4: Customs Clearance

- Document submission

- HS code verification

- Cargo examination

- Customs Out-of-Charge issued within 24–36 hours

-

Step 5: Loading & Port Handling

- Cargo moved from factory → CFS

-

Stuffing supervised to ensure:

- Proper weight distribution

- Cargo lashing & securing

- Moisture protection

- Container sealed with high-security bolt seal

-

Step 6: Vessel Loading & Export

- Container gated-in before cut-off

- BL draft verified

- Final Bill of Lading issued

-

Step 7: Overseas Delivery

- ETA & BL copy shared with buyer

- Buyer handled import customs & inland logistics

- Shipment delivered damage-free

5. Final Outcome

- Reduced export dispatch delays by 35%

- Zero documentation errors during customs clearance

- No cargo damage through improved packaging

- On-time container loading with zero rollovers

- Stronger coordination between transporter, forwarder, and CHA

- Enhanced buyer confidence through transparent communication

What is a Logistics Channel? — FAQ

Q1. What is a logistics channel in international trade? ▶

A logistics channel refers to the complete route through which goods move from seller to buyer using transport, warehouses, customs, and carriers.

Q2. How does a logistics channel work in the EXIM industry? ▶

Steps include:

- Pick-up from factory

- Export packaging

- Inland transportation

- Customs clearance

- Freight booking

- International shipping

- Import customs

- Final delivery

Q3. What types of logistics channels exist? ▶

- Air cargo channels

- Sea freight channels

- Road logistics channels

- Multimodal logistics channels

Q4. Why is logistics visibility important? ▶

Real-time visibility helps track shipment status, reduce delays, and improve trust between suppliers and buyers.

Q5. What are common logistics mistakes exporters make? ▶

- Wrong Incoterm selection

- Incomplete documents

- Using non-compliant packaging

- Not booking freight early

- Not monitoring transit times