Import Process Step By Step

How to Register as an Importer (Complete Guide)

Importer registration is the legal foundation for starting an import business. Below is a complete explanation of importer registration in India, its importance, and the step-by-step process to obtain it.

What is Importer Registration?

Importer Registration is the legal process by which an individual or business obtains official permission from the government to import goods from foreign countries.

In India, this registration is mainly done by obtaining an Importer Exporter Code (IEC), which is issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce & Industry.

The IEC is a unique 10-digit identification number that is mandatory for carrying out any import or export activity in India. Without an IEC, no importer can clear goods through customs, make foreign payments, or legally trade internationally.

Why is Importer Registration Important?

Importer registration is a legal and operational requirement for international trade. It plays a crucial role in ensuring compliance, smooth customs clearance, and financial transactions.

Key Reasons Why Importer Registration is Mandatory

-

Mandatory for Customs Clearance

Customs authorities require a valid IEC number to process import documents and release imported goods. Without IEC, shipments cannot be cleared. -

Enables Legal International Trade

Importer registration allows businesses to legally import goods and comply with Indian foreign trade regulations. -

Required for Foreign Remittances

Banks require an IEC to process international payments, including advance payments, LC transactions, and supplier remittances. -

Builds Trust & Credibility

Overseas suppliers, freight forwarders, customs agents, and banks consider IEC registration as proof of a genuine and compliant business. -

Access to Government Benefits

Registered importers can avail DGFT benefits, exemptions, and compliance support, where applicable.

Where is Importer Registration Done?

Importer registration in India is conducted completely online, making the process simple and transparent.

- Registration Platform: DGFT Online Portal

- PAN: Mandatory

- GST Registration: If applicable

- Bank Account: Required for foreign transactions

- Aadhaar: Required for individual verification

The IEC is centrally issued and valid across all Indian ports, airports, and customs locations.

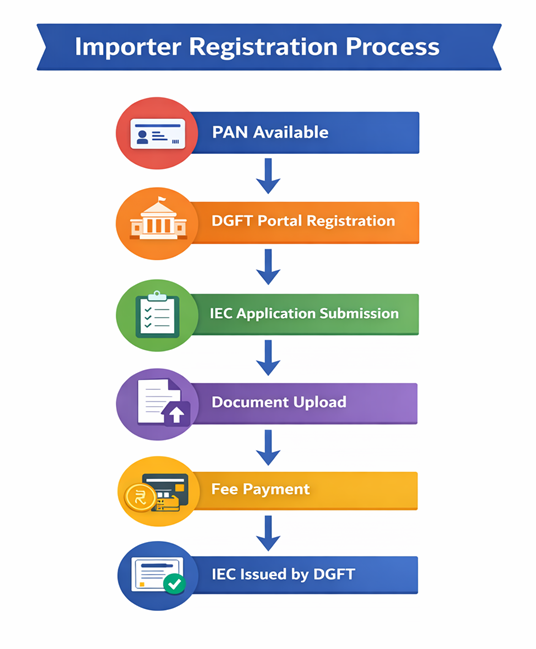

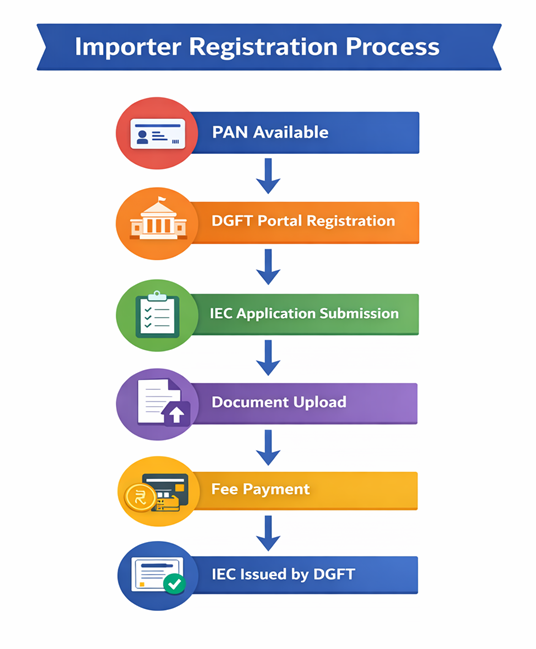

How to Register as an Importer – Step-by-Step Process

-

Obtain PAN

A valid PAN card is mandatory for IEC registration. PAN acts as the primary identity for the IEC. -

Create an Account on DGFT Portal

Register using email ID and mobile number and verify via OTP. -

Apply for IEC Online

Login to DGFT portal and fill in business and contact details. -

Upload Required Documents

PAN, address proof, cancelled cheque or bank certificate, and photograph (if individual). -

Pay Government Fees

Pay the IEC application fee online via net banking, UPI, or card. -

Receive IEC Certificate

IEC is issued electronically and sent via email. No physical certificate is required.

Important Points to Remember

- IEC registration is mandatory before importing goods

- IEC does not require annual renewal

- Any change in business details must be updated on the DGFT portal

- One PAN can have only one IEC

Conclusion

Registering as an importer is the first and most important step in starting an import business. The IEC ensures legal compliance, smooth customs clearance, secure international payments, and long-term business credibility. With proper registration, businesses can confidently enter and scale in the global trade ecosystem.

FAQ – How to Register as an Importer in India

1. What is Importer Registration in India? ▶

Importer registration is the legal process of getting permission to import goods into India by obtaining an Importer Exporter Code (IEC) from the DGFT. It is mandatory for customs clearance and international trade.

2. Is IEC Registration Mandatory for Importing Goods? ▶

Yes, IEC registration is mandatory for all commercial imports in India. Without an IEC, customs authorities will not clear goods and banks will not process foreign payments.

3. Where Can I Apply for Importer Registration? ▶

Importer registration can be completed online through the DGFT portal. The entire process is digital and valid across all Indian ports and customs locations.

4. What Documents Are Required for IEC Registration? ▶

The basic documents required for IEC registration include:

- PAN Card

- Address proof

- Bank details or cancelled cheque

All documents must match the applicant’s business details.

5. How Long Does It Take to Get an IEC Code? ▶

IEC registration usually takes 1 to 3 working days, provided all documents are correct. In many cases, the IEC is issued within 24 hours.

6. Is IEC Registration Valid for a Lifetime? ▶

Yes, the IEC is valid for a lifetime. However, importers must update or confirm their details on the DGFT portal whenever there is a change.

7. Can an Individual Apply for Importer Registration? ▶

Yes, individuals can apply for IEC registration using their personal PAN and bank account. Registering a company is not mandatory to start an import business.

8. Is IEC Enough to Start an Import Business? ▶

IEC is the first step, but importers may also need:

- Product-specific licenses

- Customs compliance

- Quality and safety approvals

9. Can Foreign Companies Apply for IEC in India? ▶

Foreign companies can apply for IEC only if they have a registered branch or office in India along with a valid Indian PAN.

10. Is IEC Required for Import Through Courier or E-commerce? ▶

Yes, IEC is required for commercial imports via:

- Courier

- E-commerce platforms

- Express cargo services

11. Do I Need to Renew IEC Every Year? ▶

No annual renewal is required. However, DGFT may require periodic confirmation or updating of IEC details to keep it active.

12. What Happens If I Import Without IEC? ▶

Importing without IEC can lead to:

- Shipment seizure

- Heavy penalties

- Delay or rejection of customs clearance

IEC is essential for legal and compliant importing.

Identifying & Verifying International Suppliers

A Complete Guide for Importers & Global Buyers

What is Supplier Identification & Verification?

Supplier Identification & Verification is the process of finding reliable international manufacturers or exporters and confirming that they are legitimate, capable, compliant, and trustworthy to do business with.

This process ensures that the overseas supplier:

- Is a legally registered business

- Has real manufacturing or export capability

- Can meet quality, quantity, and delivery commitments

- Complies with international trade and product regulations

Supplier verification is a critical step in global sourcing and must be completed before placing any purchase order or making advance payment.

Why is Supplier Verification Critical?

Supplier verification helps importers reduce risk, protect investment, and ensure smooth trade operations.

-

Reduces Fraud and Financial Risk

Verifying suppliers helps avoid fake companies, scam exporters, and advance payment fraud. Many import losses occur due to dealing with unverified overseas suppliers. -

Ensures Product Quality and Compliance

Verification confirms whether the supplier has proper manufacturing facilities, follows quality standards, and can meet product specifications and certifications. -

Prevents Shipment Delays and Disputes

A verified supplier is more likely to deliver goods on time, follow agreed terms, and provide accurate documents, reducing logistics delays and customs issues. -

Builds Long-Term Business Relationships

Working with verified international suppliers creates trust, consistency, and scalability in global trade operations.

Where to Find International Suppliers?

There are multiple reliable channels to identify overseas suppliers. Each source has its own advantages.

-

B2B Online Platforms – Navanta (New Opportunity

Unlocked)

A B2B online sourcing platform is a digital marketplace where importers can identify, evaluate, and connect with verified international manufacturers and exporters through a structured and transparent system.

Navanta is a dedicated B2B trade portal designed to simplify global sourcing, supplier verification, and international trade collaboration on a single integrated platform.

Note: Always perform independent verification even if the supplier is listed on a B2B portal. -

Trade Fairs & Exhibitions

Trade fairs allow buyers to meet suppliers face-to-face, inspect product samples, and discuss pricing and capacity directly. They are ideal for long-term sourcing. -

Trade Missions & Embassies

Government trade offices and embassies provide verified exporter lists, market insights, and trusted supplier references, making this a low-risk sourcing channel. -

Industry Referrals & Networks

Referrals from existing importers, industry associations, and logistics partners are often more reliable than random online searches.

How to Verify International Suppliers?

Supplier verification should be done in multiple stages rather than relying on a single check.

-

Verify Company Registration Documents

Ask for company registration certificates, business licenses, and export registration details. Cross-check with official databases where possible. -

Check Business License & Export History

Review years in operation, export markets served, and major clients (if disclosed). -

Third-Party Audits & Factory Inspections

Independent agencies can verify factory existence, production capacity, quality control systems, and labor compliance. -

Sample Evaluation

Request samples to check material quality, finish, packaging, and specifications before placing bulk orders. -

Video Calls & Site Visits

Conduct video walkthroughs of factories and management discussions. Physical visits are ideal, but video verification is effective. -

Payment & Contract Validation

Use secure payment terms, written contracts, and clear Incoterms. Avoid full advance payments to unverified suppliers.

Supplier Identification & Verification Flowchart

Best Practices for Importers

- Never rely on only one verification method

- Avoid rushing supplier selection

- Document all communication

- Start with small trial orders

- Maintain supplier performance records

Conclusion

Identifying and verifying international suppliers is a foundation step in successful importing. A well-verified supplier ensures quality, reliability, compliance, and long-term business growth.

Investing time and effort in supplier verification helps importers avoid losses, reduce disputes, and build sustainable global sourcing operations.

FAQ – Supplier Identification & Verification

1. What is Supplier Identification & Verification? ▶

Supplier Identification & Verification is the process of finding reliable international manufacturers or exporters and confirming their legal status, production capability, quality standards, and compliance before starting any import transaction.

2. Why is Supplier Verification Important in International Trade? ▶

Supplier verification is important to reduce fraud, avoid financial loss, and ensure product quality. It helps importers work only with genuine and trustworthy overseas suppliers, preventing shipment delays and disputes.

3. How Can Importers Find Reliable International Suppliers? ▶

Importers can find reliable suppliers through verified B2B platforms like Navanta, trade fairs, government trade missions, and trusted industry referrals. Using a structured sourcing platform improves supplier transparency and trust.

4. How Does Navanta Help in Supplier Identification and Verification? ▶

Navanta (New Opportunity Unlocked) provides access to verified supplier profiles, structured business information, and transparent communication tools. This helps importers shortlist and evaluate international suppliers efficiently and securely.

5. What Documents Are Checked During Supplier Verification? ▶

Supplier verification typically includes checking:

- Company registration certificates

- Business or export licenses

- Manufacturing or export history

- Product and quality certifications

These checks confirm the supplier’s legitimacy and operational capability.

6. Is Sample Testing Necessary Before Finalizing a Supplier? ▶

Yes, sample testing is strongly recommended. Evaluating samples helps importers verify product quality, specifications, and packaging before placing bulk orders, reducing the risk of quality issues.

7. Can Supplier Verification Reduce Import Disputes? ▶

Yes, proper supplier verification significantly reduces quality disputes, delivery delays, and contractual conflicts. Working with verified suppliers leads to smooth trade operations and long-term business relationships.

Negotiation Techniques in Import Trade

A Practical Guide for Importers & Global Buyers

What is Import Negotiation?

Import negotiation is the structured and strategic discussion between an importer (buyer) and an international supplier (seller) to finalize key commercial terms of a trade transaction.

These discussions typically cover:

- Product price

- Quality standards and specifications

- Delivery schedules

- Payment terms

- Incoterms (EXW, FOB, CIF, etc.)

- Risk sharing and responsibilities

Effective import negotiation ensures that both parties clearly understand their obligations and agree on fair, transparent, and commercially viable terms.

Why is Negotiation Important in Import Trade?

Negotiation plays a vital role in cost control, risk management, and long-term business success.

-

Controls Import Costs

Negotiation helps importers secure:- Competitive pricing

- Better freight and Incoterm terms

- Reduced hidden costs

-

Improves Profit Margins

By negotiating price, payment terms, and logistics responsibilities, importers can optimize landed cost and increase profit margins. -

Minimizes Commercial Risks

Clear negotiation reduces risks related to:- Quality disputes

- Delivery delays

- Payment conflicts

- Contract misunderstandings

-

Builds Strong Supplier Relationships

Professional negotiation builds trust, transparency, and long-term partnerships rather than one-time transactions.

Where Does Import Negotiation Take Place?

Import negotiations can happen across multiple communication channels:

- Email – For written clarity and documentation

- Video Conferencing – For face-to-face discussions across countries

- Trade Fairs & Exhibitions – For direct negotiation with multiple suppliers

- Business Meetings – In-person meetings or factory visits

Using written communication is always recommended to avoid misunderstandings.

How to Negotiate Effectively in Import Trade?

Effective negotiation requires preparation, clarity, and documentation.

-

Research Market Prices

Study global price trends, compare multiple suppliers, and understand raw material and logistics costs. This gives the importer strong bargaining power. -

Negotiate Incoterms and Payment Terms

Decide who bears freight, insurance, and risk, choose suitable payment methods (Advance, LC, DA, etc.), and balance cost savings with risk control. -

Request Volume Discounts

Negotiate better pricing for bulk or repeat orders and discuss long-term supply agreements. -

Define Quality Standards Clearly

Share detailed specifications, define tolerances and inspection standards, and agree on rejection or rework terms. -

Document Everything in Writing

Confirm negotiated terms via email, include all points in Purchase Order and contract, and avoid verbal-only agreements.

Widely Used Negotiation Techniques in Import Trade

Below are commonly used negotiation techniques from both buyer (importer) and seller (supplier) perspectives.

- Price-Based Negotiation (Buyer-Focused)

Focuses on achieving the lowest possible price, buyer compares multiple suppliers, often used for standard or commodity products.

Best For: High-volume imports, price-sensitive markets - Value-Based Negotiation (Win-Win)

Focuses on total value, not just price, includes quality, reliability, delivery, and service.

Best For: Long-term sourcing and strategic partnerships - Competitive Negotiation

Buyer negotiates with multiple suppliers simultaneously.

Best For: New sourcing and supplier shortlisting - Collaborative Negotiation

Buyer and seller work together to reduce costs.

Best For: Repeat orders and stable suppliers - Risk-Sharing Negotiation

Responsibilities and risks are shared fairly.

Best For: High-value or long-distance shipments - Time-Based Negotiation

Focuses on delivery timelines.

Best For: Urgent or seasonal imports

Common Mistakes to Avoid in Import Negotiation

- Focusing only on price

- Ignoring quality and compliance

- Not documenting agreed terms

- Paying full advance without verification

- Rushing negotiation without market research

Import Negotiation Process

Best Practices for Successful Import Negotiation

- Always prepare before negotiating

- Be clear and professional in communication

- Aim for win-win outcomes

- Start with trial orders

- Build long-term supplier relationships

Conclusion

Negotiation in import trade is not just about price reduction—it is about balancing cost, quality, risk, and reliability. A well-negotiated import deal protects the importer’s interests, ensures smooth operations, and builds sustainable global trade relationships.

FAQ – Negotiation Techniques in Import Trade

1. What is import negotiation in international trade? ▶

Import negotiation is the process where an importer and an overseas supplier discuss and finalize price, quality standards, delivery terms, payment methods, Incoterms, and risk sharing to complete an international trade deal.

2. Why are negotiation techniques important in import trade? ▶

Negotiation techniques help importers control import costs, improve profit margins, and reduce commercial risks such as quality disputes, delivery delays, and payment issues.

3. What are the most common negotiation points in import trade? ▶

The most common negotiation points include:

- Product price

- Incoterms (FOB, CIF, EXW, etc.)

- Payment terms

- Delivery timeline

- Quality and inspection standards

4. Where does import negotiation usually take place? ▶

Import negotiations usually take place through email, video conferencing, trade fairs, and business meetings. Written communication is always recommended for record and clarity.

5. What negotiation techniques are commonly used by importers? ▶

Importers commonly use techniques such as:

- Price-based negotiation

- Competitive negotiation with multiple suppliers

- Value-based (win-win) negotiation

- Risk-sharing negotiation through Incoterms

6. How can importers negotiate better prices with suppliers? ▶

Importers can negotiate better prices by:

- Researching global market prices

- Comparing multiple suppliers

- Ordering in higher volumes

- Building long-term relationships

7. How can negotiation reduce risks in import trade? ▶

Clear negotiation defines quality standards, delivery responsibility, and payment terms in advance. This minimizes misunderstandings, prevents disputes, and ensures smooth international trade operations.

Purchase Order Process in Import Trade

Purchase Order (PO) Process in Import Trade

1. What is a Purchase Order (PO)?

A Purchase Order (PO) is a formal, legally binding commercial document issued by an importer (buyer) to an exporter or overseas supplier (seller).

It clearly defines what is being purchased, at what price, under which delivery terms, and under what legal and quality conditions.

Once the supplier accepts the PO, it becomes a contractual obligation for both parties.

Key Characteristics of a Purchase Order

- Written confirmation of trade terms

- Legal reference document

- Basis for production, shipment, banking, and customs

- Protects both buyer and seller

2. Why is the Purchase Order Process Important?

The PO process ensures control, clarity, compliance, and risk reduction in international trade.

Business Importance

- Prevents disputes on price, quantity, and quality

- Enables structured supplier execution

- Improves cost and delivery planning

Legal & Compliance Importance

- Acts as legal evidence in disputes

- Required for audits and regulatory checks

- Supports customs valuation and inspections

Financial Importance

- Mandatory for LC issuance and bank approvals

- Supports payment reconciliation

3. Where is the Purchase Order Used?

A Purchase Order is used throughout the entire import lifecycle:

- Between Importer and Supplier

- With Banks (LC, remittance, compliance)

- During Customs Clearance

- For Quality Inspection Agencies

- In Accounting, ERP, and Audits

4. How Does the Purchase Order Process Work?

-

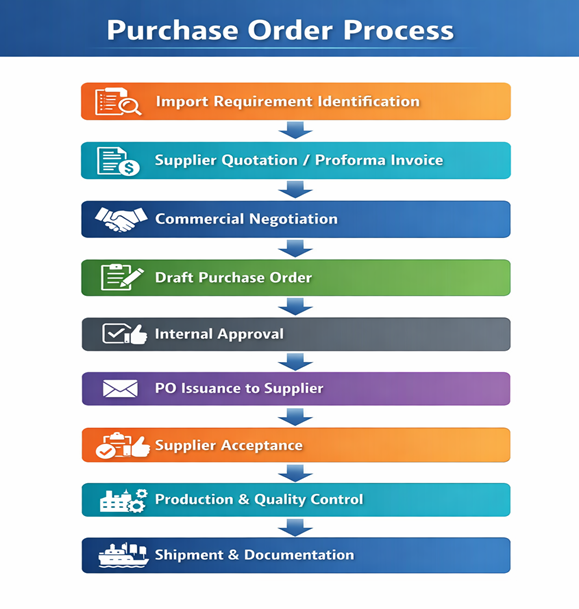

Step 1: Import Requirement Identification

The importer defines product description and specifications, quantity required, target price range, delivery timeline, and regulatory requirements. This stage ensures commercial and legal readiness. -

Step 2: Supplier Quotation & Evaluation

The importer receives supplier quotation or Proforma Invoice, pricing details, Incoterms, payment terms, and production timeline. Suppliers are evaluated on price competitiveness, quality capability, and export experience. -

Step 3: Commercial Negotiation

Negotiation finalizes final unit price, Incoterms (FOB, CIF, EXW, etc.), payment method (TT, LC, DA), quality inspection terms, and penalty and dispute clauses. Only agreed terms move to PO drafting. -

Step 4: Drafting the Purchase Order

The PO must be clear, detailed, and unambiguous.

Mandatory PO Elements:- Buyer & supplier legal details

- PO number & issue date

- Product name, HS code, and specifications

- Quantity and unit price

- Total order value

- Incoterms & delivery location

- Payment terms

- Quality, inspection & compliance clauses

- Packaging & labeling instructions

-

Step 5: Internal Approval Process

Before issuance, the PO is approved by procurement team, finance department, and compliance or management. This ensures financial control and risk management. -

Step 6: PO Issuance to Supplier

The approved PO is sent via email or ERP system and officially logged in records. The supplier reviews and acknowledges the PO. -

Step 7: Supplier Acceptance & Confirmation

Supplier confirms acceptance of all PO terms, production start date, and shipment schedule. A signed or email-confirmed PO becomes contractually active. -

Step 8: Production & Quality Control

Supplier starts production strictly as per PO. Quality controls may include pre-production inspection, during production checks, and pre-shipment inspection. -

Step 9: Shipment & Documentation

Goods are shipped according to PO terms. Supplier issues Commercial Invoice, Packing List, and shipping documents. These documents must match the PO exactly.

5. Key Clauses in an Import Purchase Order

| Clause | Purpose |

|---|---|

| Incoterms | Defines risk & cost responsibility |

| Payment Terms | Controls cash flow |

| Quality Clause | Ensures product standards |

| Inspection Clause | Reduces quality risk |

| Delivery Clause | Prevents delays |

| Dispute Clause | Legal protection |

6. Common Mistakes in the Purchase Order Process

- Incomplete product description

- Missing quality or inspection clauses

- Incorrect Incoterms

- No compliance responsibility defined

- PO not aligned with PI or LC

7. Best Practices for a Strong PO Process

- Always issue written POs

- Align PO with banking & customs requirements

- Use standard PO templates

- Keep language clear and legally precise

- Maintain proper PO records

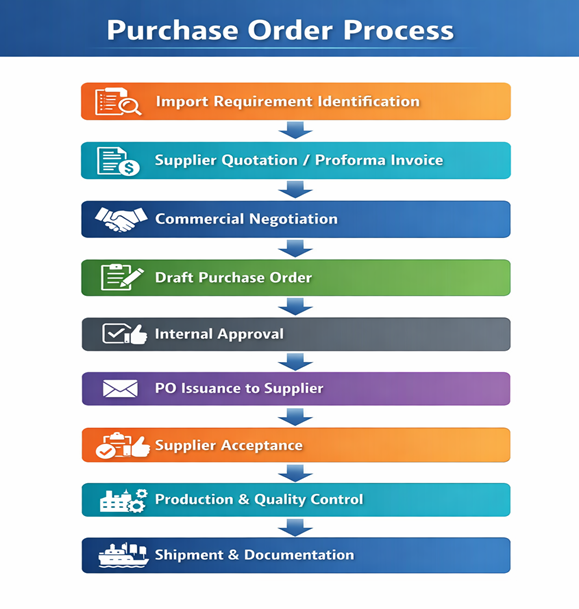

Purchase Order Flowchart

FAQ – Purchase Order Process in Import Trade

1. What is a Purchase Order (PO) in import trade? ▶

A Purchase Order (PO) is a formal and legally binding document issued by an importer to an overseas supplier. It confirms product details, quantity, price, delivery terms, payment terms, and other commercial conditions agreed during negotiation.

2. Why is the Purchase Order process important? ▶

The purchase order process is important because it:

- Provides written confirmation of agreed terms

- Reduces disputes and misunderstandings

- Acts as a legal reference for both buyer and supplier

- Supports smooth production, shipment, and documentation

3. What are the key steps in the Purchase Order process? ▶

The key steps in the purchase order process include:

- Import requirement identification

- Supplier quotation or proforma invoice

- Commercial negotiation

- Drafting and approval of PO

- PO issuance and supplier acceptance

- Production, quality control, and shipment

4. What details should be included in a Purchase Order? ▶

A standard purchase order should include:

- Buyer and supplier details

- Product description and specifications

- Quantity and unit price

- Incoterms and delivery terms

- Payment terms

- Shipment schedule

5. What happens after the PO is issued to the supplier? ▶

After PO issuance:

- The supplier reviews and accepts the PO

- Production starts as per agreed terms

- Quality control checks are conducted

- Shipment and export documentation are prepared

6. Is Purchase Order approval required internally? ▶

Yes, most companies follow an internal approval process before issuing a PO. This ensures compliance with budgets, policies, and risk controls, especially for high-value imports.

7. Can changes be made after issuing a Purchase Order? ▶

Yes, changes can be made through a PO amendment or revised purchase order, but both importer and supplier must agree to the revised terms in writing.

8. How does a Purchase Order help reduce import risks? ▶

A well-defined PO clearly states price, quality, delivery, and responsibility, which helps prevent disputes, shipment delays, and financial losses in international trade.

Import Incoterms (EXW, FCA, FOB, CIF etc.)

Import Incoterms® 2020 – Complete Professional Guide

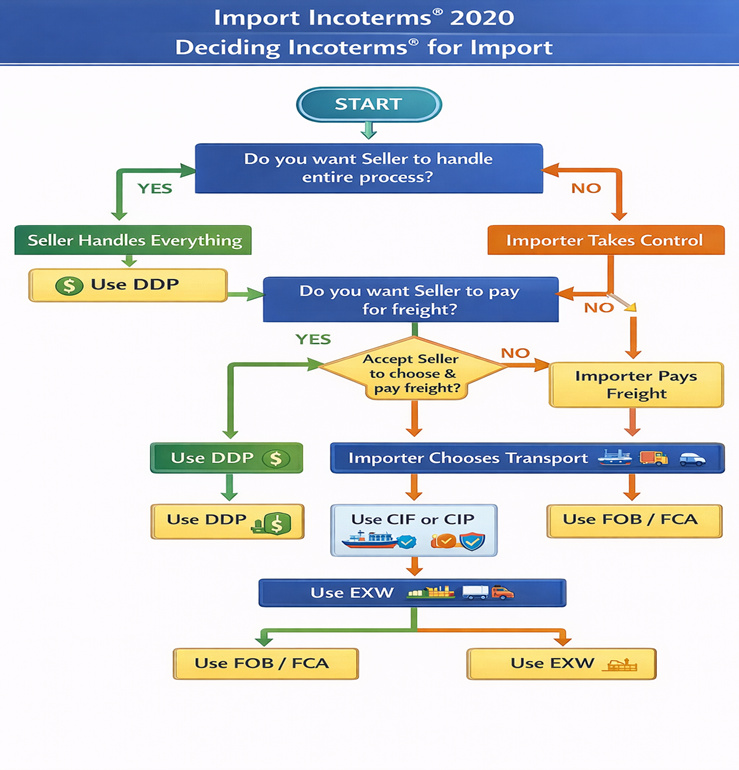

What are Import Incoterms?

Incoterms (International Commercial Terms) are internationally recognized trade rules published by the International Chamber of Commerce (ICC). They clearly define responsibilities, costs, risks, and delivery points between buyers (importers) and sellers (exporters) in international trade.

Why Import Incoterms Are Important?

- Avoid disputes between importer & exporter

- Clearly define cost responsibility

- Define risk transfer point

- Ensure smooth customs clearance

- Essential for international contracts, LC, insurance & logistics

Where Import Incoterms Are Used?

- Import Purchase Orders

- International Sales Contracts

- Letters of Credit (LC)

- Freight & Insurance Documents

- Customs & Compliance Documentation

How Import Incoterms Work?

Each Incoterm specifies:

- Delivery point

- Risk transfer

- Cost responsibility

- Who handles export/import clearance

- Who arranges freight & insurance

GROUP 1: ANY MODE OF TRANSPORT

1️. EXW – Ex Works

WHAT is EXW?

Seller makes goods available at their factory or warehouse. Buyer bears all costs and

risks from there.

WHY use EXW?

- Maximum control for importer

- Lowest seller responsibility

- Suitable for experienced importers

WHERE Risk Transfers?

At seller’s premises (factory/warehouse)

HOW it Works?

Buyer arranges pickup, export clearance, freight, insurance, import clearance.

Responsibility Summary

- Export clearance: ❌ Buyer

- Freight: ❌ Buyer

- Insurance: ❌ Buyer

- Import clearance: ❌ Buyer

Best For

Domestic-like imports, strong buyer logistics control

2. FCA – Free Carrier

WHAT is FCA?

Seller delivers goods to a carrier or named place agreed with buyer.

WHY use FCA?

- Better than EXW

- Seller handles export clearance

- Common for container shipments

WHERE Risk Transfers?

At carrier pickup point

HOW it Works?

Seller loads & clears export; buyer handles main transport.

Responsibility Summary

- Export clearance: ✅ Seller

- Freight: ❌ Buyer

- Insurance: ❌ Buyer

- Import clearance: ❌ Buyer

Best For

Containerized imports, LC transactions

3. CPT – Carriage Paid To

WHAT is CPT?

Seller pays freight to destination, but risk transfers early.

WHY use CPT?

- Buyer gets freight cost clarity

- Seller negotiates transport

WHERE Risk Transfers?

When handed to first carrier

HOW it Works?

Seller pays transport, buyer bears risk during transit.

Responsibility Summary

- Freight: ✅ Seller

- Risk during transit: ❌ Buyer

- Insurance: ❌ Buyer

4. CIP – Carriage & Insurance Paid To

WHAT is CIP?

Same as CPT but seller provides insurance.

WHY use CIP?

- Buyer protected against transit risk

- Mandatory insurance by seller

WHERE Risk Transfers?

At first carrier

HOW it Works?

Seller pays freight + insurance; risk still transfers early.

5. DPU – Delivered at Place Unloaded

WHAT is DPU?

Seller delivers & unloads goods at named place.

WHY use DPU?

- Maximum seller responsibility

- Buyer receives ready goods

WHERE Risk Transfers?

After unloading at destination

HOW it Works?

Seller handles everything till unloading.

6. DAP – Delivered at Place

WHAT is DAP?

Seller delivers goods to destination, not unloaded.

WHY use DAP?

- Door delivery

- Buyer controls unloading & customs

WHERE Risk Transfers?

At destination before unloading

7. DDP – Delivered Duty Paid

WHAT is DDP?

Seller handles everything including import duty & tax.

WHY use DDP?

- Buyer convenience

- Fixed landed cost

WHERE Risk Transfers?

At buyer’s location after delivery

GROUP 2: SEA & INLAND WATERWAY ONLY

8. FAS – Free Alongside Ship

WHAT is FAS?

Seller places goods alongside vessel at port.

WHY use FAS?

Bulk & project cargo

WHERE Risk Transfers?

Alongside ship

9. FOB – Free On Board

WHAT is FOB?

Seller loads goods on vessel.

WHY use FOB?

Most common sea import term

WHERE Risk Transfers?

Once goods are on board

10. CFR – Cost & Freight

WHAT is CFR?

Seller pays sea freight; risk transfers earlier.

WHERE Risk Transfers?

On board vessel

11. CIF – Cost, Insurance & Freight

WHAT is CIF?

Seller pays freight + insurance.

WHY use CIF?

Buyer protected at sea

WHERE Risk Transfers?

On board vessel

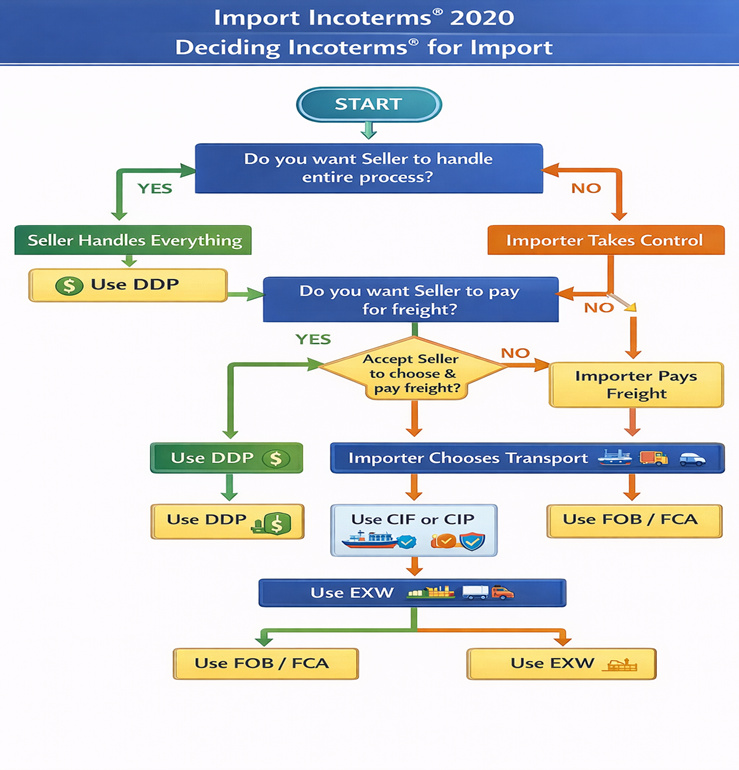

Deciding Incoterms for import process

Freight Cost Calculation

WHAT is Freight Cost in Import?

Freight Cost refers to the total transportation-related expenses incurred to move goods from the seller’s country to the importer’s destination, including international transport, handling, documentation, surcharges, and related logistics charges.

Freight cost is a critical component of landed cost and directly impacts:

- Import product pricing

- Profit margins

- Customs duty calculation

- GST/VAT liability

WHY Freight Cost Calculation is Important for Importers?

Accurate freight cost calculation helps importers to:

- Determine true landed cost

- Avoid unexpected logistics expenses

- Compare Incoterms (FOB vs CIF vs DAP)

- Select the most cost-effective shipping mode

- Negotiate better freight contracts

- Prevent customs valuation disputes

Incorrect freight calculation can lead to:

- Underpricing

- Loss of profit

- Customs penalties

- LC discrepancies

WHERE Freight Cost is Applied in Import Process?

- Import costing sheet

- Purchase order (PO)

- Price negotiation with supplier

- Customs duty valuation

- GST calculation

- Final sales pricing

- Profit & margin analysis

HOW Freight Cost Calculation Works in Import?

Freight cost calculation depends on:

- Mode of transport (Sea / Air / Road / Courier)

- Incoterms used

- Cargo type (LCL / FCL / Bulk)

- Weight & volume

- Route & destination

- Fuel & seasonal surcharges

COMPONENTS OF IMPORT FREIGHT COST (DETAILED)

1. Basic Freight Charges

WHAT are Basic Freight Charges?

Charges levied by shipping lines, airlines, or transporters for moving cargo from origin to

destination.

HOW Calculated?

- Sea Freight: Per container or per CBM

- Air Freight: Chargeable weight (higher of actual vs volumetric)

2. Origin Charges (Export Country)

Includes:

- Origin terminal handling charges (THC)

- Documentation fees

- Export handling

- Stuffing charges

- Export customs coordination

WHO Pays?

Depends on Incoterms (FOB / EXW / FCA)

3. Destination Charges (Import Country)

Includes:

- Destination THC

- DO charges

- Port handling

- Container cleaning

- Terminal fees

Critical Importer Insight ⚠

Destination charges are often not included in CIF freight.

4. Fuel & Carrier Surcharges

Types:

- BAF – Bunker Adjustment Factor

- CAF – Currency Adjustment Factor

- PSS – Peak Season Surcharge

- EBS – Emergency Bunker Surcharge

WHY Important?

These fluctuate and significantly impact total freight cost.

5. Inland Transportation Cost

WHAT is Inland Freight?

Cost to move cargo from:

- Factory to port (export)

- Port to warehouse (import)

Modes:

- Truck

- Rail

- Barge

6. Cargo Type Based Charges

LCL (Less than Container Load)

- Charged per CBM

- Consolidation charges apply

FCL (Full Container Load)

- Flat container rate

- Size: 20FT / 40FT / 40HQ

Air Cargo

Chargeable weight formula:

Length × Width × Height (cm) ÷ 6000

7. Insurance Cost (If Applicable)

When Required?

- CIF / CIP Incoterms

- High-value imports

Insurance Cost Formula

Cargo Value × 110% × Insurance Rate

8. Customs & Regulatory Costs (Indirect Freight Impact)

Although not freight, they affect landed cost:

- Customs clearance fees

- CHA charges

- Port scanning charges

- EDI charges

FREIGHT COST CALCULATION – STEP-BY-STEP (IMPORT)

-

STEP 1: Identify Incoterms

Determine whether freight is paid by seller (CIF, CPT) or buyer (FOB, FCA, EXW). -

STEP 2: Select Mode of Transport

Sea freight (economical), Air freight (fast), Courier (small shipments). -

STEP 3: Calculate Weight & Volume

Sea Freight: CBM = Length × Width × Height (meters)

Air Freight: Chargeable weight = Higher of actual or volumetric -

STEP 4: Add All Cost Components

Basic freight, origin charges, surcharges, inland transport, insurance (if applicable). -

STEP 5: Convert Currency

Use exchange rate applicable on freight invoice date and customs filing date (for duty).

FAQ – Import Customs Clearance

1. What is Import Customs Clearance? ▶

Import Customs Clearance is the legal process of declaring imported goods to customs authorities, submitting required documents, paying applicable customs duties and taxes, and obtaining official permission to release cargo into the domestic market.

2. Why is Import Customs Clearance mandatory? ▶

Customs clearance is mandatory to:

- Ensure compliance with import laws and regulations

- Collect customs duties and GST

- Prevent illegal or restricted imports

- Verify product safety, valuation, and classification

Without customs clearance, goods cannot be legally released from ports or airports.

3. Where does Import Customs Clearance take place? ▶

Import customs clearance takes place at:

- Seaports

- Airports

- Inland Container Depots (ICDs)

- Container Freight Stations (CFS)

Clearance is handled through the Indian Customs ICEGATE system or equivalent customs portals globally.

4. Who is responsible for Import Customs Clearance? ▶

The responsibility lies with:

- The Importer of Record (IOR), or

- A licensed Customs Broker / CHA appointed by the importer

Even when using a CHA, legal responsibility remains with the importer.

5. What documents are required for Import Customs Clearance? ▶

Commonly required documents include:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Import General Manifest (IGM)

- Bill of Entry

- Insurance Certificate

- Import Export Code (IEC)

- HS Code details

- Certificates (COO, MSDS, BIS, FSSAI, etc. if applicable)

6. What is an HS Code and why is it important? ▶

The HS Code (Harmonized System Code) is an internationally standardized product classification code used to determine customs duty rates, apply import restrictions or exemptions, and ensure accurate trade statistics. Incorrect HS codes may lead to penalties, delays, or reassessment.

7. What is a Bill of Entry (BOE)? ▶

A Bill of Entry is a legal customs declaration filed by the importer or CHA that provides cargo details, product classification, customs value, and applicable duties and taxes. Cargo clearance is not possible without BOE approval.

8. How are customs duties calculated on imports? ▶

Customs duty calculation is based on assessable value (CIF value), Basic Customs Duty (BCD), Social Welfare Surcharge (SWS), IGST, and Compensation Cess (if applicable). Duties vary based on HS code and trade agreements.

9. What is Customs Examination? ▶

Customs examination is a physical or X-ray inspection of cargo to verify product description, check quantity and value, and detect misdeclaration or prohibited goods. Not all shipments are examined; selection depends on risk assessment.

10. What is “Out of Charge (OOC)” in customs clearance? ▶

Out of Charge (OOC) is the final approval issued by customs authorities allowing cargo release from port or CFS and inland transportation to the importer’s warehouse. OOC confirms all duties and compliance requirements are fulfilled.

11. How long does Import Customs Clearance take? ▶

Clearance timelines depend on:

- Document accuracy

- Customs examination requirements

- Duty payment speed

- Regulatory approvals

Typical timelines:

- Green channel: 1–2 days

- Examination cases: 3–7 days

- Regulatory cargo: 7–15 days+

12. What are common reasons for customs clearance delays? ▶

Common causes include:

- Incorrect HS code

- Incomplete documentation

- Under-valuation disputes

- Regulatory non-compliance

- Delayed duty payment

Proper planning minimizes clearance delays.

13. What penalties apply for incorrect import declarations? ▶

Penalties may include:

- Monetary fines

- Cargo seizure

- Duty reassessment

- Blacklisting for repeat offenses

Compliance and transparency are essential.

14. Can customs duty be reduced legally? ▶

Yes, through Free Trade Agreements (FTAs), exemption notifications, duty drawback schemes, and correct valuation and HS classification. Always ensure eligibility before claiming benefits.

15. Is customs clearance required for courier and personal imports? ▶

Yes. Even courier or personal imports require simplified customs clearance, KYC documents, and applicable duties and taxes. Rules differ based on shipment value and purpose.

16. Why should businesses use a professional customs broker? ▶

A licensed customs broker:

- Ensures legal compliance

- Minimizes delays and penalties

- Handles documentation and assessments

- Saves time and operational cost

Professional handling improves supply chain efficiency.

17. What happens after customs clearance? ▶

After clearance, cargo is released from port or CFS, inland transportation is arranged, goods are delivered to the importer’s warehouse, and final landed cost is calculated.

Duties, Taxes & Tariff Calculation in Import Trade

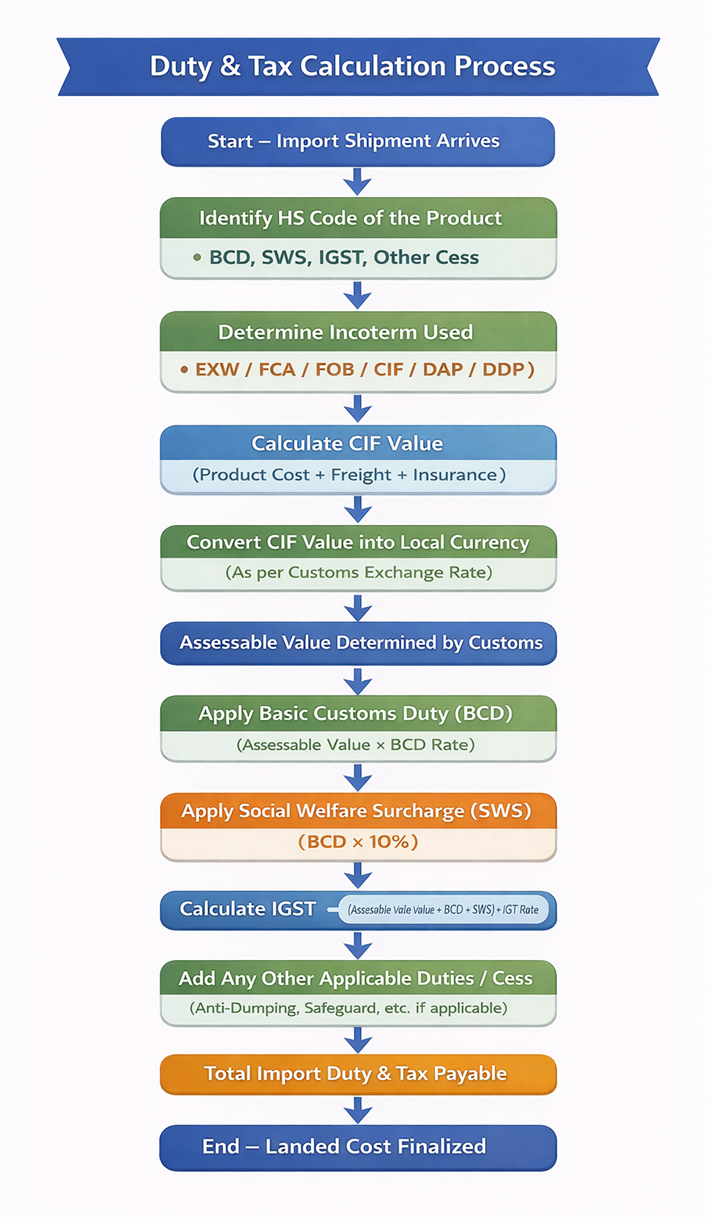

What is Duties, Taxes & Tariff Calculation?

Duties, taxes, and tariff calculation is the process of determining the total government charges payable on imported goods at the time of customs clearance. These charges are calculated based on the customs value, HS code, country of origin, and applicable Incoterms.

Why is Duty & Tax Calculation Important?

- Determines final landed cost

- Impacts product pricing & profitability

- Mandatory for customs clearance

- Prevents penalties, delays, and disputes

- Helps choose the right Incoterm

Where Are Duties & Taxes Applied?

Duties and taxes are applied at:

- Port / Airport of import

- During Bill of Entry filing

- Customs valuation stage

- IGST & duty payment stage

Core Components of Import Duties & Taxes (India)

- Assessable Value (AV)

Customs value on which duties are calculated

Usually based on CIF value - Basic Customs Duty (BCD)

Rate as per HS code - Social Welfare Surcharge (SWS)

10% of BCD - IGST

Based on GST rate of the product

Standard Import Duty Calculation Formula (India)

Assessable Value (AV) = CIF Value × Exchange Rate

BCD = AV × BCD Rate

SWS = BCD × 10%

IGST = (AV + BCD + SWS) × IGST Rate

Total Import Duty = BCD + SWS + IGST

Duties, Taxes & Tariff Calculation – Incoterms Wise

1. EXW – Ex Works

What Happens in EXW?

Importer bears all costs and risks from supplier’s factory.

Why Duty Calculation is Complex?

Because freight, insurance, and export costs must be added manually to reach CIF value.

How is Duty Calculated under EXW?

CIF Value = EXW Product Price + Inland Transport (Origin) + Export Clearance + International Freight + Insurance

Duty Formula (EXW): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Very High

2. FCA – Free Carrier

What Happens in FCA? Seller clears export & hands over goods to carrier.

Why FCA is Better than EXW? Cleaner documentation and easier valuation.

CIF Value = FCA Price + International Freight + Insurance

Duty Formula (FCA): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Moderate

3. FOB – Free On Board

What Happens in FOB? Seller bears cost till goods are loaded on vessel.

Why FOB is Most Preferred? Clear division of responsibility and transparent costing.

CIF Value = FOB Price + Ocean / Air Freight + Insurance

Duty Formula (FOB): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Medium

4. CFR – Cost & Freight

What Happens in CFR? Seller pays freight, but risk transfers at loading port.

Important Note: Insurance is not included.

CIF Value = CFR Price + Insurance

Duty Formula (CFR): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Medium

5. CIF – Cost, Insurance & Freight

What Happens in CIF? Seller pays freight and minimum insurance.

Why CIF is Simple for Beginners? All major cost components already included.

CIF Value = CIF Invoice Value

Duty Formula (CIF): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Medium

6. DAP – Delivered at Place

What Happens in DAP? Seller delivers goods to buyer’s location, excluding duties & taxes.

Who Pays Duties? Importer pays 100% duties and IGST.

Duty Formula (DAP): Assessable Value = CIF × Exchange Rate

Total Duty = BCD + SWS + IGST

Importer Risk: Low

7. DDP – Delivered Duty Paid

What Happens in DDP? Seller pays all duties, taxes, freight, and delivery costs.

Duty Formula (DDP – Seller Side):

DDP Price = Product Cost + Freight + Insurance + BCD + SWS + IGST + Delivery Charges

Importer Risk: Very Low

Summary Table – Incoterms vs Duty Responsibility

| Incoterm | Duty Paid By | CIF Built By |

|---|---|---|

| EXW | Importer | Importer |

| FCA | Importer | Importer |

| FOB | Importer | Importer |

| CFR | Importer | Seller (Freight only) |

| CIF | Importer | Seller |

| DAP | Importer | Seller |

| DDP | Seller | Seller |

Common Mistakes in Duty & Tax Calculation

- Wrong HS Code selection

- Ignoring insurance in CIF value

- Assuming CIF includes destination charges

- Using incorrect exchange rate

- Misunderstanding Incoterm responsibility

Best Practices for Accurate Duty Calculation

- Always confirm HS Code

- Use CIF-based valuation

- Match Incoterm with invoice value

- Cross-check duty via ICEGATE or CHA

- Maintain a detailed costing sheet

Final Formula – Landed Cost (Importer View)

Landed Cost =

Product Cost + Freight + Insurance + BCD + SWS + IGST + Port Charges + Inland Transport

Important Points to Remember

- IEC registration is mandatory before importing goods

- IEC does not require annual renewal

- Any change in business details must be updated on the DGFT portal

- One PAN can have only one IEC

Conclusion

Registering as an importer is the first and most important step in starting an import business. The IEC ensures legal compliance, smooth customs clearance, secure international payments, and long-term business credibility. With proper registration, businesses can confidently enter and scale in the global trade ecosystem.

FAQ – How to Register as an Importer in India

1. What is Importer Registration in India? ▶

Importer registration is the legal process of getting permission to import goods into India by obtaining an Importer Exporter Code (IEC) from the DGFT. It is mandatory for customs clearance and international trade.

2. Is IEC Registration Mandatory for Importing Goods? ▶

Yes, IEC registration is mandatory for all commercial imports in India. Without an IEC, customs authorities will not clear goods and banks will not process foreign payments.

3. Where Can I Apply for Importer Registration? ▶

Importer registration can be completed online through the DGFT portal. The entire process is digital and valid across all Indian ports and customs locations.

4. What Documents Are Required for IEC Registration? ▶

The basic documents required for IEC registration include:

- PAN Card

- Address proof

- Bank details or cancelled cheque

All documents must match the applicant’s business details.

5. How Long Does It Take to Get an IEC Code? ▶

IEC registration usually takes 1 to 3 working days, provided all documents are correct. In many cases, the IEC is issued within 24 hours.

6. Is IEC Registration Valid for a Lifetime? ▶

Yes, the IEC is valid for a lifetime. However, importers must update or confirm their details on the DGFT portal whenever there is a change.

7. Can an Individual Apply for Importer Registration? ▶

Yes, individuals can apply for IEC registration using their personal PAN and bank account. Registering a company is not mandatory to start an import business.

8. Is IEC Enough to Start an Import Business? ▶

IEC is the first step, but importers may also need:

- Product-specific licenses

- Customs compliance

- Quality and safety approvals

9. Can Foreign Companies Apply for IEC in India? ▶

Foreign companies can apply for IEC only if they have a registered branch or office in India along with a valid Indian PAN.

10. Is IEC Required for Import Through Courier or E-commerce? ▶

Yes, IEC is required for commercial imports via:

- Courier

- E-commerce platforms

- Express cargo services

11. Do I Need to Renew IEC Every Year? ▶

No annual renewal is required. However, DGFT may require periodic confirmation or updating of IEC details to keep it active.

12. What Happens If I Import Without IEC? ▶

Importing without IEC can lead to:

- Shipment seizure

- Heavy penalties

- Delay or rejection of customs clearance

IEC is essential for legal and compliant importing.

Identifying & Verifying International Suppliers

A Complete Guide for Importers & Global Buyers

What is Supplier Identification & Verification?

Supplier Identification & Verification is the process of finding reliable international manufacturers or exporters and confirming that they are legitimate, capable, compliant, and trustworthy to do business with.

This process ensures that the overseas supplier:

- Is a legally registered business

- Has real manufacturing or export capability

- Can meet quality, quantity, and delivery commitments

- Complies with international trade and product regulations

Supplier verification is a critical step in global sourcing and must be completed before placing any purchase order or making advance payment.

Why is Supplier Verification Critical?

Supplier verification helps importers reduce risk, protect investment, and ensure smooth trade operations.

-

Reduces Fraud and Financial Risk

Verifying suppliers helps avoid fake companies, scam exporters, and advance payment fraud. Many import losses occur due to dealing with unverified overseas suppliers. -

Ensures Product Quality and Compliance

Verification confirms whether the supplier has proper manufacturing facilities, follows quality standards, and can meet product specifications and certifications. -

Prevents Shipment Delays and Disputes

A verified supplier is more likely to deliver goods on time, follow agreed terms, and provide accurate documents, reducing logistics delays and customs issues. -

Builds Long-Term Business Relationships

Working with verified international suppliers creates trust, consistency, and scalability in global trade operations.

Where to Find International Suppliers?

There are multiple reliable channels to identify overseas suppliers. Each source has its own advantages.

-

B2B Online Platforms – Navanta (New Opportunity

Unlocked)

A B2B online sourcing platform is a digital marketplace where importers can identify, evaluate, and connect with verified international manufacturers and exporters through a structured and transparent system.

Navanta is a dedicated B2B trade portal designed to simplify global sourcing, supplier verification, and international trade collaboration on a single integrated platform.

Note: Always perform independent verification even if the supplier is listed on a B2B portal. -

Trade Fairs & Exhibitions

Trade fairs allow buyers to meet suppliers face-to-face, inspect product samples, and discuss pricing and capacity directly. They are ideal for long-term sourcing. -

Trade Missions & Embassies

Government trade offices and embassies provide verified exporter lists, market insights, and trusted supplier references, making this a low-risk sourcing channel. -

Industry Referrals & Networks

Referrals from existing importers, industry associations, and logistics partners are often more reliable than random online searches.

How to Verify International Suppliers?

Supplier verification should be done in multiple stages rather than relying on a single check.

-

Verify Company Registration Documents

Ask for company registration certificates, business licenses, and export registration details. Cross-check with official databases where possible. -

Check Business License & Export History

Review years in operation, export markets served, and major clients (if disclosed). -

Third-Party Audits & Factory Inspections

Independent agencies can verify factory existence, production capacity, quality control systems, and labor compliance. -

Sample Evaluation

Request samples to check material quality, finish, packaging, and specifications before placing bulk orders. -

Video Calls & Site Visits

Conduct video walkthroughs of factories and management discussions. Physical visits are ideal, but video verification is effective. -

Payment & Contract Validation

Use secure payment terms, written contracts, and clear Incoterms. Avoid full advance payments to unverified suppliers.

Supplier Identification & Verification Flowchart

Best Practices for Importers

- Never rely on only one verification method

- Avoid rushing supplier selection

- Document all communication

- Start with small trial orders

- Maintain supplier performance records

Conclusion

Identifying and verifying international suppliers is a foundation step in successful importing. A well-verified supplier ensures quality, reliability, compliance, and long-term business growth.

Investing time and effort in supplier verification helps importers avoid losses, reduce disputes, and build sustainable global sourcing operations.

FAQ – Supplier Identification & Verification

1. What is Supplier Identification & Verification? ▶

Supplier Identification & Verification is the process of finding reliable international manufacturers or exporters and confirming their legal status, production capability, quality standards, and compliance before starting any import transaction.

2. Why is Supplier Verification Important in International Trade? ▶

Supplier verification is important to reduce fraud, avoid financial loss, and ensure product quality. It helps importers work only with genuine and trustworthy overseas suppliers, preventing shipment delays and disputes.

3. How Can Importers Find Reliable International Suppliers? ▶

Importers can find reliable suppliers through verified B2B platforms like Navanta, trade fairs, government trade missions, and trusted industry referrals. Using a structured sourcing platform improves supplier transparency and trust.

4. How Does Navanta Help in Supplier Identification and Verification? ▶

Navanta (New Opportunity Unlocked) provides access to verified supplier profiles, structured business information, and transparent communication tools. This helps importers shortlist and evaluate international suppliers efficiently and securely.

5. What Documents Are Checked During Supplier Verification? ▶

Supplier verification typically includes checking:

- Company registration certificates

- Business or export licenses

- Manufacturing or export history

- Product and quality certifications

These checks confirm the supplier’s legitimacy and operational capability.

6. Is Sample Testing Necessary Before Finalizing a Supplier? ▶

Yes, sample testing is strongly recommended. Evaluating samples helps importers verify product quality, specifications, and packaging before placing bulk orders, reducing the risk of quality issues.

7. Can Supplier Verification Reduce Import Disputes? ▶

Yes, proper supplier verification significantly reduces quality disputes, delivery delays, and contractual conflicts. Working with verified suppliers leads to smooth trade operations and long-term business relationships.

Negotiation Techniques in Import Trade

A Practical Guide for Importers & Global Buyers

What is Import Negotiation?

Import negotiation is the structured and strategic discussion between an importer (buyer) and an international supplier (seller) to finalize key commercial terms of a trade transaction.

These discussions typically cover:

- Product price

- Quality standards and specifications

- Delivery schedules

- Payment terms

- Incoterms (EXW, FOB, CIF, etc.)

- Risk sharing and responsibilities

Effective import negotiation ensures that both parties clearly understand their obligations and agree on fair, transparent, and commercially viable terms.

Why is Negotiation Important in Import Trade?

Negotiation plays a vital role in cost control, risk management, and long-term business success.

-

Controls Import Costs

Negotiation helps importers secure:- Competitive pricing

- Better freight and Incoterm terms

- Reduced hidden costs

-

Improves Profit Margins

By negotiating price, payment terms, and logistics responsibilities, importers can optimize landed cost and increase profit margins. -

Minimizes Commercial Risks

Clear negotiation reduces risks related to:- Quality disputes

- Delivery delays

- Payment conflicts

- Contract misunderstandings

-

Builds Strong Supplier Relationships

Professional negotiation builds trust, transparency, and long-term partnerships rather than one-time transactions.

Where Does Import Negotiation Take Place?

Import negotiations can happen across multiple communication channels:

- Email – For written clarity and documentation

- Video Conferencing – For face-to-face discussions across countries

- Trade Fairs & Exhibitions – For direct negotiation with multiple suppliers

- Business Meetings – In-person meetings or factory visits

Using written communication is always recommended to avoid misunderstandings.

How to Negotiate Effectively in Import Trade?

Effective negotiation requires preparation, clarity, and documentation.

-

Research Market Prices

Study global price trends, compare multiple suppliers, and understand raw material and logistics costs. This gives the importer strong bargaining power. -

Negotiate Incoterms and Payment Terms

Decide who bears freight, insurance, and risk, choose suitable payment methods (Advance, LC, DA, etc.), and balance cost savings with risk control. -

Request Volume Discounts

Negotiate better pricing for bulk or repeat orders and discuss long-term supply agreements. -

Define Quality Standards Clearly

Share detailed specifications, define tolerances and inspection standards, and agree on rejection or rework terms. -

Document Everything in Writing

Confirm negotiated terms via email, include all points in Purchase Order and contract, and avoid verbal-only agreements.

Widely Used Negotiation Techniques in Import Trade

Below are commonly used negotiation techniques from both buyer (importer) and seller (supplier) perspectives.

- Price-Based Negotiation (Buyer-Focused)

Focuses on achieving the lowest possible price, buyer compares multiple suppliers, often used for standard or commodity products.

Best For: High-volume imports, price-sensitive markets - Value-Based Negotiation (Win-Win)

Focuses on total value, not just price, includes quality, reliability, delivery, and service.

Best For: Long-term sourcing and strategic partnerships - Competitive Negotiation

Buyer negotiates with multiple suppliers simultaneously.

Best For: New sourcing and supplier shortlisting - Collaborative Negotiation

Buyer and seller work together to reduce costs.

Best For: Repeat orders and stable suppliers - Risk-Sharing Negotiation

Responsibilities and risks are shared fairly.

Best For: High-value or long-distance shipments - Time-Based Negotiation

Focuses on delivery timelines.

Best For: Urgent or seasonal imports

Common Mistakes to Avoid in Import Negotiation

- Focusing only on price

- Ignoring quality and compliance

- Not documenting agreed terms

- Paying full advance without verification

- Rushing negotiation without market research

Import Negotiation Process

Best Practices for Successful Import Negotiation

- Always prepare before negotiating

- Be clear and professional in communication

- Aim for win-win outcomes

- Start with trial orders

- Build long-term supplier relationships

Conclusion

Negotiation in import trade is not just about price reduction—it is about balancing cost, quality, risk, and reliability. A well-negotiated import deal protects the importer’s interests, ensures smooth operations, and builds sustainable global trade relationships.

FAQ – Negotiation Techniques in Import Trade

1. What is import negotiation in international trade? ▶

Import negotiation is the process where an importer and an overseas supplier discuss and finalize price, quality standards, delivery terms, payment methods, Incoterms, and risk sharing to complete an international trade deal.

2. Why are negotiation techniques important in import trade? ▶

Negotiation techniques help importers control import costs, improve profit margins, and reduce commercial risks such as quality disputes, delivery delays, and payment issues.

3. What are the most common negotiation points in import trade? ▶

The most common negotiation points include:

- Product price

- Incoterms (FOB, CIF, EXW, etc.)

- Payment terms

- Delivery timeline

- Quality and inspection standards

4. Where does import negotiation usually take place? ▶

Import negotiations usually take place through email, video conferencing, trade fairs, and business meetings. Written communication is always recommended for record and clarity.

5. What negotiation techniques are commonly used by importers? ▶

Importers commonly use techniques such as:

- Price-based negotiation

- Competitive negotiation with multiple suppliers

- Value-based (win-win) negotiation

- Risk-sharing negotiation through Incoterms

6. How can importers negotiate better prices with suppliers? ▶

Importers can negotiate better prices by:

- Researching global market prices

- Comparing multiple suppliers

- Ordering in higher volumes

- Building long-term relationships

7. How can negotiation reduce risks in import trade? ▶

Clear negotiation defines quality standards, delivery responsibility, and payment terms in advance. This minimizes misunderstandings, prevents disputes, and ensures smooth international trade operations.

Purchase Order Process in Import Trade

Purchase Order (PO) Process in Import Trade

1. What is a Purchase Order (PO)?

A Purchase Order (PO) is a formal, legally binding commercial document issued by an importer (buyer) to an exporter or overseas supplier (seller).

It clearly defines what is being purchased, at what price, under which delivery terms, and under what legal and quality conditions.

Once the supplier accepts the PO, it becomes a contractual obligation for both parties.

Key Characteristics of a Purchase Order

- Written confirmation of trade terms

- Legal reference document

- Basis for production, shipment, banking, and customs

- Protects both buyer and seller

2. Why is the Purchase Order Process Important?

The PO process ensures control, clarity, compliance, and risk reduction in international trade.

Business Importance

- Prevents disputes on price, quantity, and quality

- Enables structured supplier execution

- Improves cost and delivery planning

Legal & Compliance Importance

- Acts as legal evidence in disputes

- Required for audits and regulatory checks

- Supports customs valuation and inspections

Financial Importance

- Mandatory for LC issuance and bank approvals

- Supports payment reconciliation

3. Where is the Purchase Order Used?

A Purchase Order is used throughout the entire import lifecycle:

- Between Importer and Supplier

- With Banks (LC, remittance, compliance)

- During Customs Clearance

- For Quality Inspection Agencies

- In Accounting, ERP, and Audits

4. How Does the Purchase Order Process Work?

-

Step 1: Import Requirement Identification

The importer defines product description and specifications, quantity required, target price range, delivery timeline, and regulatory requirements. This stage ensures commercial and legal readiness. -

Step 2: Supplier Quotation & Evaluation

The importer receives supplier quotation or Proforma Invoice, pricing details, Incoterms, payment terms, and production timeline. Suppliers are evaluated on price competitiveness, quality capability, and export experience. -

Step 3: Commercial Negotiation

Negotiation finalizes final unit price, Incoterms (FOB, CIF, EXW, etc.), payment method (TT, LC, DA), quality inspection terms, and penalty and dispute clauses. Only agreed terms move to PO drafting. -

Step 4: Drafting the Purchase Order

The PO must be clear, detailed, and unambiguous.

Mandatory PO Elements:- Buyer & supplier legal details

- PO number & issue date

- Product name, HS code, and specifications

- Quantity and unit price

- Total order value

- Incoterms & delivery location

- Payment terms

- Quality, inspection & compliance clauses

- Packaging & labeling instructions

-

Step 5: Internal Approval Process

Before issuance, the PO is approved by procurement team, finance department, and compliance or management. This ensures financial control and risk management. -

Step 6: PO Issuance to Supplier

The approved PO is sent via email or ERP system and officially logged in records. The supplier reviews and acknowledges the PO. -

Step 7: Supplier Acceptance & Confirmation

Supplier confirms acceptance of all PO terms, production start date, and shipment schedule. A signed or email-confirmed PO becomes contractually active. -

Step 8: Production & Quality Control

Supplier starts production strictly as per PO. Quality controls may include pre-production inspection, during production checks, and pre-shipment inspection. -

Step 9: Shipment & Documentation

Goods are shipped according to PO terms. Supplier issues Commercial Invoice, Packing List, and shipping documents. These documents must match the PO exactly.

5. Key Clauses in an Import Purchase Order

| Clause | Purpose |

|---|---|

| Incoterms | Defines risk & cost responsibility |

| Payment Terms | Controls cash flow |

| Quality Clause | Ensures product standards |

| Inspection Clause | Reduces quality risk |

| Delivery Clause | Prevents delays |

| Dispute Clause | Legal protection |

6. Common Mistakes in the Purchase Order Process

- Incomplete product description

- Missing quality or inspection clauses

- Incorrect Incoterms

- No compliance responsibility defined

- PO not aligned with PI or LC

7. Best Practices for a Strong PO Process

- Always issue written POs

- Align PO with banking & customs requirements

- Use standard PO templates

- Keep language clear and legally precise

- Maintain proper PO records

Purchase Order Flowchart

FAQ – Purchase Order Process in Import Trade

1. What is a Purchase Order (PO) in import trade? ▶

A Purchase Order (PO) is a formal and legally binding document issued by an importer to an overseas supplier. It confirms product details, quantity, price, delivery terms, payment terms, and other commercial conditions agreed during negotiation.

2. Why is the Purchase Order process important? ▶

The purchase order process is important because it:

- Provides written confirmation of agreed terms

- Reduces disputes and misunderstandings

- Acts as a legal reference for both buyer and supplier

- Supports smooth production, shipment, and documentation

3. What are the key steps in the Purchase Order process? ▶

The key steps in the purchase order process include:

- Import requirement identification

- Supplier quotation or proforma invoice

- Commercial negotiation

- Drafting and approval of PO

- PO issuance and supplier acceptance

- Production, quality control, and shipment

4. What details should be included in a Purchase Order? ▶

A standard purchase order should include:

- Buyer and supplier details

- Product description and specifications

- Quantity and unit price

- Incoterms and delivery terms

- Payment terms

- Shipment schedule

5. What happens after the PO is issued to the supplier? ▶

After PO issuance:

- The supplier reviews and accepts the PO

- Production starts as per agreed terms

- Quality control checks are conducted

- Shipment and export documentation are prepared

6. Is Purchase Order approval required internally? ▶

Yes, most companies follow an internal approval process before issuing a PO. This ensures compliance with budgets, policies, and risk controls, especially for high-value imports.

7. Can changes be made after issuing a Purchase Order? ▶

Yes, changes can be made through a PO amendment or revised purchase order, but both importer and supplier must agree to the revised terms in writing.

8. How does a Purchase Order help reduce import risks? ▶

A well-defined PO clearly states price, quality, delivery, and responsibility, which helps prevent disputes, shipment delays, and financial losses in international trade.

Import Incoterms (EXW, FCA, FOB, CIF etc.)

Import Incoterms® 2020 – Complete Professional Guide

What are Import Incoterms?

Incoterms (International Commercial Terms) are internationally recognized trade rules published by the International Chamber of Commerce (ICC). They clearly define responsibilities, costs, risks, and delivery points between buyers (importers) and sellers (exporters) in international trade.

Why Import Incoterms Are Important?

- Avoid disputes between importer & exporter

- Clearly define cost responsibility

- Define risk transfer point

- Ensure smooth customs clearance

- Essential for international contracts, LC, insurance & logistics

Where Import Incoterms Are Used?

- Import Purchase Orders

- International Sales Contracts

- Letters of Credit (LC)

- Freight & Insurance Documents

- Customs & Compliance Documentation

How Import Incoterms Work?

Each Incoterm specifies:

- Delivery point

- Risk transfer

- Cost responsibility

- Who handles export/import clearance

- Who arranges freight & insurance

GROUP 1: ANY MODE OF TRANSPORT

1️. EXW – Ex Works

WHAT is EXW?

Seller makes goods available at their factory or warehouse. Buyer bears all costs and

risks from there.

WHY use EXW?

- Maximum control for importer

- Lowest seller responsibility

- Suitable for experienced importers

WHERE Risk Transfers?

At seller’s premises (factory/warehouse)

HOW it Works?

Buyer arranges pickup, export clearance, freight, insurance, import clearance.

Responsibility Summary

- Export clearance: ❌ Buyer

- Freight: ❌ Buyer

- Insurance: ❌ Buyer

- Import clearance: ❌ Buyer

Best For

Domestic-like imports, strong buyer logistics control

2. FCA – Free Carrier

WHAT is FCA?

Seller delivers goods to a carrier or named place agreed with buyer.

WHY use FCA?

- Better than EXW

- Seller handles export clearance

- Common for container shipments

WHERE Risk Transfers?

At carrier pickup point

HOW it Works?

Seller loads & clears export; buyer handles main transport.

Responsibility Summary

- Export clearance: ✅ Seller

- Freight: ❌ Buyer

- Insurance: ❌ Buyer

- Import clearance: ❌ Buyer

Best For

Containerized imports, LC transactions

3. CPT – Carriage Paid To

WHAT is CPT?

Seller pays freight to destination, but risk transfers early.

WHY use CPT?

- Buyer gets freight cost clarity

- Seller negotiates transport

WHERE Risk Transfers?

When handed to first carrier

HOW it Works?

Seller pays transport, buyer bears risk during transit.

Responsibility Summary

- Freight: ✅ Seller

- Risk during transit: ❌ Buyer

- Insurance: ❌ Buyer

4. CIP – Carriage & Insurance Paid To

WHAT is CIP?

Same as CPT but seller provides insurance.

WHY use CIP?

- Buyer protected against transit risk

- Mandatory insurance by seller

WHERE Risk Transfers?

At first carrier

HOW it Works?

Seller pays freight + insurance; risk still transfers early.

5. DPU – Delivered at Place Unloaded

WHAT is DPU?

Seller delivers & unloads goods at named place.

WHY use DPU?

- Maximum seller responsibility

- Buyer receives ready goods

WHERE Risk Transfers?

After unloading at destination

HOW it Works?

Seller handles everything till unloading.

6. DAP – Delivered at Place

WHAT is DAP?

Seller delivers goods to destination, not unloaded.

WHY use DAP?

- Door delivery

- Buyer controls unloading & customs

WHERE Risk Transfers?

At destination before unloading

7. DDP – Delivered Duty Paid

WHAT is DDP?

Seller handles everything including import duty & tax.

WHY use DDP?

- Buyer convenience

- Fixed landed cost

WHERE Risk Transfers?

At buyer’s location after delivery

GROUP 2: SEA & INLAND WATERWAY ONLY

8. FAS – Free Alongside Ship

WHAT is FAS?

Seller places goods alongside vessel at port.

WHY use FAS?

Bulk & project cargo

WHERE Risk Transfers?

Alongside ship

9. FOB – Free On Board

WHAT is FOB?

Seller loads goods on vessel.

WHY use FOB?

Most common sea import term

WHERE Risk Transfers?

Once goods are on board

10. CFR – Cost & Freight

WHAT is CFR?

Seller pays sea freight; risk transfers earlier.

WHERE Risk Transfers?

On board vessel

11. CIF – Cost, Insurance & Freight

WHAT is CIF?

Seller pays freight + insurance.

WHY use CIF?

Buyer protected at sea

WHERE Risk Transfers?

On board vessel

Deciding Incoterms for import process

Freight Cost Calculation

WHAT is Freight Cost in Import?

Freight Cost refers to the total transportation-related expenses incurred to move goods from the seller’s country to the importer’s destination, including international transport, handling, documentation, surcharges, and related logistics charges.

Freight cost is a critical component of landed cost and directly impacts:

- Import product pricing

- Profit margins

- Customs duty calculation

- GST/VAT liability

WHY Freight Cost Calculation is Important for Importers?

Accurate freight cost calculation helps importers to:

- Determine true landed cost

- Avoid unexpected logistics expenses

- Compare Incoterms (FOB vs CIF vs DAP)

- Select the most cost-effective shipping mode

- Negotiate better freight contracts

- Prevent customs valuation disputes

Incorrect freight calculation can lead to:

- Underpricing

- Loss of profit

- Customs penalties

- LC discrepancies

WHERE Freight Cost is Applied in Import Process?

- Import costing sheet

- Purchase order (PO)

- Price negotiation with supplier

- Customs duty valuation

- GST calculation

- Final sales pricing

- Profit & margin analysis

HOW Freight Cost Calculation Works in Import?

Freight cost calculation depends on:

- Mode of transport (Sea / Air / Road / Courier)

- Incoterms used

- Cargo type (LCL / FCL / Bulk)

- Weight & volume

- Route & destination

- Fuel & seasonal surcharges

COMPONENTS OF IMPORT FREIGHT COST (DETAILED)

1. Basic Freight Charges

WHAT are Basic Freight Charges?

Charges levied by shipping lines, airlines, or transporters for moving cargo from origin to

destination.

HOW Calculated?

- Sea Freight: Per container or per CBM

- Air Freight: Chargeable weight (higher of actual vs volumetric)

2. Origin Charges (Export Country)

Includes:

- Origin terminal handling charges (THC)

- Documentation fees